#!/usr/bin/env python

# coding: utf-8

# # Riskfolio-Lib Tutorial:

#

#

#

#

#

#

#

__[Financionerioncios](https://financioneroncios.wordpress.com)__

#

__[Orenji](https://www.linkedin.com/company/orenj-i)__

#

__[Riskfolio-Lib](https://riskfolio-lib.readthedocs.io/en/latest/)__

#

__[Dany Cajas](https://www.linkedin.com/in/dany-cajas/)__

#

# ## Tutorial 13: Riskfolio-Lib and Xlwings

#

# ## 1. Downloading the data:

# In[ ]:

import numpy as np

import pandas as pd

import yfinance as yf

import warnings

warnings.filterwarnings("ignore")

pd.options.display.float_format = '{:.4%}'.format

# Date range

start = '2016-01-01'

end = '2019-12-30'

# Tickers of assets

assets = ['JCI', 'TGT', 'CMCSA', 'CPB', 'MO', 'APA', 'MMC', 'JPM',

'ZION', 'PSA', 'BAX', 'BMY', 'LUV', 'PCAR', 'TXT', 'TMO',

'DE', 'MSFT', 'HPQ', 'SEE', 'VZ', 'CNP', 'NI', 'T', 'BA']

assets.sort()

# Downloading data

data = yf.download(assets, start = start, end = end, auto_adjust=False)

data = data.loc[:,('Adj Close', slice(None))]

data.columns = assets

# In[2]:

# Calculating returns

Y = data[assets].pct_change().dropna()

display(Y.head())

# ## 2. Estimating Mean Variance Portfolios

#

# ### 2.1 Calculating the portfolio that maximizes Sharpe ratio.

# In[3]:

import riskfolio as rp

# Building the portfolio object

port = rp.Portfolio(returns=Y)

# Calculating optimal portfolio

# Select method and estimate input parameters:

method_mu='hist' # Method to estimate expected returns based on historical data.

method_cov='hist' # Method to estimate covariance matrix based on historical data.

port.assets_stats(method_mu=method_mu, method_cov=method_cov)

# Estimate optimal portfolio:

model='Classic' # Could be Classic (historical), BL (Black Litterman) or FM (Factor Model)

rm = 'MV' # Risk measure used, this time will be variance

obj = 'Sharpe' # Objective function, could be MinRisk, MaxRet, Utility or Sharpe

hist = True # Use historical scenarios for risk measures that depend on scenarios

rf = 0 # Risk free rate

l = 0 # Risk aversion factor, only useful when obj is 'Utility'

w = port.optimization(model=model, rm=rm, obj=obj, rf=rf, l=l, hist=hist)

display(w.T)

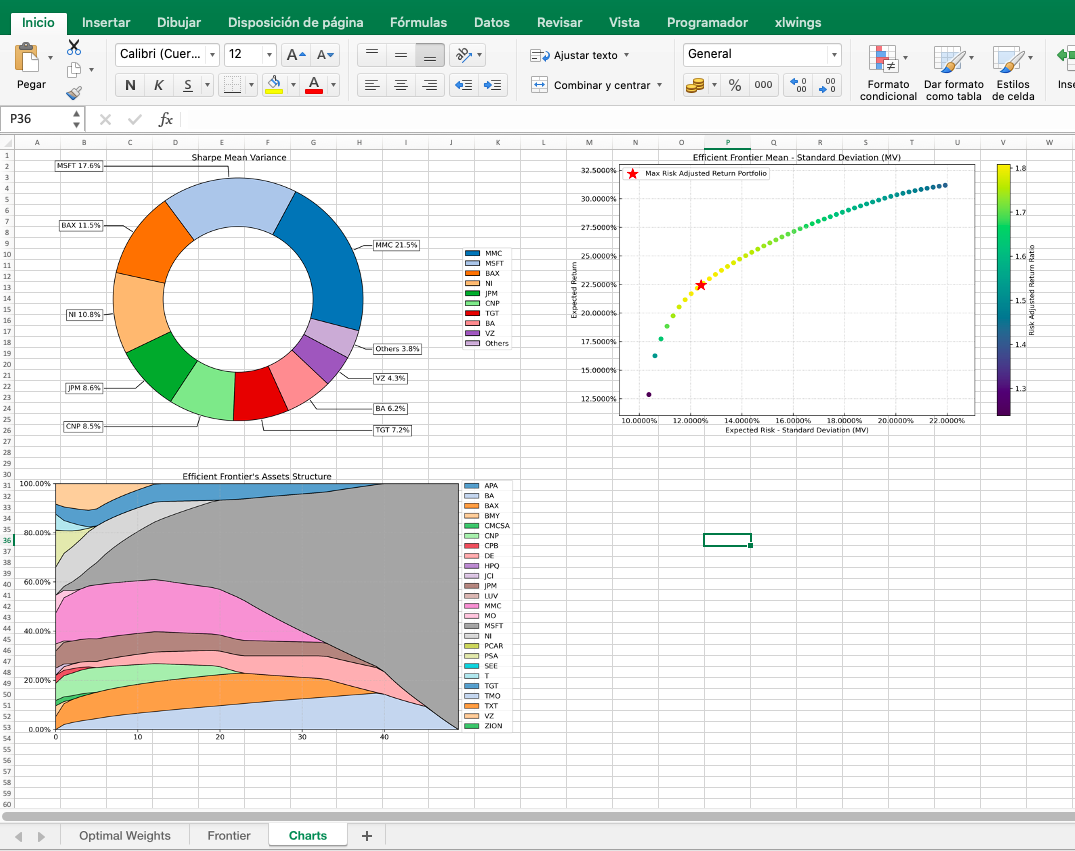

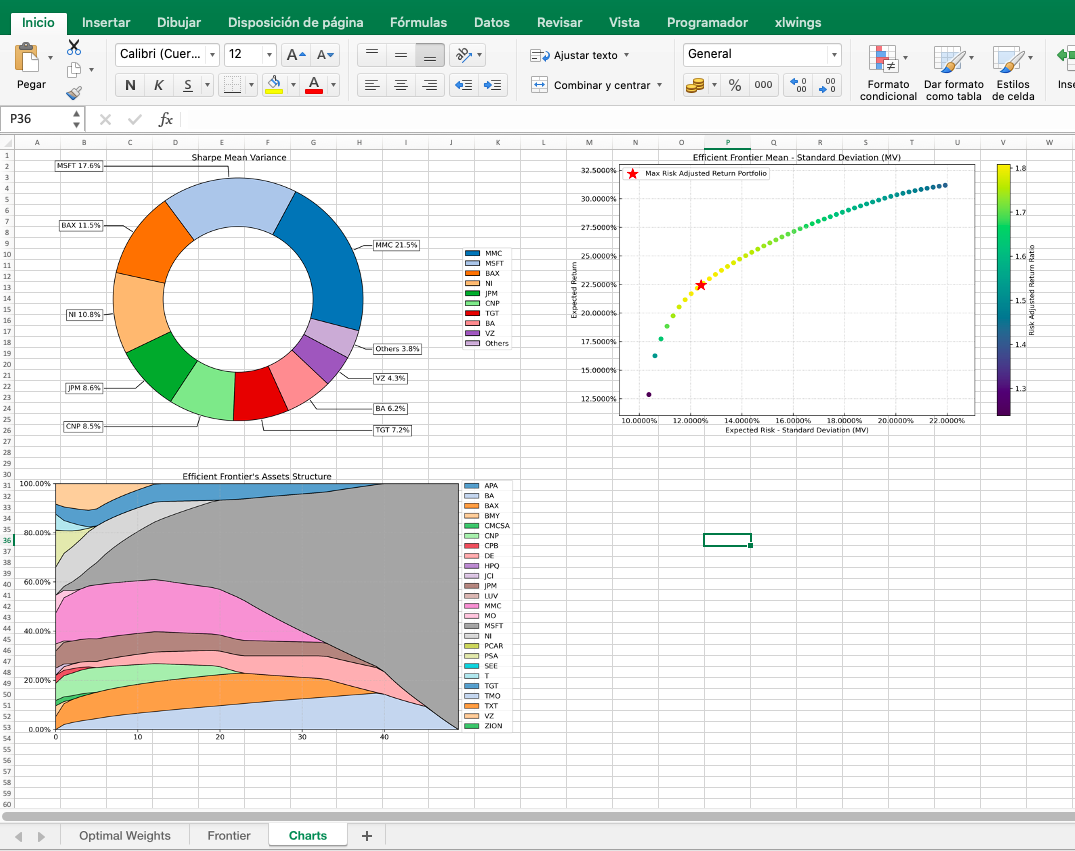

# ### 2.2 Plotting portfolio composition

# In[4]:

import matplotlib.pyplot as plt

# Plotting the composition of the portfolio

fig_1, ax_1 = plt.subplots(figsize=(10,6))

ax_1 = rp.plot_pie(w=w, title='Sharpe Mean Variance', others=0.05, nrow=25, cmap = "tab20",

height=6, width=10, ax=ax_1)

# ### 2.3 Calculate efficient frontier

# In[5]:

points = 50 # Number of points of the frontier

frontier = port.efficient_frontier(model=model, rm=rm, points=points, rf=rf, hist=hist)

display(frontier.T.head())

# In[6]:

# Plotting the efficient frontier

label = 'Max Risk Adjusted Return Portfolio' # Title of point

mu = port.mu # Expected returns

cov = port.cov # Covariance matrix

returns = port.returns # Returns of the assets

fig_2, ax_2 = plt.subplots(figsize=(10,6))

rp.plot_frontier(w_frontier=frontier, mu=mu, cov=cov, returns=returns, rm=rm,

rf=rf, alpha=0.01, cmap='viridis', w=w, label=label,

marker='*', s=16, c='r', height=6, width=10, ax=ax_2)

# In[7]:

# Plotting efficient frontier composition

fig_3, ax_3 = plt.subplots(figsize=(10,6))

rp.plot_frontier_area(w_frontier=frontier, cmap="tab20", height=6, width=10, ax=ax_3)

# ## 3. Combining Riskfolio-Lib and Xlwings

#

# ### 3.1 Creating an Empty Excel Workbook

# In[8]:

import xlwings as xw

# Creating an empty Excel Workbook

wb = xw.Book()

sheet1 = wb.sheets[0]

sheet1.name = 'Charts'

sheet2 = wb.sheets.add('Frontier')

sheet3 = wb.sheets.add('Optimal Weights')

# ### 3.2 Adding Pictures to Sheet 1

# In[9]:

sheet1.pictures.add(fig_1, name = "Weights",

update = True,

top = sheet1.range("A1").top,

left = sheet1.range("A1").left)

sheet1.pictures.add(fig_2, name = "Frontier",

update = True,

top = sheet1.range("M1").top,

left = sheet1.range("M1").left)

sheet1.pictures.add(fig_3, name = "Composition",

update = True,

top = sheet1.range("A30").top,

left = sheet1.range("A30").left)

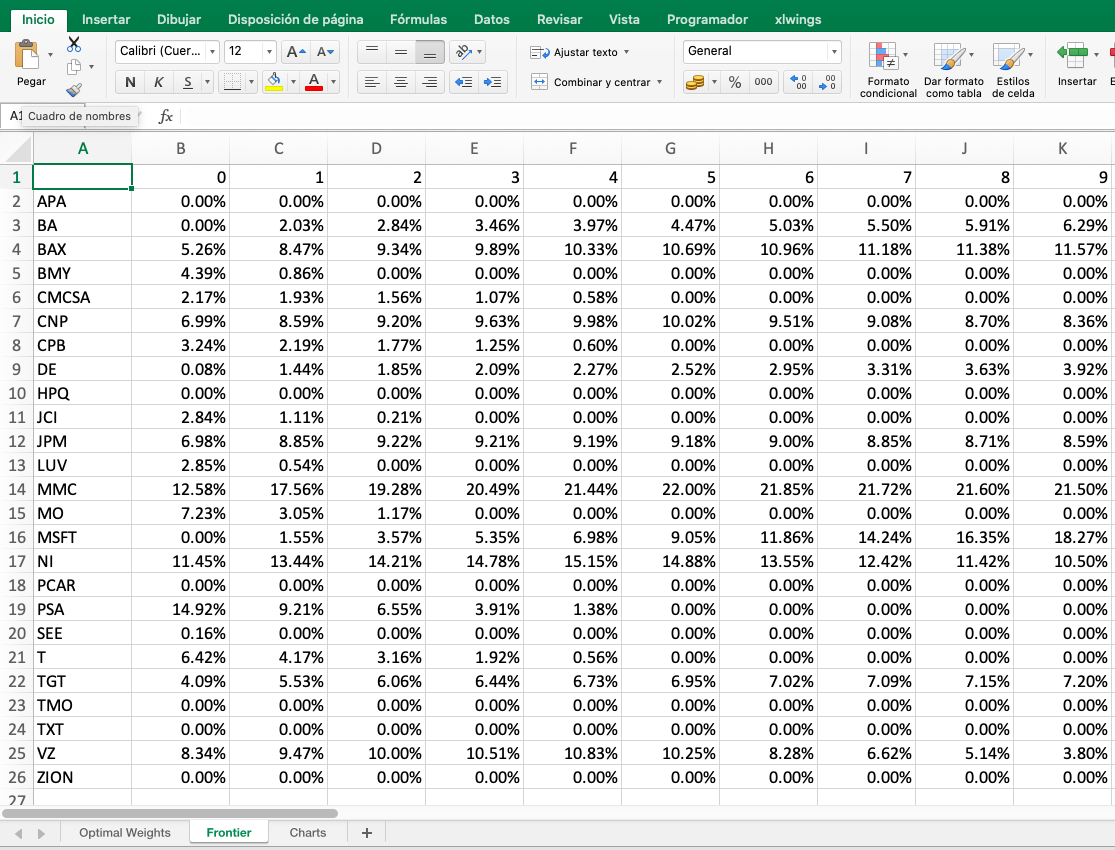

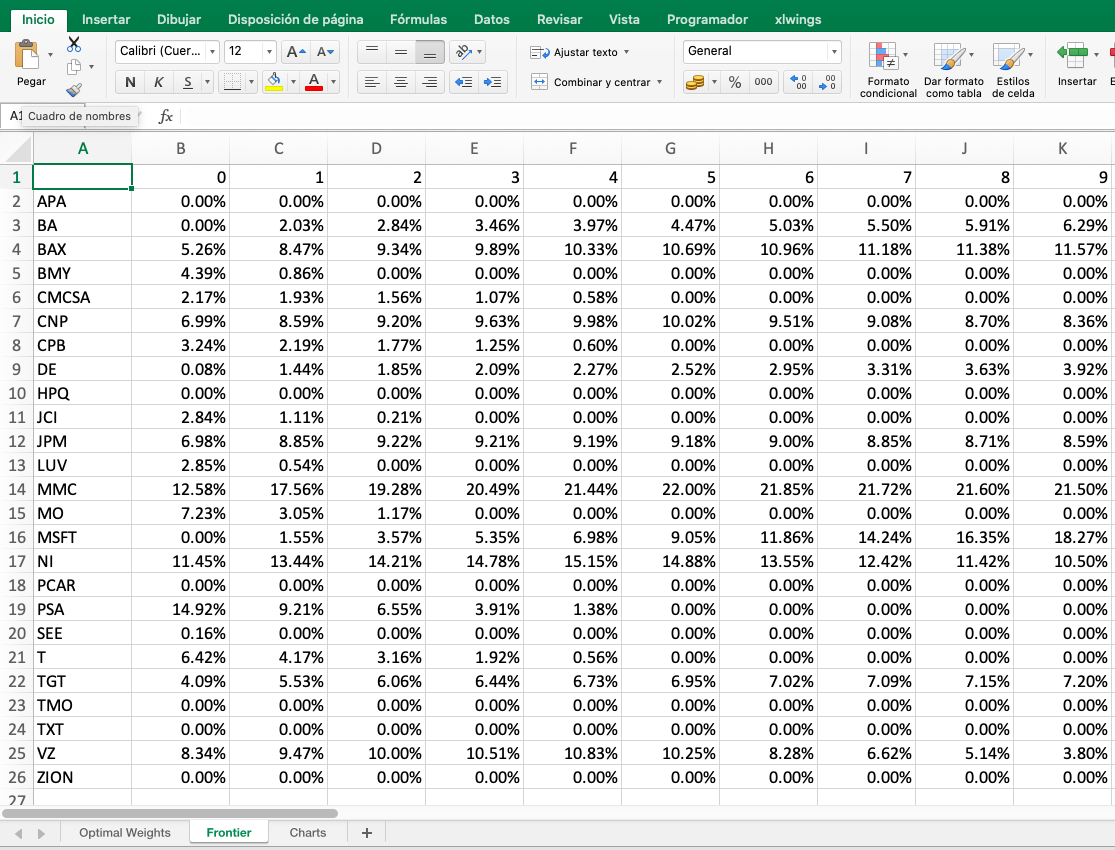

#  # ### 3.2 Adding Data to Sheet 2 and Sheet 3

# In[10]:

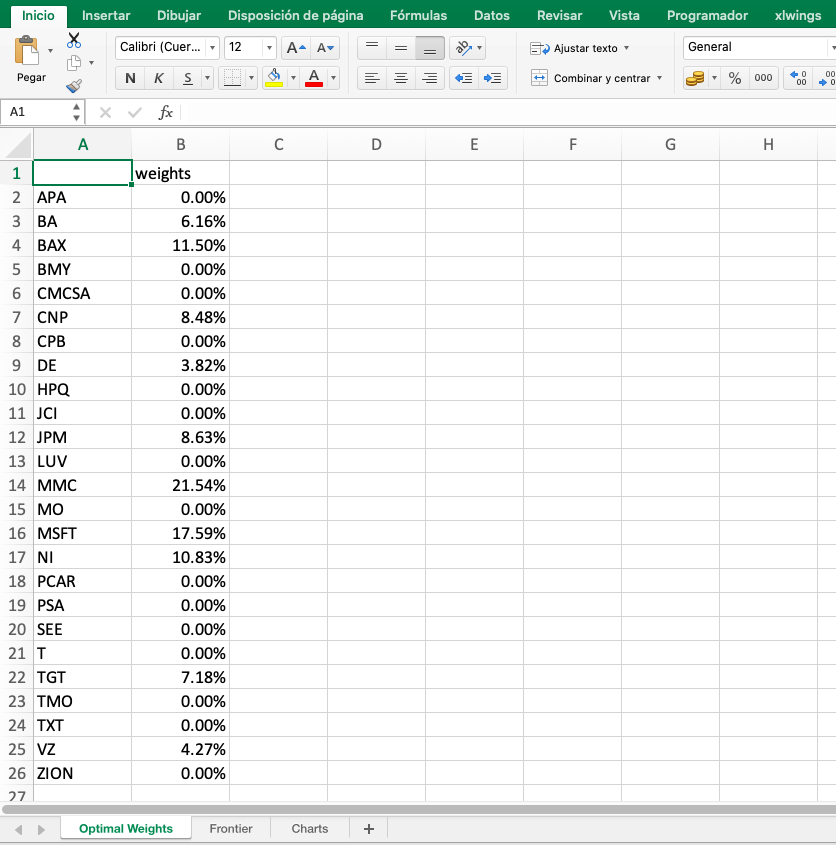

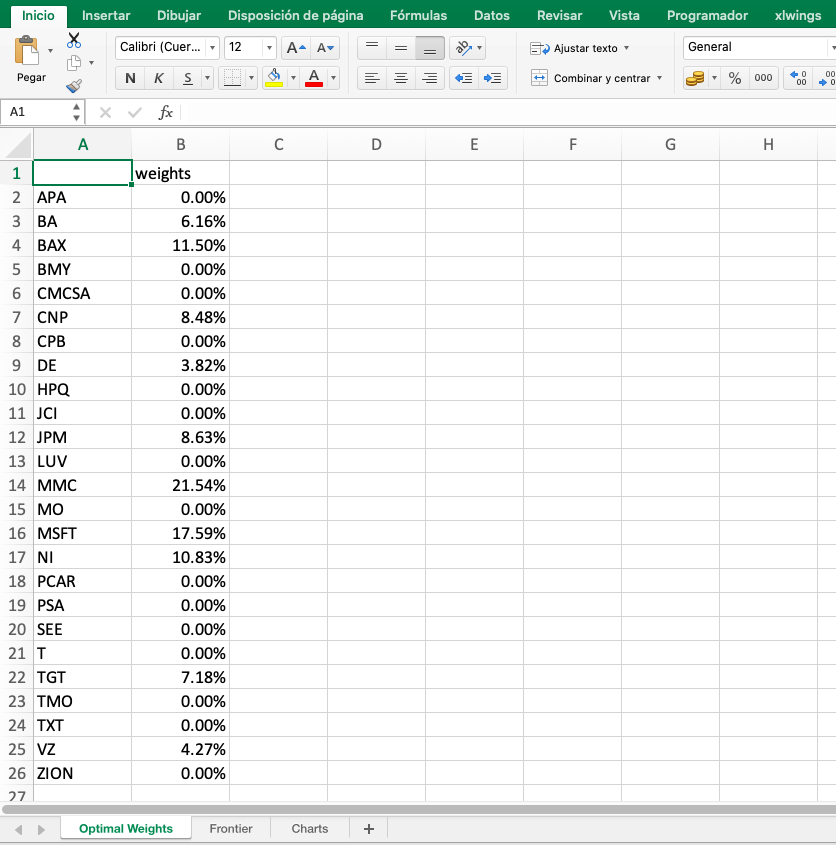

# Writing the weights of the frontier in the Excel Workbook

sheet2.range('A1').value = frontier.applymap('{:.6%}'.format)

# Writing the optimal weights in the Excel Workbook

sheet3.range('A1').value = w.applymap('{:.6%}'.format)

#

# ### 3.2 Adding Data to Sheet 2 and Sheet 3

# In[10]:

# Writing the weights of the frontier in the Excel Workbook

sheet2.range('A1').value = frontier.applymap('{:.6%}'.format)

# Writing the optimal weights in the Excel Workbook

sheet3.range('A1').value = w.applymap('{:.6%}'.format)

#  #

#

# ### 3.2 Adding Data to Sheet 2 and Sheet 3

# In[10]:

# Writing the weights of the frontier in the Excel Workbook

sheet2.range('A1').value = frontier.applymap('{:.6%}'.format)

# Writing the optimal weights in the Excel Workbook

sheet3.range('A1').value = w.applymap('{:.6%}'.format)

#

# ### 3.2 Adding Data to Sheet 2 and Sheet 3

# In[10]:

# Writing the weights of the frontier in the Excel Workbook

sheet2.range('A1').value = frontier.applymap('{:.6%}'.format)

# Writing the optimal weights in the Excel Workbook

sheet3.range('A1').value = w.applymap('{:.6%}'.format)

#  #

#