#!/usr/bin/env python

# coding: utf-8

# # "Implement Markowitz Portfolio Optimization in Only 3 Lines of Code"

# > "Use fastquant to maximize the returns of your stock portfolio given its overall risk profile"

#

# - toc: true

# - branch: master

# - badges: true

# - comments: true

# - author: Benjamin Cabalona, Jerome de Leon

# - categories: [portfolio, optimization]

# In[1]:

# uncomment to install in colab

# !pip3 install fastquant

#  # # Some Basic Ideas

#

# **Stock or Share** is a unit of ownership in a company. When you invest in the stock market, (stock market is basically a place for buying or selling stocks) there are 2 main ways of earning:

#

# - **Dividend** - This is an amount paid to you by a company for your investment.

# - **Stock Trading** - The profit that you make for buying/selling stocks.

# - **Portfolio** - A combination of assets of an individual / investor.

#

# Fundamentally, you can earn money by buying some stocks, in the hope that it's price will increase in the future.

#

# There are actually clever ways on how to earn even if you predict that a stock price will decline, but that's outside the scope of this lecture.

#

# So in this lecture, we'll oversimplify and what we want is to **buy a stock cheap, and sell it when its price has increased** because that way we will make a profit. Otherwise we will incur a loss, if we decided to sell a stock at a cheaper price.

#

# # Modern Portfolio Theory (Markowitz Model)

#

# As mentioned above, investing in the stock market can result in either profit or loss.

#

# In a nutshell, Modern Portfolio Theory is a way of maximizing return for a given risk. We will define what *return* and *risk* means shortly.

#

# Let's understand this by using an example.

#

# Suppose you wanted to invest in the stock market. After completing your research, you decided to invest in the following companies:

#

# - MEG

# - MAXS

# - JFC

# - ALI

#

# We will download the data for this using a python library called fastquant. It was actually developed by a fellow Filipino Data Scientist. It aims to democratize data-driven investments for everyone.

#

#

# **NOTE** The model we'll be using relies on the assumption that returns are normally distributed. Therefore, it helps if we have large number of data points.

# In[2]:

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import warnings

import scipy.optimize as optimization

from fastquant import get_stock_data

warnings.filterwarnings('ignore')

get_ipython().run_line_magic('matplotlib', 'inline')

# In[3]:

stocks = ['MEG', 'MAXS', 'JFC', 'ALI']

datas = []

for i in stocks:

df = get_stock_data(i, "2017-01-01", "2020-01-01")

df = df.reset_index()

df.columns = ['DATE',i]

df = df[['DATE',i]]

datas.append(df)

datas1 = pd.merge(datas[0],datas[1],on=['DATE'])

datas2 = pd.merge(datas[2],datas[3],on=['DATE'])

data = pd.merge(datas1,datas2,on=['DATE'])

data.index = data['DATE']

data.drop('DATE',axis=1,inplace=True)

# The table below shows the first 5 entries in our dataset. The values here are *closing prices*. A *closing price* is a price of a stock at the end of a given trading day.

# In[4]:

data.head()

# Now, let's ask ourselves. Why don't we invest in a single company, instead of investing in multiple companies?

#

# Modern Portfolio Theory tells us that we can *minimize* our loss thru diversification. Let's understand this with an example.

#

# Suppose you decided to invest on January 2017. For illustraton purposes, let's consider the period January 2017 - May 2018.

#

# - Case 1: You invested solely on MAXS

# - Case 2: You decided to invest 50% to MAXS and the other 50% to JFC

#

# If you decided to go with case 1, it would be clear that you could immediately lose some money (as the chart shows a decreasing trend). If you instead decided to go with Case 2, your loss could have been mitigated since the price for JFC is increasing during that period.

#

# Of course you could argue that "why not invest all of my money in JFC", well my counter argument to that would be, when JFC is experiencing a decline in it's price, there would be some other company that's actually experiencing an increase in it's price.

#

# ## Key Takeaway

#

# - Invest in multiple stocks as much as possible, to minimize your loss. (Technically uncorrelated or negatively correlated)

# In[5]:

data['MAXS'].plot(figsize=(12,5),legend=True)

# In[6]:

data['JFC'].plot(figsize=(12,5),legend=True,color='r')

# Now, let's define what a return is. Intuitively, we can define return as :

#

# *The stock price today minus the stock price yesterday. Divide the difference by the stock price yesterday*

#

# More formally,

#

# The *return* $R_{t,t+1}$ from time $t$ to time ${t+1}$ is given by:

#

# $$ R_{t,t+1} = \frac{P_{t+1}-P_{t}}{P_{t}} $$

#

# where $P_i$ is the price of the stock for a given time point.

# In[7]:

returns = data.pct_change()

returns

# The mean of the returns is called the **Expected Return**.

#

# Similarly, the **Risk or Volatility** is the standard deviation of the returns.

#

# (This is different from the expected return and volatility of a portfolio, this is for a single stock)

# In[8]:

returns.mean()

# In[9]:

returns.std()

# We'll only plot MAXS and MEG to emphasize that the return for MEG is more volatile.

# In[10]:

returns[['MAXS','MEG']].plot(figsize=(12,5))

# ## Expected Return and Risk of a Portfolio

#

# Suppose your portfolio consists of returns $R_1, R_2, R_3, ... ,R_n$. Then, the expected return of a portfolio is given by:

#

# $E(R) = w_1E(R_1) + w_2E(R_2) + w_3E(R_3) + ... + w_nE(R_n) $

#

# where $w_i$ is the $i$th component of an $n-dimensional$ vector, and $\Sigma w_i = 1.$

# In[11]:

weights = np.random.random(len(stocks))

weights /= np.sum(weights)

weights

# In[12]:

returns.mean()

# In[13]:

def calculate_portfolio_return(returns, weights):

portfolio_return = np.sum(returns.mean()*weights)*252

print("Expected Portfolio Return:", portfolio_return)

# In[14]:

calculate_portfolio_return(returns,weights)

# If you had a course in Probability, you might recall that expectation of a random variable is linear while the variance is not. That's the same argument why the formula for the variance of a portfolio is quite more complicated.

#

# $Var(R) = \bf{w^{T}}\Sigma \textbf{w}$

#

# where $\Sigma$ is the covariance matrix of $R_i$

# In[15]:

returns.cov()

# In[16]:

np.sqrt(returns.cov())

# In[17]:

returns.std()

# In[18]:

def calculate_portfolio_risk(returns, weights):

portfolio_variance = np.sqrt(np.dot(weights.T, np.dot(returns.cov()*252,weights)))

print("Expected Risk:", portfolio_variance)

# In[19]:

calculate_portfolio_risk(returns,weights)

# ## Sharpe Ratio

#

#

# Remember, what we want is to find the best possible weight vector $\bf{w}$ that would give us the best possible return, with a minimal risk. Therefore, we will introduce a new metric called the *sharpe ratio*. It's simply equal to

#

# $$S.R. = \frac{E(R) - R_f}{\sqrt{Var(R)}}$$

#

# where $R_f$ is the *risk free return*. Since we're only limiting ourselves to risky assets (stocks) therefore, the formula becomes

#

# $$S.R. = \frac{E(R) - 0}{\sqrt{Var(R)}} = \frac{E(R)}{\sqrt{Var(R)}}$$

# In[20]:

def generate_portfolios(weights, returns):

preturns = []

pvariances = []

for i in range(10000):

weights = np.random.random(len(stocks))

weights/=np.sum(weights)

preturns.append(np.sum(returns.mean()*weights)*252)

pvariances.append(np.sqrt(np.dot(weights.T,np.dot(returns.cov()*252,weights))))

preturns = np.array(preturns)

pvariances = np.array(pvariances)

return preturns,pvariances

def plot_portfolios(returns, variances):

plt.figure(figsize=(10,6))

plt.scatter(variances,returns,c=returns/variances,marker='o')

plt.grid(True)

plt.xlabel('Expected Volatility')

plt.ylabel('Expected Return')

plt.colorbar(label='Sharpe Ratio')

plt.show()

# In[21]:

preturns, pvariances = generate_portfolios(weights,returns)

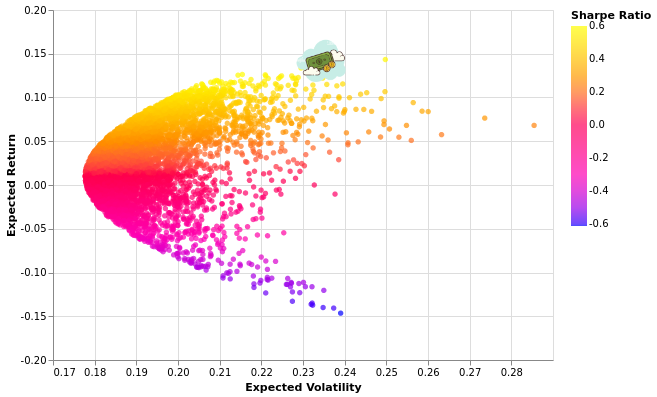

# ## Monte - Carlo Simulation

#

# Here, we simulated 10,000 possible weight allocations, and computed their respective expected return, risk and sharpe ratio.

# In[22]:

plot_portfolios(preturns, pvariances)

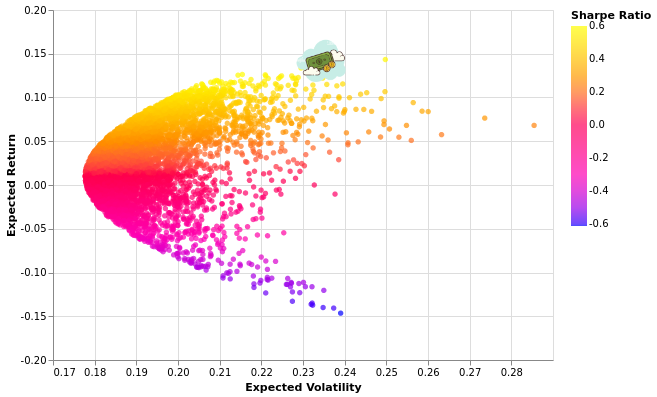

# # Finding and plotting the Optimal Weights (the hard way)

#

# At a high level, we would want to run an optimization algorithm that would

#

#

# $$maximize\ \frac{E(R)-R_f}{\sqrt{Var(R)}}$$

#

# $$s.t. \forall w_i, w_i\geq0\ and\ \Sigma w_i=1$$

#

# Full details of the mathematics behind this can be found on resources.

# In[23]:

def statistics(weights, returns):

portfolio_return=np.sum(returns.mean()*weights)*252

portfolio_volatility=np.sqrt(np.dot(weights.T,np.dot(returns.cov()*252,weights)))

return np.array([portfolio_return,portfolio_volatility,portfolio_return/portfolio_volatility])

def min_func_sharpe(weights,returns):

return -statistics(weights,returns)[2]

def optimize_portfolio(weights,returns):

constraints = ({'type':'eq','fun': lambda x: np.sum(x)-1})

bounds = tuple((0,1) for x in range(len(stocks)))

optimum=optimization.minimize(fun=min_func_sharpe,x0=weights,args=returns,method='SLSQP',bounds=bounds,constraints=constraints)

return optimum

def print_optimal_portfolio(optimum, returns):

print("Optimal weights:", optimum['x'].round(3))

print("Expected return, volatility and Sharpe ratio:", statistics(optimum['x'].round(3),returns))

def show_optimal_portfolio(optimum, returns, preturns, pvariances):

plt.figure(figsize=(10,6))

plt.scatter(pvariances,preturns,c=preturns/pvariances,marker='o')

plt.grid(True)

plt.xlabel('Expected Volatility')

plt.ylabel('Expected Return')

plt.colorbar(label='Sharpe Ratio')

plt.plot(statistics(optimum['x'],returns)[1],statistics(optimum['x'],returns)[0],'g*',markersize=20.0)

plt.show()

# In[24]:

optimum=optimize_portfolio(weights,returns)

print_optimal_portfolio(optimum, returns)

show_optimal_portfolio(optimum, returns, preturns, pvariances)

# # Finding and plotting the Optimal Weights (the fastquant way)

#

# Since our goal is to promote data driven investments by making quantitative analysis in finance accessible to everyone, the markowitz model is also implemented in fastquant. All it takes is a few lines of code as shown below.

# In[25]:

from fastquant import Portfolio

# In[26]:

stock_list = ['MEG', 'MAXS', 'JFC', 'ALI']

p = Portfolio(stock_list,"2017-01-01", "2020-01-01")

axs = p.data.plot(subplots=True, figsize=(15,10))

fig = p.plot_portfolio(N=1000)

# # Bonus Section : Interactive Charts

#

# This section is expected to **NOT** render in github, but does in fastpages.

#

# It is expected to look like the image below, and in addition, the tooltip is interactive.

#

#

# # Some Basic Ideas

#

# **Stock or Share** is a unit of ownership in a company. When you invest in the stock market, (stock market is basically a place for buying or selling stocks) there are 2 main ways of earning:

#

# - **Dividend** - This is an amount paid to you by a company for your investment.

# - **Stock Trading** - The profit that you make for buying/selling stocks.

# - **Portfolio** - A combination of assets of an individual / investor.

#

# Fundamentally, you can earn money by buying some stocks, in the hope that it's price will increase in the future.

#

# There are actually clever ways on how to earn even if you predict that a stock price will decline, but that's outside the scope of this lecture.

#

# So in this lecture, we'll oversimplify and what we want is to **buy a stock cheap, and sell it when its price has increased** because that way we will make a profit. Otherwise we will incur a loss, if we decided to sell a stock at a cheaper price.

#

# # Modern Portfolio Theory (Markowitz Model)

#

# As mentioned above, investing in the stock market can result in either profit or loss.

#

# In a nutshell, Modern Portfolio Theory is a way of maximizing return for a given risk. We will define what *return* and *risk* means shortly.

#

# Let's understand this by using an example.

#

# Suppose you wanted to invest in the stock market. After completing your research, you decided to invest in the following companies:

#

# - MEG

# - MAXS

# - JFC

# - ALI

#

# We will download the data for this using a python library called fastquant. It was actually developed by a fellow Filipino Data Scientist. It aims to democratize data-driven investments for everyone.

#

#

# **NOTE** The model we'll be using relies on the assumption that returns are normally distributed. Therefore, it helps if we have large number of data points.

# In[2]:

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import warnings

import scipy.optimize as optimization

from fastquant import get_stock_data

warnings.filterwarnings('ignore')

get_ipython().run_line_magic('matplotlib', 'inline')

# In[3]:

stocks = ['MEG', 'MAXS', 'JFC', 'ALI']

datas = []

for i in stocks:

df = get_stock_data(i, "2017-01-01", "2020-01-01")

df = df.reset_index()

df.columns = ['DATE',i]

df = df[['DATE',i]]

datas.append(df)

datas1 = pd.merge(datas[0],datas[1],on=['DATE'])

datas2 = pd.merge(datas[2],datas[3],on=['DATE'])

data = pd.merge(datas1,datas2,on=['DATE'])

data.index = data['DATE']

data.drop('DATE',axis=1,inplace=True)

# The table below shows the first 5 entries in our dataset. The values here are *closing prices*. A *closing price* is a price of a stock at the end of a given trading day.

# In[4]:

data.head()

# Now, let's ask ourselves. Why don't we invest in a single company, instead of investing in multiple companies?

#

# Modern Portfolio Theory tells us that we can *minimize* our loss thru diversification. Let's understand this with an example.

#

# Suppose you decided to invest on January 2017. For illustraton purposes, let's consider the period January 2017 - May 2018.

#

# - Case 1: You invested solely on MAXS

# - Case 2: You decided to invest 50% to MAXS and the other 50% to JFC

#

# If you decided to go with case 1, it would be clear that you could immediately lose some money (as the chart shows a decreasing trend). If you instead decided to go with Case 2, your loss could have been mitigated since the price for JFC is increasing during that period.

#

# Of course you could argue that "why not invest all of my money in JFC", well my counter argument to that would be, when JFC is experiencing a decline in it's price, there would be some other company that's actually experiencing an increase in it's price.

#

# ## Key Takeaway

#

# - Invest in multiple stocks as much as possible, to minimize your loss. (Technically uncorrelated or negatively correlated)

# In[5]:

data['MAXS'].plot(figsize=(12,5),legend=True)

# In[6]:

data['JFC'].plot(figsize=(12,5),legend=True,color='r')

# Now, let's define what a return is. Intuitively, we can define return as :

#

# *The stock price today minus the stock price yesterday. Divide the difference by the stock price yesterday*

#

# More formally,

#

# The *return* $R_{t,t+1}$ from time $t$ to time ${t+1}$ is given by:

#

# $$ R_{t,t+1} = \frac{P_{t+1}-P_{t}}{P_{t}} $$

#

# where $P_i$ is the price of the stock for a given time point.

# In[7]:

returns = data.pct_change()

returns

# The mean of the returns is called the **Expected Return**.

#

# Similarly, the **Risk or Volatility** is the standard deviation of the returns.

#

# (This is different from the expected return and volatility of a portfolio, this is for a single stock)

# In[8]:

returns.mean()

# In[9]:

returns.std()

# We'll only plot MAXS and MEG to emphasize that the return for MEG is more volatile.

# In[10]:

returns[['MAXS','MEG']].plot(figsize=(12,5))

# ## Expected Return and Risk of a Portfolio

#

# Suppose your portfolio consists of returns $R_1, R_2, R_3, ... ,R_n$. Then, the expected return of a portfolio is given by:

#

# $E(R) = w_1E(R_1) + w_2E(R_2) + w_3E(R_3) + ... + w_nE(R_n) $

#

# where $w_i$ is the $i$th component of an $n-dimensional$ vector, and $\Sigma w_i = 1.$

# In[11]:

weights = np.random.random(len(stocks))

weights /= np.sum(weights)

weights

# In[12]:

returns.mean()

# In[13]:

def calculate_portfolio_return(returns, weights):

portfolio_return = np.sum(returns.mean()*weights)*252

print("Expected Portfolio Return:", portfolio_return)

# In[14]:

calculate_portfolio_return(returns,weights)

# If you had a course in Probability, you might recall that expectation of a random variable is linear while the variance is not. That's the same argument why the formula for the variance of a portfolio is quite more complicated.

#

# $Var(R) = \bf{w^{T}}\Sigma \textbf{w}$

#

# where $\Sigma$ is the covariance matrix of $R_i$

# In[15]:

returns.cov()

# In[16]:

np.sqrt(returns.cov())

# In[17]:

returns.std()

# In[18]:

def calculate_portfolio_risk(returns, weights):

portfolio_variance = np.sqrt(np.dot(weights.T, np.dot(returns.cov()*252,weights)))

print("Expected Risk:", portfolio_variance)

# In[19]:

calculate_portfolio_risk(returns,weights)

# ## Sharpe Ratio

#

#

# Remember, what we want is to find the best possible weight vector $\bf{w}$ that would give us the best possible return, with a minimal risk. Therefore, we will introduce a new metric called the *sharpe ratio*. It's simply equal to

#

# $$S.R. = \frac{E(R) - R_f}{\sqrt{Var(R)}}$$

#

# where $R_f$ is the *risk free return*. Since we're only limiting ourselves to risky assets (stocks) therefore, the formula becomes

#

# $$S.R. = \frac{E(R) - 0}{\sqrt{Var(R)}} = \frac{E(R)}{\sqrt{Var(R)}}$$

# In[20]:

def generate_portfolios(weights, returns):

preturns = []

pvariances = []

for i in range(10000):

weights = np.random.random(len(stocks))

weights/=np.sum(weights)

preturns.append(np.sum(returns.mean()*weights)*252)

pvariances.append(np.sqrt(np.dot(weights.T,np.dot(returns.cov()*252,weights))))

preturns = np.array(preturns)

pvariances = np.array(pvariances)

return preturns,pvariances

def plot_portfolios(returns, variances):

plt.figure(figsize=(10,6))

plt.scatter(variances,returns,c=returns/variances,marker='o')

plt.grid(True)

plt.xlabel('Expected Volatility')

plt.ylabel('Expected Return')

plt.colorbar(label='Sharpe Ratio')

plt.show()

# In[21]:

preturns, pvariances = generate_portfolios(weights,returns)

# ## Monte - Carlo Simulation

#

# Here, we simulated 10,000 possible weight allocations, and computed their respective expected return, risk and sharpe ratio.

# In[22]:

plot_portfolios(preturns, pvariances)

# # Finding and plotting the Optimal Weights (the hard way)

#

# At a high level, we would want to run an optimization algorithm that would

#

#

# $$maximize\ \frac{E(R)-R_f}{\sqrt{Var(R)}}$$

#

# $$s.t. \forall w_i, w_i\geq0\ and\ \Sigma w_i=1$$

#

# Full details of the mathematics behind this can be found on resources.

# In[23]:

def statistics(weights, returns):

portfolio_return=np.sum(returns.mean()*weights)*252

portfolio_volatility=np.sqrt(np.dot(weights.T,np.dot(returns.cov()*252,weights)))

return np.array([portfolio_return,portfolio_volatility,portfolio_return/portfolio_volatility])

def min_func_sharpe(weights,returns):

return -statistics(weights,returns)[2]

def optimize_portfolio(weights,returns):

constraints = ({'type':'eq','fun': lambda x: np.sum(x)-1})

bounds = tuple((0,1) for x in range(len(stocks)))

optimum=optimization.minimize(fun=min_func_sharpe,x0=weights,args=returns,method='SLSQP',bounds=bounds,constraints=constraints)

return optimum

def print_optimal_portfolio(optimum, returns):

print("Optimal weights:", optimum['x'].round(3))

print("Expected return, volatility and Sharpe ratio:", statistics(optimum['x'].round(3),returns))

def show_optimal_portfolio(optimum, returns, preturns, pvariances):

plt.figure(figsize=(10,6))

plt.scatter(pvariances,preturns,c=preturns/pvariances,marker='o')

plt.grid(True)

plt.xlabel('Expected Volatility')

plt.ylabel('Expected Return')

plt.colorbar(label='Sharpe Ratio')

plt.plot(statistics(optimum['x'],returns)[1],statistics(optimum['x'],returns)[0],'g*',markersize=20.0)

plt.show()

# In[24]:

optimum=optimize_portfolio(weights,returns)

print_optimal_portfolio(optimum, returns)

show_optimal_portfolio(optimum, returns, preturns, pvariances)

# # Finding and plotting the Optimal Weights (the fastquant way)

#

# Since our goal is to promote data driven investments by making quantitative analysis in finance accessible to everyone, the markowitz model is also implemented in fastquant. All it takes is a few lines of code as shown below.

# In[25]:

from fastquant import Portfolio

# In[26]:

stock_list = ['MEG', 'MAXS', 'JFC', 'ALI']

p = Portfolio(stock_list,"2017-01-01", "2020-01-01")

axs = p.data.plot(subplots=True, figsize=(15,10))

fig = p.plot_portfolio(N=1000)

# # Bonus Section : Interactive Charts

#

# This section is expected to **NOT** render in github, but does in fastpages.

#

# It is expected to look like the image below, and in addition, the tooltip is interactive.

#

#  #

# Refer to this link https://altair-viz.github.io/getting_started/installation.html for altair's installation, but most likely

#

# ```python

# !pip3 install altair

# ```

#

# should do the trick.

# In[27]:

import altair as alt

alt.renderers.set_embed_options(actions=False)

# In[28]:

weights = pd.DataFrame(optimum['x'].round(2),columns=['weights'])

weights['Symbols'] = stocks

# In[29]:

returns,variances = p.generate_portfolios(N=5000)

portfolios = pd.DataFrame()

portfolios['Expected Return'] = returns

portfolios['Expected Volatility'] = variances

portfolios['Sharpe Ratio'] = portfolios['Expected Return'] / portfolios['Expected Volatility']

minimumX = portfolios['Expected Volatility'].min()

maximumX = portfolios['Expected Volatility'].max()

minimumY = portfolios['Expected Return'].min()

maximumY = portfolios['Expected Return'].max()

optimum = p.calculate_statistics(p.optimum_weights)

optimal = pd.DataFrame()

optimal['Expected Return'] = [optimum[0]]

optimal['Expected Volatility'] = [optimum[1]]

optimal['Sharpe Ratio'] = [optimum[2]]

optimal['img'] = "https://img.icons8.com/clouds/100/000000/us-dollar--v1.png"

# In[30]:

# uncomment if N > 5000

# alt.data_transformers.enable('json')

# In[31]:

chart = alt.Chart(portfolios).mark_circle().encode(

x = alt.X('Expected Volatility',scale=alt.Scale(domain=[minimumX,maximumX])),

y = alt.X('Expected Return',scale=alt.Scale(domain=[minimumY,maximumY])),

color = alt.Color('Sharpe Ratio',scale=alt.Scale(range=['blue','yellow'])),

tooltip = ['Sharpe Ratio']

).properties(height=350,width=500)

optimal_chart = alt.Chart(optimal).mark_image(height=60,width=60).encode(

x = alt.X('Expected Volatility',scale=alt.Scale(domain=[minimumX,maximumX])),

y = alt.X('Expected Return',scale=alt.Scale(domain=[minimumY,maximumY])),

color = alt.Color('Sharpe Ratio',scale=alt.Scale(range=['blue','yellow'])),

tooltip = ['Sharpe Ratio'],

url = 'img'

).properties(height=350,width=500)

visualization = chart+optimal_chart

visualization

# Resources:

#

# - Financial Mathematics

# - https://www.springer.com/gp/book/9780857290816

# - General Investing

# - https://www.ig.com/en/learn-to-trade/ig-academy

#

# Refer to this link https://altair-viz.github.io/getting_started/installation.html for altair's installation, but most likely

#

# ```python

# !pip3 install altair

# ```

#

# should do the trick.

# In[27]:

import altair as alt

alt.renderers.set_embed_options(actions=False)

# In[28]:

weights = pd.DataFrame(optimum['x'].round(2),columns=['weights'])

weights['Symbols'] = stocks

# In[29]:

returns,variances = p.generate_portfolios(N=5000)

portfolios = pd.DataFrame()

portfolios['Expected Return'] = returns

portfolios['Expected Volatility'] = variances

portfolios['Sharpe Ratio'] = portfolios['Expected Return'] / portfolios['Expected Volatility']

minimumX = portfolios['Expected Volatility'].min()

maximumX = portfolios['Expected Volatility'].max()

minimumY = portfolios['Expected Return'].min()

maximumY = portfolios['Expected Return'].max()

optimum = p.calculate_statistics(p.optimum_weights)

optimal = pd.DataFrame()

optimal['Expected Return'] = [optimum[0]]

optimal['Expected Volatility'] = [optimum[1]]

optimal['Sharpe Ratio'] = [optimum[2]]

optimal['img'] = "https://img.icons8.com/clouds/100/000000/us-dollar--v1.png"

# In[30]:

# uncomment if N > 5000

# alt.data_transformers.enable('json')

# In[31]:

chart = alt.Chart(portfolios).mark_circle().encode(

x = alt.X('Expected Volatility',scale=alt.Scale(domain=[minimumX,maximumX])),

y = alt.X('Expected Return',scale=alt.Scale(domain=[minimumY,maximumY])),

color = alt.Color('Sharpe Ratio',scale=alt.Scale(range=['blue','yellow'])),

tooltip = ['Sharpe Ratio']

).properties(height=350,width=500)

optimal_chart = alt.Chart(optimal).mark_image(height=60,width=60).encode(

x = alt.X('Expected Volatility',scale=alt.Scale(domain=[minimumX,maximumX])),

y = alt.X('Expected Return',scale=alt.Scale(domain=[minimumY,maximumY])),

color = alt.Color('Sharpe Ratio',scale=alt.Scale(range=['blue','yellow'])),

tooltip = ['Sharpe Ratio'],

url = 'img'

).properties(height=350,width=500)

visualization = chart+optimal_chart

visualization

# Resources:

#

# - Financial Mathematics

# - https://www.springer.com/gp/book/9780857290816

# - General Investing

# - https://www.ig.com/en/learn-to-trade/ig-academy

#

# Refer to this link https://altair-viz.github.io/getting_started/installation.html for altair's installation, but most likely

#

# ```python

# !pip3 install altair

# ```

#

# should do the trick.

# In[27]:

import altair as alt

alt.renderers.set_embed_options(actions=False)

# In[28]:

weights = pd.DataFrame(optimum['x'].round(2),columns=['weights'])

weights['Symbols'] = stocks

# In[29]:

returns,variances = p.generate_portfolios(N=5000)

portfolios = pd.DataFrame()

portfolios['Expected Return'] = returns

portfolios['Expected Volatility'] = variances

portfolios['Sharpe Ratio'] = portfolios['Expected Return'] / portfolios['Expected Volatility']

minimumX = portfolios['Expected Volatility'].min()

maximumX = portfolios['Expected Volatility'].max()

minimumY = portfolios['Expected Return'].min()

maximumY = portfolios['Expected Return'].max()

optimum = p.calculate_statistics(p.optimum_weights)

optimal = pd.DataFrame()

optimal['Expected Return'] = [optimum[0]]

optimal['Expected Volatility'] = [optimum[1]]

optimal['Sharpe Ratio'] = [optimum[2]]

optimal['img'] = "https://img.icons8.com/clouds/100/000000/us-dollar--v1.png"

# In[30]:

# uncomment if N > 5000

# alt.data_transformers.enable('json')

# In[31]:

chart = alt.Chart(portfolios).mark_circle().encode(

x = alt.X('Expected Volatility',scale=alt.Scale(domain=[minimumX,maximumX])),

y = alt.X('Expected Return',scale=alt.Scale(domain=[minimumY,maximumY])),

color = alt.Color('Sharpe Ratio',scale=alt.Scale(range=['blue','yellow'])),

tooltip = ['Sharpe Ratio']

).properties(height=350,width=500)

optimal_chart = alt.Chart(optimal).mark_image(height=60,width=60).encode(

x = alt.X('Expected Volatility',scale=alt.Scale(domain=[minimumX,maximumX])),

y = alt.X('Expected Return',scale=alt.Scale(domain=[minimumY,maximumY])),

color = alt.Color('Sharpe Ratio',scale=alt.Scale(range=['blue','yellow'])),

tooltip = ['Sharpe Ratio'],

url = 'img'

).properties(height=350,width=500)

visualization = chart+optimal_chart

visualization

# Resources:

#

# - Financial Mathematics

# - https://www.springer.com/gp/book/9780857290816

# - General Investing

# - https://www.ig.com/en/learn-to-trade/ig-academy

#

# Refer to this link https://altair-viz.github.io/getting_started/installation.html for altair's installation, but most likely

#

# ```python

# !pip3 install altair

# ```

#

# should do the trick.

# In[27]:

import altair as alt

alt.renderers.set_embed_options(actions=False)

# In[28]:

weights = pd.DataFrame(optimum['x'].round(2),columns=['weights'])

weights['Symbols'] = stocks

# In[29]:

returns,variances = p.generate_portfolios(N=5000)

portfolios = pd.DataFrame()

portfolios['Expected Return'] = returns

portfolios['Expected Volatility'] = variances

portfolios['Sharpe Ratio'] = portfolios['Expected Return'] / portfolios['Expected Volatility']

minimumX = portfolios['Expected Volatility'].min()

maximumX = portfolios['Expected Volatility'].max()

minimumY = portfolios['Expected Return'].min()

maximumY = portfolios['Expected Return'].max()

optimum = p.calculate_statistics(p.optimum_weights)

optimal = pd.DataFrame()

optimal['Expected Return'] = [optimum[0]]

optimal['Expected Volatility'] = [optimum[1]]

optimal['Sharpe Ratio'] = [optimum[2]]

optimal['img'] = "https://img.icons8.com/clouds/100/000000/us-dollar--v1.png"

# In[30]:

# uncomment if N > 5000

# alt.data_transformers.enable('json')

# In[31]:

chart = alt.Chart(portfolios).mark_circle().encode(

x = alt.X('Expected Volatility',scale=alt.Scale(domain=[minimumX,maximumX])),

y = alt.X('Expected Return',scale=alt.Scale(domain=[minimumY,maximumY])),

color = alt.Color('Sharpe Ratio',scale=alt.Scale(range=['blue','yellow'])),

tooltip = ['Sharpe Ratio']

).properties(height=350,width=500)

optimal_chart = alt.Chart(optimal).mark_image(height=60,width=60).encode(

x = alt.X('Expected Volatility',scale=alt.Scale(domain=[minimumX,maximumX])),

y = alt.X('Expected Return',scale=alt.Scale(domain=[minimumY,maximumY])),

color = alt.Color('Sharpe Ratio',scale=alt.Scale(range=['blue','yellow'])),

tooltip = ['Sharpe Ratio'],

url = 'img'

).properties(height=350,width=500)

visualization = chart+optimal_chart

visualization

# Resources:

#

# - Financial Mathematics

# - https://www.springer.com/gp/book/9780857290816

# - General Investing

# - https://www.ig.com/en/learn-to-trade/ig-academy