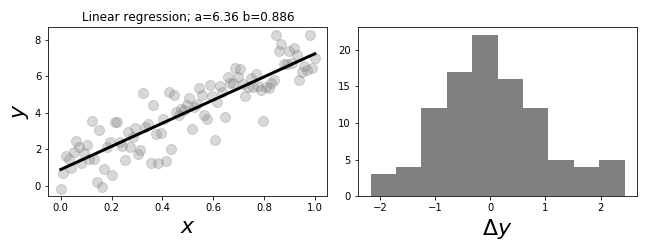

The panel on the left # shows the data and regression line. The panel on the right shows a histogram of # the regression errors.

# #

#

#

#

# The graph on the left of

# [Figure](#fig:Regression_001)

# shows the regression line plotted against the

# data. The estimated

# parameters are noted in the title. The histogram on the

# right of

# [Figure](#fig:Regression_001) shows the residual errors in the model.

# It is always a good idea to inspect the residuals of any regression

# for

# normality. These are the differences between the fitted line for

# each $x_i$

# value and the corresponding $y_i$ value in the data.

# Note that the $x$ term does

# not have to be uniformly monotone.

#

# To decouple the deterministic variation from

# the random variation, we can fix

# the index and write separate problems of the

# form

#

# $$

# y_i = a x_i +b + \epsilon_i

# $$

#

# where $\epsilon_i \sim \mathcal{N}(0,\sigma^2)$. What could we do with

# just

# this one component of the problem? In other words, suppose we had

# $m$-samples of

# this component as in $\lbrace y_{i,k}\rbrace_{k=1}^m$. Following

# the usual

# procedure, we could obtain estimates of the mean of $y_i$ as

#

# $$

# \hat{y_i} = \frac{1}{m}\sum_{k=1}^m y_{i,k}

# $$

#

# However, this tells us nothing about the individual parameters $a$

# and $b$

# because they are not separable in the terms that are computed, namely,

# we may

# have

#

# $$

# \mathbb{E}(y_i) = a x_i +b

# $$

#

# but we still only have one equation and the two unknowns, $a$ and

# $b$. How

# about if we consider and fix another component $j$ as in

#

# $$

# y_j = a x_j +b + \epsilon_i

# $$

#

# Then, we have

#

# $$

# \mathbb{E}(y_j) = a x_j +b

# $$

#

# so at least now we have two equations and two unknowns and we know how to

# estimate the left hand sides of these equations from the data using the

# estimators $\hat{y_i}$ and $\hat{y_j}$. Let's see how this works in the code

# sample below.

# In[4]:

x0, xn =x[0],x[80]

# generate synthetic data

y_0 = a*x0 + np.random.randn(20)+b

y_1 = a*xn + np.random.randn(20)+b

# mean along sample dimension

yhat = np.array([y_0,y_1]).mean(axis=1)

a_,b_=np.linalg.solve(np.array([[x0,1],

[xn,1]]),yhat)

#

#

#

#

#

#

#

#

#

# The graph on the left of

# [Figure](#fig:Regression_001)

# shows the regression line plotted against the

# data. The estimated

# parameters are noted in the title. The histogram on the

# right of

# [Figure](#fig:Regression_001) shows the residual errors in the model.

# It is always a good idea to inspect the residuals of any regression

# for

# normality. These are the differences between the fitted line for

# each $x_i$

# value and the corresponding $y_i$ value in the data.

# Note that the $x$ term does

# not have to be uniformly monotone.

#

# To decouple the deterministic variation from

# the random variation, we can fix

# the index and write separate problems of the

# form

#

# $$

# y_i = a x_i +b + \epsilon_i

# $$

#

# where $\epsilon_i \sim \mathcal{N}(0,\sigma^2)$. What could we do with

# just

# this one component of the problem? In other words, suppose we had

# $m$-samples of

# this component as in $\lbrace y_{i,k}\rbrace_{k=1}^m$. Following

# the usual

# procedure, we could obtain estimates of the mean of $y_i$ as

#

# $$

# \hat{y_i} = \frac{1}{m}\sum_{k=1}^m y_{i,k}

# $$

#

# However, this tells us nothing about the individual parameters $a$

# and $b$

# because they are not separable in the terms that are computed, namely,

# we may

# have

#

# $$

# \mathbb{E}(y_i) = a x_i +b

# $$

#

# but we still only have one equation and the two unknowns, $a$ and

# $b$. How

# about if we consider and fix another component $j$ as in

#

# $$

# y_j = a x_j +b + \epsilon_i

# $$

#

# Then, we have

#

# $$

# \mathbb{E}(y_j) = a x_j +b

# $$

#

# so at least now we have two equations and two unknowns and we know how to

# estimate the left hand sides of these equations from the data using the

# estimators $\hat{y_i}$ and $\hat{y_j}$. Let's see how this works in the code

# sample below.

# In[4]:

x0, xn =x[0],x[80]

# generate synthetic data

y_0 = a*x0 + np.random.randn(20)+b

y_1 = a*xn + np.random.randn(20)+b

# mean along sample dimension

yhat = np.array([y_0,y_1]).mean(axis=1)

a_,b_=np.linalg.solve(np.array([[x0,1],

[xn,1]]),yhat)

#

#

#

#

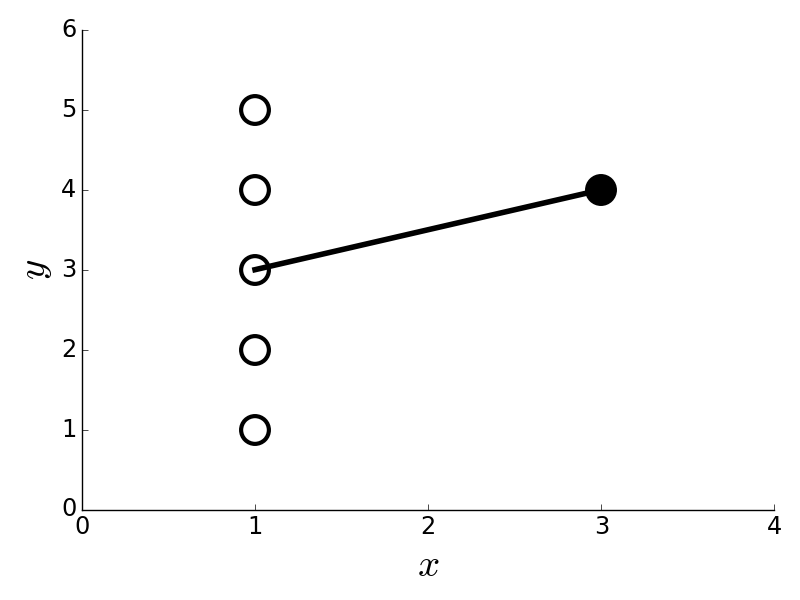

# The fitted and true lines are plotted with # the data values. The squares at either end of the solid line show the mean value # for each of the data groups shown.

# #

#

#

#

# **Programming

# Tip.**

#

# The prior code uses the `solve` function in the Numpy `linalg` module,

# which

# contains the core linear algebra codes in Numpy that incorporate the

# battle-tested LAPACK library.

#

#

#

# We can write out the solution for the

# estimated parameters for this

# case where $x_0 =0$

#

# $$

# \begin{align*}

# \hat{a} &= \frac{\hat{y}_i - \hat{y}_0}{x_i} \\\

# \hat{b} &=

# \hat{y_0} \\\

# \end{align*}

# $$

#

# The expectations and variances of these estimators are the following,

#

# $$

# \begin{align*}

# \mathbb{E}(\hat{a}) &= \frac{a x_i }{x_i}=a \\\

# \mathbb{E}(\hat{b}) &=b \\\

# \mathbb{V}(\hat{a}) &= \frac{2 \sigma^2}{x_i^2} \\\

# \mathbb{V}(\hat{b}) &= \sigma^2

# \end{align*}

# $$

#

# The expectations show that the estimators are unbiased. The

# estimator

# $\hat{a}$ has a variance that decreases as larger points $x_i$ are

# selected.

# That is, it is better to have samples further out along the

# horizontal axis for

# fitting the line. This variance quantifies the *leverage*

# of those distant

# points.

#

# **Regression From Projection Methods.** Let's see if we can apply our

# knowledge

# of projection methods to the general case. In vector notation, we can

# write

# the following:

#

# $$

# \mathbf{y} = a \mathbf{x} + b\mathbf{1} + \boldsymbol{\epsilon}

# $$

#

# where $\mathbf{1}$ is the vector of all ones.

# Let's use the inner-product

# notation,

#

# $$

# \langle \mathbf{x},\mathbf{y} \rangle = \mathbb{E}(\mathbf{x}^T \mathbf{y})

# $$

#

# Then, by taking the inner-product with some $\mathbf{x}_1 \in

# \mathbf{1}^\perp$

# we obtain [^perp],

#

# [^perp]: The space of all vectors, $\mathbf{a}$ such that

# $\langle

# \mathbf{a},\mathbf{1} \rangle = 0$ is denoted $\mathbf{1}^\perp$.

#

# $$

# \langle \mathbf{y},\mathbf{x}_1 \rangle = a \langle \mathbf{x},\mathbf{x}_1

# \rangle

# $$

#

# Recall that $\mathbb{E}(\boldsymbol{\epsilon})=\mathbf{0}$. We

# can finally

# solve for $a$ as

#

#

#

#

# $$

# \begin{equation}

# \hat{a} = \frac{\langle\mathbf{y},\mathbf{x}_1 \rangle}{\langle

# \mathbf{x},\mathbf{x}_1 \rangle}

# \end{equation}

# \label{eq:ahat} \tag{1}

# $$

#

# That was pretty neat but now we have the mysterious $\mathbf{x}_1$

# vector.

# Where does this come from? If we project $\mathbf{x}$ onto the

# $\mathbf{1}^\perp$, then we get the MMSE approximation to $\mathbf{x}$ in the

# $\mathbf{1}^\perp$ space. Thus, we take

#

# $$

# \mathbf{x}_1 = P_{\mathbf{1}^\perp} (\mathbf{x})

# $$

#

# Remember that $P_{\mathbf{1}^\perp} $ is a projection matrix so the length of

# $\mathbf{x}_1$ is at most $\mathbf{x}$. This means that the denominator in

# the

# $\hat{a}$ equation above is really just the length of the $\mathbf{x}$

# vector in

# the coordinate system of $P_{\mathbf{1}^\perp} $. Because the

# projection is

# orthogonal (namely, of minimum length), the Pythagorean theorem

# gives this

# length as the following:

#

# $$

# \langle \mathbf{x},\mathbf{x}_1 \rangle ^2=\langle \mathbf{x},\mathbf{x}

# \rangle- \langle\mathbf{1},\mathbf{x} \rangle^2

# $$

#

# The first term on the right is the length of the $\mathbf{x}$ vector

# and last

# term is the length of $\mathbf{x}$ in the coordinate system orthogonal

# to

# $P_{\mathbf{1}^\perp} $, namely that of $\mathbf{1}$. We

# can use this geometric

# interpretation to understand what is going on in

# typical linear regression in

# much more detail. The fact that the denominator is

# the orthogonal projection of

# $\mathbf{x}$ tells us that the choice of

# $\mathbf{x}_1$ has the strongest effect

# (i.e., largest value) on reducing

# the variance of $\hat{a}$. That is, the more

# $\mathbf{x}$ is aligned with

# $\mathbf{1}$, the worse the variance of $\hat{a}$.

# This makes intuitive sense

# because the closer $\mathbf{x}$ is to $\mathbf{1}$,

# the more constant it is,

# and we have already seen from our one-dimensional

# example that distance between

# the $x$ terms pays off in reduced variance. We

# already know that $\hat{a}$

# is an unbiased estimator, and, because we chose

# $\mathbf{x}_1$ deliberately as a

# projection, we know that it is also of minimum

# variance. Such estimators are

# known as Minimum-Variance Unbiased Estimators

# (MVUE).

#

# In the same spirit, let's examine the numerator of $\hat{a}$ in

# Equation [1](#eq:ahat). We can write

# $\mathbf{x}_{1}$ as the following

#

# $$

# \mathbf{x}_{1} = \mathbf{x} - P_{\mathbf{1}} \mathbf{x}

# $$

#

# where $P_{\mathbf{1}}$ is projection matrix of $\mathbf{x}$ onto the

# $\mathbf{1}$ vector. Using this, the numerator of $\hat{a}$ becomes

#

# $$

# \langle \mathbf{y}, \mathbf{x}_1\rangle =\langle \mathbf{y},

# \mathbf{x}\rangle -\langle \mathbf{y}, P_{\mathbf{1}} \mathbf{x}\rangle

# $$

#

# Note that,

#

# $$

# P_{\mathbf{1}} = \mathbf{1} \mathbf{1}^T \frac{1}{n}

# $$

#

# so that writing this out explicitly gives

#

# $$

# \langle \mathbf{y}, P_{\mathbf{1}} \mathbf{x}\rangle = \left(\mathbf{y}^T

# \mathbf{1}\right) \left(\mathbf{1}^T \mathbf{x}\right)/n =\left(\sum

# y_i\right)\left(\sum x_{i}\right)/n

# $$

#

# and similarly, we have the following for the denominator:

#

# $$

# \langle \mathbf{x}, P_{\mathbf{1}} \mathbf{x}\rangle = \left(\mathbf{x}^T

# \mathbf{1}\right) \left(\mathbf{1}^T \mathbf{x}\right)/n =\left(\sum

# x_i\right)\left(\sum x_{i}\right)/n

# $$

#

# So, plugging all of this together gives the following,

#

# $$

# \hat{a} = \frac{\mathbf{x}^T\mathbf{y}-(\sum x_i)(\sum y_i)/n}{\mathbf{x}^T

# \mathbf{x} -(\sum x_i)^2/n}

# $$

#

# with corresponding variance,

#

# $$

# \begin{align*}

# \mathbb{V}(\hat{a}) &= \sigma^2

# \frac{\|\mathbf{x}_1\|^2}{\langle\mathbf{x},\mathbf{x}_1\rangle^2} \\\

# &= \frac{\sigma^2}{\Vert \mathbf{x}\Vert^2-n(\overline{x}^2)}

# \end{align*}

# $$

#

# Using the same approach with $\hat{b}$ gives,

#

#

#

#

# $$

# \begin{equation}

# \hat{b} = \frac{\langle \mathbf{y},\mathbf{x}^{\perp}

# \rangle}{\langle \mathbf{1},\mathbf{x}^{\perp}\rangle}

# \label{_auto1} \tag{2}

# \end{equation}

# $$

#

#

#

#

# $$

# \begin{equation} \

# = \frac{\langle

# \mathbf{y},\mathbf{1}-P_{\mathbf{x}}(\mathbf{1})\rangle}{\langle

# \mathbf{1},\mathbf{1}-P_{\mathbf{x}}(\mathbf{1})\rangle}

# \label{_auto2} \tag{3}

# \end{equation}

# $$

#

#

#

#

# $$

# \begin{equation} \

# = \frac{\mathbf{x}^T \mathbf{x}(\sum y_i)/n

# -\mathbf{x}^T\mathbf{y}(\sum x_i)/n}{\mathbf{x}^T \mathbf{x} -(\sum x_i)^2/n}

# \label{_auto3} \tag{4}

# \end{equation}

# $$

#

# where

#

# $$

# P_{\mathbf{x}} = \frac{\mathbf{\mathbf{x} \mathbf{x}^T}}{\| \mathbf{x} \|^2}

# $$

#

# with variance

#

# $$

# \begin{align*}

# \mathbb{V}(\hat{b})&=\sigma^2 \frac{\langle

# \boldsymbol{\mathbf{1}-P_{\mathbf{x}}(\mathbf{1})},\boldsymbol{\mathbf{1}-P_{\mathbf{x}}(\mathbf{1})}\rangle}{\langle

# \mathbf{1},\boldsymbol{\mathbf{1}-P_{\mathbf{x}}(\mathbf{1})}\rangle^2} \\\

# &=\frac{\sigma^2}{n-\frac{(n\overline{x})^2}{\Vert\mathbf{x}\Vert^2}}

# \end{align*}

# $$

#

# **Qualifying the Estimates.** Our formulas for the variance above include the

# unknown $\sigma^2$, which we must estimate from the data itself using our

# plug-

# in estimates. We can form the residual sum of squares as

#

# $$

# \texttt{RSS} = \sum_i (\hat{a} x_i + \hat{b} - y_i)^2

# $$

#

# Thus, the estimate of $\sigma^2$ can be expressed as

#

# $$

# \hat{\sigma}^2 = \frac{\texttt{RSS}}{n-2}

# $$

#

# where $n$ is the number of samples. This is also known as the

# *residual mean

# square*. The $n-2$ represents the *degrees of freedom* (`df`).

# Because we

# estimated two parameters from the same data we have $n-2$ instead of

# $n$. Thus,

# in general, $\texttt{df} = n - p$, where $p$ is the number of

# estimated

# parameters. Under the assumption that the noise is Gaussian, the

# $\texttt{RSS}/\sigma^2$ is chi-squared distributed with $n-2$ degrees of

# freedom. Another important term is the *sum of squares about the mean*, (a.k.a

# *corrected* sum of squares),

#

# $$

# \texttt{SYY} = \sum (y_i - \bar{y})^2

# $$

#

# The $\texttt{SYY}$ captures the idea of not using the $x_i$ data and

# just using

# the mean of the $y_i$ data to estimate $y$. These two terms lead

# to the $R^2$

# term,

#

# $$

# R^2=1-\frac{\texttt{RSS}}{ \texttt{SYY} }

# $$

#

# Note that for perfect regression, $R^2=1$. That is, if the

# regression gets

# each $y_i$ data point exactly right, then

# $\texttt{RSS}=0$ this term equals one.

# Thus, this term is used to

# measure of goodness-of-fit. The `stats` module in

# `scipy` computes

# many of these terms automatically,

# In[5]:

from scipy import stats

slope,intercept,r_value,p_value,stderr = stats.linregress(x,y)

# where the square of the `r_value` variable is the $R^2$ above. The

# computed

# p-value is the two-sided hypothesis test with a null hypothesis that

# the slope

# of the line is zero. In other words, this tests whether or not the

# linear

# regression makes sense for the data for that hypothesis. The

# Statsmodels

# module provides a powerful extension to Scipy's stats module by

# making it easy

# to do regression and keep track of these parameters. Let's

# reformulate our

# problem using the Statsmodels framework by creating

# a Pandas dataframe for the

# data,

# In[6]:

import statsmodels.formula.api as smf

from pandas import DataFrame

import numpy as np

d = DataFrame({'x':np.linspace(0,1,10)}) # create data

d['y'] = a*d.x+ b + np.random.randn(*d.x.shape)

#

#

# Now that we have the input data in the above

# Pandas dataframe, we

# can perform the regression as in the following,

# In[7]:

results = smf.ols('y ~ x', data=d).fit()

# The $\sim$ symbol is notation for $y = a x + b + \epsilon$, where the

# constant

# $b$ is implicit in this usage of Statsmodels. The names in the string

# are taken

# from the columns in the dataframe. This makes it very easy to build

# models with

# complicated interactions between the named columns in the

# dataframe. We can

# examine a report of the model fit by looking at the summary,

# In[8]:

print (results.summary2())

# ```

#

# Results: Ordinary least squares

# =================================================================

# Model: OLS Adj. R-squared: 0.808

# Dependent Variable: y AIC: 28.1821

# Date: 0000-00-00 00:00 BIC: 00.0000

# No. Observations: 10 Log-Likelihood: -12.091

# Df Model: 1 F-statistic: 38.86

# Df Residuals: 8 Prob (F-statistic): 0.000250

# R-squared: 0.829 Scale: 0.82158

# -------------------------------------------------------------------

# Coef. Std.Err. t P>|t| [0.025 0.975]

# -------------------------------------------------------------------

# Intercept 1.5352 0.5327 2.8817 0.0205 0.3067 2.7637

# x 5.5990 0.8981 6.2340 0.0003 3.5279 7.6701

#

# There is a lot more here than we have discussed so far, but the

# Statsmodels

# documentation is the best place to go for complete information

# about this

# report. The F-statistic attempts to capture the contrast between

# including the

# slope parameter or leaving it off. That is, consider two

# hypotheses:

# ```

#

# $$

# \begin{align*}

# H_0 \colon \mathbb{E}(Y|X=x) &= b \\\

# H_1 \colon

# \mathbb{E}(Y|X=x) &= b + a x

# \end{align*}

# $$

#

# In order to quantify how much better adding the slope term is for

# the

# regression, we compute the following:

#

# $$

# F = \frac{\texttt{SYY} - \texttt{RSS}}{ \hat{\sigma}^2 }

# $$

#

# The numerator computes the difference in the residual squared errors

# between

# including the slope in the regression or just using the mean of the

# $y_i$

# values. Once again, if we assume (or can claim asymptotically) that the

# $\epsilon$ noise term is Gaussian, $\epsilon \sim \mathcal{N}(0,\sigma^2)$,

# then

# the $H_0$ hypothesis will follow an F-distribution [^fdist] with degrees of

# freedom from the numerator and denominator. In this case, $F \sim F(1,n-2)$.

# The

# value of this statistic is reported by Statsmodels above. The corresponding

# reported probability shows the chance of $F$ exceeding its computed value if

# $H_0$ were true. So, the take-home message from all this is that including the

# slope leads to a much smaller reduction in squared error than could be expected

# from a favorable draw of $n$ points of this data, under the Gaussian additive

# noise assumption. This is evidence that including the slope is meaningful for

# this data.

#

# [^fdist]: The $F(m,n)$ F-distribution has two integer degree-of-

# freedom parameters, $m$

# and $n$.

#

#

# The Statsmodels report also shows the

# adjusted $R^2$ term.

# This is a correction to the $R^2$ calculation that accounts

# for the number of parameters $p$ that the regression is

# fitting and the sample

# size $n$,

#

# $$

# \texttt{Adjusted } R^2 = 1- \frac{\texttt{RSS}/(n-p)}{\texttt{SYY}/(n-1)}

# $$

#

# This is always lower than $R^2$ except when $p=1$ (i.e., estimating

# only $b$).

# This becomes a better way to compare regressions when one is

# attempting to fit

# many parameters with comparatively small $n$.

#

# **Linear Prediction.** Using

# linear regression for prediction introduces

# some other issues. Recall the

# following expectation,

#

# $$

# \mathbb{E}(Y|X=x) \approx \hat{a} x + \hat{b}

# $$

#

# where we have determined $\hat{a}$ and $\hat{b}$ from the data.

# Given a new

# point of interest, $x_p$, we would certainly compute

#

# $$

# \hat{y}_p = \hat{a} x_p + \hat{b}

# $$

#

# as the predicted value for $\hat{ y_p }$. This is the same as saying

# that our

# best prediction for $y$ based on $x_p$ is the above conditional

# expectation. The

# variance for this is the following,

#

# $$

# \mathbb{V}(y_p) = x_p^2 \mathbb{V}(\hat{a}) +\mathbb{V}(\hat{b})+2 x_p

# \texttt{cov}(\hat{a}\hat{b})

# $$

#

# Note that we have the covariance above because $\hat{a}$ and

# $\hat{b}$ are

# derived from the same data. We can work this out below using

# our previous

# notation from [1](#eq:ahat),

#

# $$

# \begin{align*}

# \texttt{cov}(\hat{a}\hat{b})=&\frac{\mathbf{x}_1^T

# \mathbb{V}\lbrace\mathbf{y}\mathbf{y}^T\rbrace\mathbf{x}^{\perp}}{(\mathbf{x}_1^T

# \mathbf{x})(\mathbf{1}^T \mathbf{x}^{\perp})} = \frac{\mathbf{x}_1^T

# \sigma^2\mathbf{I}\mathbf{x}^{\perp}}{(\mathbf{x}_1^T \mathbf{x})(\mathbf{1}^T

# \mathbf{x}^{\perp})}\\\

# =&\sigma^2\frac{\mathbf{x}_1^T\mathbf{x}^{\perp}}{(\mathbf{x}_1^T

# \mathbf{x})(\mathbf{1}^T \mathbf{x}^{\perp})} =

# \sigma^2\frac{\left(\mathbf{x}-P_1\mathbf{x}\right)^T\mathbf{x}^{\perp}}{(\mathbf{x}_1^T

# \mathbf{x})(\mathbf{1}^T \mathbf{x}^{\perp})}\\\

# =&\sigma^2\frac{-\mathbf{x}^T P_1^T\mathbf{x}^{\perp}}{(\mathbf{x}_1^T

# \mathbf{x})(\mathbf{1}^T \mathbf{x}^{\perp})} =

# \sigma^2\frac{-\mathbf{x}^T\frac{1}{n}\mathbf{1}

# \mathbf{1}^T\mathbf{x}^{\perp}}{(\mathbf{x}_1^T \mathbf{x})(\mathbf{1}^T

# \mathbf{x}^{\perp})}\\\

# =&\sigma^2\frac{-\mathbf{x}^T\frac{1}{n}\mathbf{1}}{(\mathbf{x}_1^T \mathbf{x})}

# = \frac{-\sigma^2\overline{x}}{\sum_{i=1}^n(x_i^2-\overline{x}^2)}\\\

# \end{align*}

# $$

#

# After plugging all this in, we obtain the following,

#

# $$

# \mathbb{V}(y_p)=\sigma^2 \frac{x_p^2-2 x_p\overline{x}+\Vert

# \mathbf{x}\Vert^2/n}{\Vert\mathbf{x}\Vert^2-n\overline{x}^2}

# $$

#

# where, in practice, we use the plug-in estimate for

# the $\sigma^2$.

#

# There is

# an important consequence for the confidence interval for

# $y_p$. We cannot simply

# use the square root of $\mathbb{V}(y_p)$

# to form the confidence interval because

# the model includes the

# extra $\epsilon$ noise term. In particular, the

# parameters were

# computed using a set of statistics from the data, but now must

# include different realizations for the noise term for the

# prediction part. This

# means we have to compute

#

# $$

# \eta^2=\mathbb{V}(y_p)+\sigma^2

# $$

#

# Then, the 95\% confidence interval $y_p \in

# (y_p-2\hat{\eta},y_p+2\hat{\eta})$

# is the following,

#

# $$

# \mathbb{P}(y_p-2\hat{\eta}< y_p <

# y_p+2\hat{\eta})\approx\mathbb{P}(-2<\mathcal{N}(0,1)<2) \approx 0.95

# $$

#

# where $\hat{\eta}$ comes from substituting the

# plug-in estimate for $\sigma$.

# ## Extensions to Multiple Covariates

#

# With all the machinery we have, it is a

# short notational hop to consider

# multiple regressors as in the following,

#

# $$

# \mathbf{Y} = \mathbf{X} \boldsymbol{\beta} +\boldsymbol{\epsilon}

# $$

#

# with the usual $\mathbb{E}(\boldsymbol{\epsilon})=\mathbf{0}$ and

# $\mathbb{V}(\boldsymbol{\epsilon})=\sigma^2\mathbf{I}$. Thus, $\mathbf{X}$ is a

# $n \times p$ full rank matrix of regressors and $\mathbf{Y}$ is the $n$-vector

# of observations. Note that the constant term has been incorporated into

# $\mathbf{X}$ as a column of ones. The corresponding estimated solution for

# $\boldsymbol{\beta}$ is the following,

#

# $$

# \hat{ \boldsymbol{\beta} } = (\mathbf{X}^T \mathbf{X})^{-1} \mathbf{X}^T

# \mathbf{Y}

# $$

#

# with corresponding variance,

#

# $$

# \mathbb{V}(\hat{\boldsymbol{\beta}})=\sigma^2(\mathbf{X}^T \mathbf{X})^{-1}

# $$

#

# and with the assumption of Gaussian errors, we have

#

# $$

# \hat{\boldsymbol{\beta}}\sim \mathcal{N}(\boldsymbol{\beta},

# \sigma^2(\mathbf{X}^T \mathbf{X})^{-1})

# $$

#

# The unbiased estimate of $\sigma^2$ is the following,

#

# $$

# \hat{\sigma}^2 = \frac{1}{n-p}\sum \hat{\epsilon}_i^2

# $$

#

# where $\hat{ \boldsymbol{\epsilon}}=\mathbf{X}\hat{\boldsymbol{\beta}}

# -\mathbf{Y}$

# is the vector of residuals. Tukey christened the following matrix

# as the *hat*

# matrix (a.k.a. influence matrix),

#

# $$

# \mathbf{V}=\mathbf{X}(\mathbf{X}^T\mathbf{X})^{-1}\mathbf{X}^T

# $$

#

# because it maps $\mathbf{Y}$ into $\hat{ \mathbf{Y} }$,

#

# $$

# \hat{ \mathbf{Y} } = \mathbf{V} \mathbf{Y}

# $$

#

# As an exercise you can check that $\mathbf{V}$ is a projection

# matrix. Note

# that that matrix is solely a function of $\mathbf{X}$. The

# diagonal elements of

# $\mathbf{V}$ are called the *leverage values* and are

# contained in the closed

# interval $[1/n,1]$. These terms measure of distance

# between the values of $x_i$

# and the mean values over the $n$ observations.

# Thus, the leverage terms depend

# only on $\mathbf{X}$. This is the

# generalization of our initial discussion of

# leverage where we had multiple

# samples at only two $x_i$ points. Using the hat

# matrix, we can compute the

# variance of each residual, $e_i = \hat{y}-y_i$ as

#

# $$

# \mathbb{V}(e_i) = \sigma^2 (1-v_{i})

# $$

#

# where $v_i=V_{i,i}$. Given the above-mentioned bounds on $v_{i}$,

# these are

# always less than $\sigma^2$.

#

# Degeneracy in the columns of $\mathbf{X}$ can

# become a problem. This is when

# two or more of the columns become co-linear. We

# have already seen this with our

# single regressor example wherein $\mathbf{x}$

# close to $\mathbf{1}$ was bad

# news. To compensate for this effect we can load

# the diagonal elements and solve

# for the unknown parameters as in the following,

#

# $$

# \hat{ \boldsymbol{\beta} } = (\mathbf{X}^T \mathbf{X}+\alpha \mathbf{I})^{-1}

# \mathbf{X}^T \mathbf{Y}

# $$

#

# where $\alpha>0$ is a tunable hyper-parameter. This method is known

# as *ridge

# regression* and was proposed in 1970 by Hoerl and Kenndard. It can be

# shown that

# this is the equivalent to minimizing the following objective,

#

# $$

# \Vert \mathbf{Y}- \mathbf{X} \boldsymbol{\beta}\Vert^2 + \alpha \Vert

# \boldsymbol{\beta}\Vert^2

# $$

#

# In other words, the length of the estimated $\boldsymbol{\beta}$ is

# penalized

# with larger $\alpha$. This has the effect of stabilizing the

# subsequent inverse

# calculation and also providing a means to trade bias and

# variance, which we will

# discuss at length in the section

# [ch:ml:sec:regularization](#ch:ml:sec:regularization)

#

# **Interpreting

# Residuals.** Our model assumes an additive Gaussian noise term.

# We can check

# the voracity of this assumption by examining the residuals after

# fitting. The

# residuals are the difference between the fitted values and the

# original data

#

# $$

# \hat{\epsilon}_i = \hat{a} x_i + \hat{b} - y_i

# $$

#

# While the p-value and the F-ratio provide some indication of whether

# or not

# computing the slope of the regression makes sense, we can get directly

# at the

# key assumption of additive Gaussian noise.

#

# For sufficiently small dimensions,

# the `scipy.stats.probplot` we discussed in

# the last chapter provides quick

# visual evidence one way or another by plotting

# the standardized residuals,

#

# $$

# r_i = \frac{e_i}{\hat{\sigma}\sqrt{1-v_i}}

# $$

#

# The other part of the iid assumption implies homoscedasticity (all

# $r_i$ have

# equal variances). Under the additive Gaussian noise assumption, the

# $e_i$ should

# also be distributed according to $\mathcal{N}(0,\sigma^2(1-v_i))$.

# The

# normalized residuals $r_i$ should then be distributed according to

# $\mathcal{N}(0,1)$. Thus, the presence of any $r_i \notin [-1.96,1.96]$ should

# not be common at the 5% significance level and is thereby breeds suspicion

# regarding the homoscedasticity assumption.

#

# The Levene test in

# `scipy.stats.leven` tests the null hypothesis that all the

# variances are equal.

# This basically checks whether or not the standardized

# residuals vary across

# $x_i$ more than expected. Under the homoscedasticity

# assumption, the variance

# should be independent of $x_i$. If not, then this is a

# clue that there is a

# missing variable in the analysis or that the variables

# themselves should be

# transformed (e.g., using the $\log$ function) into another

# format that can

# reduce this effect. Also, we can use weighted least-squares

# instead of ordinary

# least-squares.

#

# **Variable Scaling.** It is tempting to conclude in a multiple

# regression that small coefficients in any of the $\boldsymbol{\beta}$ terms

# implies that those terms are not important. However, simple unit conversions

# can cause this effect. For example, if one of the regressors is in

# units of

# kilometers and the others are in meters, then just the scale

# factor can give the

# impression of outsized or under-sized effects. The

# common way to account for

# this is to scale the regressors so that

#

# $$

# x^\prime = \frac{x-\bar{x}}{\sigma_x}

# $$

#

# This has the side effect of converting the slope parameters

# into correlation

# coefficients, which is bounded by $\pm 1$.

#

# **Influential Data.** We have

# already discussed the idea

# of leverage. The concept of *influence* combines

# leverage with

# outliers. To understand influence, consider

# [Figure](#fig:Regression_005).

#

#

#

#

#

#

#

#

#

#

# **Programming

# Tip.**

#

# The prior code uses the `solve` function in the Numpy `linalg` module,

# which

# contains the core linear algebra codes in Numpy that incorporate the

# battle-tested LAPACK library.

#

#

#

# We can write out the solution for the

# estimated parameters for this

# case where $x_0 =0$

#

# $$

# \begin{align*}

# \hat{a} &= \frac{\hat{y}_i - \hat{y}_0}{x_i} \\\

# \hat{b} &=

# \hat{y_0} \\\

# \end{align*}

# $$

#

# The expectations and variances of these estimators are the following,

#

# $$

# \begin{align*}

# \mathbb{E}(\hat{a}) &= \frac{a x_i }{x_i}=a \\\

# \mathbb{E}(\hat{b}) &=b \\\

# \mathbb{V}(\hat{a}) &= \frac{2 \sigma^2}{x_i^2} \\\

# \mathbb{V}(\hat{b}) &= \sigma^2

# \end{align*}

# $$

#

# The expectations show that the estimators are unbiased. The

# estimator

# $\hat{a}$ has a variance that decreases as larger points $x_i$ are

# selected.

# That is, it is better to have samples further out along the

# horizontal axis for

# fitting the line. This variance quantifies the *leverage*

# of those distant

# points.

#

# **Regression From Projection Methods.** Let's see if we can apply our

# knowledge

# of projection methods to the general case. In vector notation, we can

# write

# the following:

#

# $$

# \mathbf{y} = a \mathbf{x} + b\mathbf{1} + \boldsymbol{\epsilon}

# $$

#

# where $\mathbf{1}$ is the vector of all ones.

# Let's use the inner-product

# notation,

#

# $$

# \langle \mathbf{x},\mathbf{y} \rangle = \mathbb{E}(\mathbf{x}^T \mathbf{y})

# $$

#

# Then, by taking the inner-product with some $\mathbf{x}_1 \in

# \mathbf{1}^\perp$

# we obtain [^perp],

#

# [^perp]: The space of all vectors, $\mathbf{a}$ such that

# $\langle

# \mathbf{a},\mathbf{1} \rangle = 0$ is denoted $\mathbf{1}^\perp$.

#

# $$

# \langle \mathbf{y},\mathbf{x}_1 \rangle = a \langle \mathbf{x},\mathbf{x}_1

# \rangle

# $$

#

# Recall that $\mathbb{E}(\boldsymbol{\epsilon})=\mathbf{0}$. We

# can finally

# solve for $a$ as

#

#

#

#

# $$

# \begin{equation}

# \hat{a} = \frac{\langle\mathbf{y},\mathbf{x}_1 \rangle}{\langle

# \mathbf{x},\mathbf{x}_1 \rangle}

# \end{equation}

# \label{eq:ahat} \tag{1}

# $$

#

# That was pretty neat but now we have the mysterious $\mathbf{x}_1$

# vector.

# Where does this come from? If we project $\mathbf{x}$ onto the

# $\mathbf{1}^\perp$, then we get the MMSE approximation to $\mathbf{x}$ in the

# $\mathbf{1}^\perp$ space. Thus, we take

#

# $$

# \mathbf{x}_1 = P_{\mathbf{1}^\perp} (\mathbf{x})

# $$

#

# Remember that $P_{\mathbf{1}^\perp} $ is a projection matrix so the length of

# $\mathbf{x}_1$ is at most $\mathbf{x}$. This means that the denominator in

# the

# $\hat{a}$ equation above is really just the length of the $\mathbf{x}$

# vector in

# the coordinate system of $P_{\mathbf{1}^\perp} $. Because the

# projection is

# orthogonal (namely, of minimum length), the Pythagorean theorem

# gives this

# length as the following:

#

# $$

# \langle \mathbf{x},\mathbf{x}_1 \rangle ^2=\langle \mathbf{x},\mathbf{x}

# \rangle- \langle\mathbf{1},\mathbf{x} \rangle^2

# $$

#

# The first term on the right is the length of the $\mathbf{x}$ vector

# and last

# term is the length of $\mathbf{x}$ in the coordinate system orthogonal

# to

# $P_{\mathbf{1}^\perp} $, namely that of $\mathbf{1}$. We

# can use this geometric

# interpretation to understand what is going on in

# typical linear regression in

# much more detail. The fact that the denominator is

# the orthogonal projection of

# $\mathbf{x}$ tells us that the choice of

# $\mathbf{x}_1$ has the strongest effect

# (i.e., largest value) on reducing

# the variance of $\hat{a}$. That is, the more

# $\mathbf{x}$ is aligned with

# $\mathbf{1}$, the worse the variance of $\hat{a}$.

# This makes intuitive sense

# because the closer $\mathbf{x}$ is to $\mathbf{1}$,

# the more constant it is,

# and we have already seen from our one-dimensional

# example that distance between

# the $x$ terms pays off in reduced variance. We

# already know that $\hat{a}$

# is an unbiased estimator, and, because we chose

# $\mathbf{x}_1$ deliberately as a

# projection, we know that it is also of minimum

# variance. Such estimators are

# known as Minimum-Variance Unbiased Estimators

# (MVUE).

#

# In the same spirit, let's examine the numerator of $\hat{a}$ in

# Equation [1](#eq:ahat). We can write

# $\mathbf{x}_{1}$ as the following

#

# $$

# \mathbf{x}_{1} = \mathbf{x} - P_{\mathbf{1}} \mathbf{x}

# $$

#

# where $P_{\mathbf{1}}$ is projection matrix of $\mathbf{x}$ onto the

# $\mathbf{1}$ vector. Using this, the numerator of $\hat{a}$ becomes

#

# $$

# \langle \mathbf{y}, \mathbf{x}_1\rangle =\langle \mathbf{y},

# \mathbf{x}\rangle -\langle \mathbf{y}, P_{\mathbf{1}} \mathbf{x}\rangle

# $$

#

# Note that,

#

# $$

# P_{\mathbf{1}} = \mathbf{1} \mathbf{1}^T \frac{1}{n}

# $$

#

# so that writing this out explicitly gives

#

# $$

# \langle \mathbf{y}, P_{\mathbf{1}} \mathbf{x}\rangle = \left(\mathbf{y}^T

# \mathbf{1}\right) \left(\mathbf{1}^T \mathbf{x}\right)/n =\left(\sum

# y_i\right)\left(\sum x_{i}\right)/n

# $$

#

# and similarly, we have the following for the denominator:

#

# $$

# \langle \mathbf{x}, P_{\mathbf{1}} \mathbf{x}\rangle = \left(\mathbf{x}^T

# \mathbf{1}\right) \left(\mathbf{1}^T \mathbf{x}\right)/n =\left(\sum

# x_i\right)\left(\sum x_{i}\right)/n

# $$

#

# So, plugging all of this together gives the following,

#

# $$

# \hat{a} = \frac{\mathbf{x}^T\mathbf{y}-(\sum x_i)(\sum y_i)/n}{\mathbf{x}^T

# \mathbf{x} -(\sum x_i)^2/n}

# $$

#

# with corresponding variance,

#

# $$

# \begin{align*}

# \mathbb{V}(\hat{a}) &= \sigma^2

# \frac{\|\mathbf{x}_1\|^2}{\langle\mathbf{x},\mathbf{x}_1\rangle^2} \\\

# &= \frac{\sigma^2}{\Vert \mathbf{x}\Vert^2-n(\overline{x}^2)}

# \end{align*}

# $$

#

# Using the same approach with $\hat{b}$ gives,

#

#

#

#

# $$

# \begin{equation}

# \hat{b} = \frac{\langle \mathbf{y},\mathbf{x}^{\perp}

# \rangle}{\langle \mathbf{1},\mathbf{x}^{\perp}\rangle}

# \label{_auto1} \tag{2}

# \end{equation}

# $$

#

#

#

#

# $$

# \begin{equation} \

# = \frac{\langle

# \mathbf{y},\mathbf{1}-P_{\mathbf{x}}(\mathbf{1})\rangle}{\langle

# \mathbf{1},\mathbf{1}-P_{\mathbf{x}}(\mathbf{1})\rangle}

# \label{_auto2} \tag{3}

# \end{equation}

# $$

#

#

#

#

# $$

# \begin{equation} \

# = \frac{\mathbf{x}^T \mathbf{x}(\sum y_i)/n

# -\mathbf{x}^T\mathbf{y}(\sum x_i)/n}{\mathbf{x}^T \mathbf{x} -(\sum x_i)^2/n}

# \label{_auto3} \tag{4}

# \end{equation}

# $$

#

# where

#

# $$

# P_{\mathbf{x}} = \frac{\mathbf{\mathbf{x} \mathbf{x}^T}}{\| \mathbf{x} \|^2}

# $$

#

# with variance

#

# $$

# \begin{align*}

# \mathbb{V}(\hat{b})&=\sigma^2 \frac{\langle

# \boldsymbol{\mathbf{1}-P_{\mathbf{x}}(\mathbf{1})},\boldsymbol{\mathbf{1}-P_{\mathbf{x}}(\mathbf{1})}\rangle}{\langle

# \mathbf{1},\boldsymbol{\mathbf{1}-P_{\mathbf{x}}(\mathbf{1})}\rangle^2} \\\

# &=\frac{\sigma^2}{n-\frac{(n\overline{x})^2}{\Vert\mathbf{x}\Vert^2}}

# \end{align*}

# $$

#

# **Qualifying the Estimates.** Our formulas for the variance above include the

# unknown $\sigma^2$, which we must estimate from the data itself using our

# plug-

# in estimates. We can form the residual sum of squares as

#

# $$

# \texttt{RSS} = \sum_i (\hat{a} x_i + \hat{b} - y_i)^2

# $$

#

# Thus, the estimate of $\sigma^2$ can be expressed as

#

# $$

# \hat{\sigma}^2 = \frac{\texttt{RSS}}{n-2}

# $$

#

# where $n$ is the number of samples. This is also known as the

# *residual mean

# square*. The $n-2$ represents the *degrees of freedom* (`df`).

# Because we

# estimated two parameters from the same data we have $n-2$ instead of

# $n$. Thus,

# in general, $\texttt{df} = n - p$, where $p$ is the number of

# estimated

# parameters. Under the assumption that the noise is Gaussian, the

# $\texttt{RSS}/\sigma^2$ is chi-squared distributed with $n-2$ degrees of

# freedom. Another important term is the *sum of squares about the mean*, (a.k.a

# *corrected* sum of squares),

#

# $$

# \texttt{SYY} = \sum (y_i - \bar{y})^2

# $$

#

# The $\texttt{SYY}$ captures the idea of not using the $x_i$ data and

# just using

# the mean of the $y_i$ data to estimate $y$. These two terms lead

# to the $R^2$

# term,

#

# $$

# R^2=1-\frac{\texttt{RSS}}{ \texttt{SYY} }

# $$

#

# Note that for perfect regression, $R^2=1$. That is, if the

# regression gets

# each $y_i$ data point exactly right, then

# $\texttt{RSS}=0$ this term equals one.

# Thus, this term is used to

# measure of goodness-of-fit. The `stats` module in

# `scipy` computes

# many of these terms automatically,

# In[5]:

from scipy import stats

slope,intercept,r_value,p_value,stderr = stats.linregress(x,y)

# where the square of the `r_value` variable is the $R^2$ above. The

# computed

# p-value is the two-sided hypothesis test with a null hypothesis that

# the slope

# of the line is zero. In other words, this tests whether or not the

# linear

# regression makes sense for the data for that hypothesis. The

# Statsmodels

# module provides a powerful extension to Scipy's stats module by

# making it easy

# to do regression and keep track of these parameters. Let's

# reformulate our

# problem using the Statsmodels framework by creating

# a Pandas dataframe for the

# data,

# In[6]:

import statsmodels.formula.api as smf

from pandas import DataFrame

import numpy as np

d = DataFrame({'x':np.linspace(0,1,10)}) # create data

d['y'] = a*d.x+ b + np.random.randn(*d.x.shape)

#

#

# Now that we have the input data in the above

# Pandas dataframe, we

# can perform the regression as in the following,

# In[7]:

results = smf.ols('y ~ x', data=d).fit()

# The $\sim$ symbol is notation for $y = a x + b + \epsilon$, where the

# constant

# $b$ is implicit in this usage of Statsmodels. The names in the string

# are taken

# from the columns in the dataframe. This makes it very easy to build

# models with

# complicated interactions between the named columns in the

# dataframe. We can

# examine a report of the model fit by looking at the summary,

# In[8]:

print (results.summary2())

# ```

#

# Results: Ordinary least squares

# =================================================================

# Model: OLS Adj. R-squared: 0.808

# Dependent Variable: y AIC: 28.1821

# Date: 0000-00-00 00:00 BIC: 00.0000

# No. Observations: 10 Log-Likelihood: -12.091

# Df Model: 1 F-statistic: 38.86

# Df Residuals: 8 Prob (F-statistic): 0.000250

# R-squared: 0.829 Scale: 0.82158

# -------------------------------------------------------------------

# Coef. Std.Err. t P>|t| [0.025 0.975]

# -------------------------------------------------------------------

# Intercept 1.5352 0.5327 2.8817 0.0205 0.3067 2.7637

# x 5.5990 0.8981 6.2340 0.0003 3.5279 7.6701

#

# There is a lot more here than we have discussed so far, but the

# Statsmodels

# documentation is the best place to go for complete information

# about this

# report. The F-statistic attempts to capture the contrast between

# including the

# slope parameter or leaving it off. That is, consider two

# hypotheses:

# ```

#

# $$

# \begin{align*}

# H_0 \colon \mathbb{E}(Y|X=x) &= b \\\

# H_1 \colon

# \mathbb{E}(Y|X=x) &= b + a x

# \end{align*}

# $$

#

# In order to quantify how much better adding the slope term is for

# the

# regression, we compute the following:

#

# $$

# F = \frac{\texttt{SYY} - \texttt{RSS}}{ \hat{\sigma}^2 }

# $$

#

# The numerator computes the difference in the residual squared errors

# between

# including the slope in the regression or just using the mean of the

# $y_i$

# values. Once again, if we assume (or can claim asymptotically) that the

# $\epsilon$ noise term is Gaussian, $\epsilon \sim \mathcal{N}(0,\sigma^2)$,

# then

# the $H_0$ hypothesis will follow an F-distribution [^fdist] with degrees of

# freedom from the numerator and denominator. In this case, $F \sim F(1,n-2)$.

# The

# value of this statistic is reported by Statsmodels above. The corresponding

# reported probability shows the chance of $F$ exceeding its computed value if

# $H_0$ were true. So, the take-home message from all this is that including the

# slope leads to a much smaller reduction in squared error than could be expected

# from a favorable draw of $n$ points of this data, under the Gaussian additive

# noise assumption. This is evidence that including the slope is meaningful for

# this data.

#

# [^fdist]: The $F(m,n)$ F-distribution has two integer degree-of-

# freedom parameters, $m$

# and $n$.

#

#

# The Statsmodels report also shows the

# adjusted $R^2$ term.

# This is a correction to the $R^2$ calculation that accounts

# for the number of parameters $p$ that the regression is

# fitting and the sample

# size $n$,

#

# $$

# \texttt{Adjusted } R^2 = 1- \frac{\texttt{RSS}/(n-p)}{\texttt{SYY}/(n-1)}

# $$

#

# This is always lower than $R^2$ except when $p=1$ (i.e., estimating

# only $b$).

# This becomes a better way to compare regressions when one is

# attempting to fit

# many parameters with comparatively small $n$.

#

# **Linear Prediction.** Using

# linear regression for prediction introduces

# some other issues. Recall the

# following expectation,

#

# $$

# \mathbb{E}(Y|X=x) \approx \hat{a} x + \hat{b}

# $$

#

# where we have determined $\hat{a}$ and $\hat{b}$ from the data.

# Given a new

# point of interest, $x_p$, we would certainly compute

#

# $$

# \hat{y}_p = \hat{a} x_p + \hat{b}

# $$

#

# as the predicted value for $\hat{ y_p }$. This is the same as saying

# that our

# best prediction for $y$ based on $x_p$ is the above conditional

# expectation. The

# variance for this is the following,

#

# $$

# \mathbb{V}(y_p) = x_p^2 \mathbb{V}(\hat{a}) +\mathbb{V}(\hat{b})+2 x_p

# \texttt{cov}(\hat{a}\hat{b})

# $$

#

# Note that we have the covariance above because $\hat{a}$ and

# $\hat{b}$ are

# derived from the same data. We can work this out below using

# our previous

# notation from [1](#eq:ahat),

#

# $$

# \begin{align*}

# \texttt{cov}(\hat{a}\hat{b})=&\frac{\mathbf{x}_1^T

# \mathbb{V}\lbrace\mathbf{y}\mathbf{y}^T\rbrace\mathbf{x}^{\perp}}{(\mathbf{x}_1^T

# \mathbf{x})(\mathbf{1}^T \mathbf{x}^{\perp})} = \frac{\mathbf{x}_1^T

# \sigma^2\mathbf{I}\mathbf{x}^{\perp}}{(\mathbf{x}_1^T \mathbf{x})(\mathbf{1}^T

# \mathbf{x}^{\perp})}\\\

# =&\sigma^2\frac{\mathbf{x}_1^T\mathbf{x}^{\perp}}{(\mathbf{x}_1^T

# \mathbf{x})(\mathbf{1}^T \mathbf{x}^{\perp})} =

# \sigma^2\frac{\left(\mathbf{x}-P_1\mathbf{x}\right)^T\mathbf{x}^{\perp}}{(\mathbf{x}_1^T

# \mathbf{x})(\mathbf{1}^T \mathbf{x}^{\perp})}\\\

# =&\sigma^2\frac{-\mathbf{x}^T P_1^T\mathbf{x}^{\perp}}{(\mathbf{x}_1^T

# \mathbf{x})(\mathbf{1}^T \mathbf{x}^{\perp})} =

# \sigma^2\frac{-\mathbf{x}^T\frac{1}{n}\mathbf{1}

# \mathbf{1}^T\mathbf{x}^{\perp}}{(\mathbf{x}_1^T \mathbf{x})(\mathbf{1}^T

# \mathbf{x}^{\perp})}\\\

# =&\sigma^2\frac{-\mathbf{x}^T\frac{1}{n}\mathbf{1}}{(\mathbf{x}_1^T \mathbf{x})}

# = \frac{-\sigma^2\overline{x}}{\sum_{i=1}^n(x_i^2-\overline{x}^2)}\\\

# \end{align*}

# $$

#

# After plugging all this in, we obtain the following,

#

# $$

# \mathbb{V}(y_p)=\sigma^2 \frac{x_p^2-2 x_p\overline{x}+\Vert

# \mathbf{x}\Vert^2/n}{\Vert\mathbf{x}\Vert^2-n\overline{x}^2}

# $$

#

# where, in practice, we use the plug-in estimate for

# the $\sigma^2$.

#

# There is

# an important consequence for the confidence interval for

# $y_p$. We cannot simply

# use the square root of $\mathbb{V}(y_p)$

# to form the confidence interval because

# the model includes the

# extra $\epsilon$ noise term. In particular, the

# parameters were

# computed using a set of statistics from the data, but now must

# include different realizations for the noise term for the

# prediction part. This

# means we have to compute

#

# $$

# \eta^2=\mathbb{V}(y_p)+\sigma^2

# $$

#

# Then, the 95\% confidence interval $y_p \in

# (y_p-2\hat{\eta},y_p+2\hat{\eta})$

# is the following,

#

# $$

# \mathbb{P}(y_p-2\hat{\eta}< y_p <

# y_p+2\hat{\eta})\approx\mathbb{P}(-2<\mathcal{N}(0,1)<2) \approx 0.95

# $$

#

# where $\hat{\eta}$ comes from substituting the

# plug-in estimate for $\sigma$.

# ## Extensions to Multiple Covariates

#

# With all the machinery we have, it is a

# short notational hop to consider

# multiple regressors as in the following,

#

# $$

# \mathbf{Y} = \mathbf{X} \boldsymbol{\beta} +\boldsymbol{\epsilon}

# $$

#

# with the usual $\mathbb{E}(\boldsymbol{\epsilon})=\mathbf{0}$ and

# $\mathbb{V}(\boldsymbol{\epsilon})=\sigma^2\mathbf{I}$. Thus, $\mathbf{X}$ is a

# $n \times p$ full rank matrix of regressors and $\mathbf{Y}$ is the $n$-vector

# of observations. Note that the constant term has been incorporated into

# $\mathbf{X}$ as a column of ones. The corresponding estimated solution for

# $\boldsymbol{\beta}$ is the following,

#

# $$

# \hat{ \boldsymbol{\beta} } = (\mathbf{X}^T \mathbf{X})^{-1} \mathbf{X}^T

# \mathbf{Y}

# $$

#

# with corresponding variance,

#

# $$

# \mathbb{V}(\hat{\boldsymbol{\beta}})=\sigma^2(\mathbf{X}^T \mathbf{X})^{-1}

# $$

#

# and with the assumption of Gaussian errors, we have

#

# $$

# \hat{\boldsymbol{\beta}}\sim \mathcal{N}(\boldsymbol{\beta},

# \sigma^2(\mathbf{X}^T \mathbf{X})^{-1})

# $$

#

# The unbiased estimate of $\sigma^2$ is the following,

#

# $$

# \hat{\sigma}^2 = \frac{1}{n-p}\sum \hat{\epsilon}_i^2

# $$

#

# where $\hat{ \boldsymbol{\epsilon}}=\mathbf{X}\hat{\boldsymbol{\beta}}

# -\mathbf{Y}$

# is the vector of residuals. Tukey christened the following matrix

# as the *hat*

# matrix (a.k.a. influence matrix),

#

# $$

# \mathbf{V}=\mathbf{X}(\mathbf{X}^T\mathbf{X})^{-1}\mathbf{X}^T

# $$

#

# because it maps $\mathbf{Y}$ into $\hat{ \mathbf{Y} }$,

#

# $$

# \hat{ \mathbf{Y} } = \mathbf{V} \mathbf{Y}

# $$

#

# As an exercise you can check that $\mathbf{V}$ is a projection

# matrix. Note

# that that matrix is solely a function of $\mathbf{X}$. The

# diagonal elements of

# $\mathbf{V}$ are called the *leverage values* and are

# contained in the closed

# interval $[1/n,1]$. These terms measure of distance

# between the values of $x_i$

# and the mean values over the $n$ observations.

# Thus, the leverage terms depend

# only on $\mathbf{X}$. This is the

# generalization of our initial discussion of

# leverage where we had multiple

# samples at only two $x_i$ points. Using the hat

# matrix, we can compute the

# variance of each residual, $e_i = \hat{y}-y_i$ as

#

# $$

# \mathbb{V}(e_i) = \sigma^2 (1-v_{i})

# $$

#

# where $v_i=V_{i,i}$. Given the above-mentioned bounds on $v_{i}$,

# these are

# always less than $\sigma^2$.

#

# Degeneracy in the columns of $\mathbf{X}$ can

# become a problem. This is when

# two or more of the columns become co-linear. We

# have already seen this with our

# single regressor example wherein $\mathbf{x}$

# close to $\mathbf{1}$ was bad

# news. To compensate for this effect we can load

# the diagonal elements and solve

# for the unknown parameters as in the following,

#

# $$

# \hat{ \boldsymbol{\beta} } = (\mathbf{X}^T \mathbf{X}+\alpha \mathbf{I})^{-1}

# \mathbf{X}^T \mathbf{Y}

# $$

#

# where $\alpha>0$ is a tunable hyper-parameter. This method is known

# as *ridge

# regression* and was proposed in 1970 by Hoerl and Kenndard. It can be

# shown that

# this is the equivalent to minimizing the following objective,

#

# $$

# \Vert \mathbf{Y}- \mathbf{X} \boldsymbol{\beta}\Vert^2 + \alpha \Vert

# \boldsymbol{\beta}\Vert^2

# $$

#

# In other words, the length of the estimated $\boldsymbol{\beta}$ is

# penalized

# with larger $\alpha$. This has the effect of stabilizing the

# subsequent inverse

# calculation and also providing a means to trade bias and

# variance, which we will

# discuss at length in the section

# [ch:ml:sec:regularization](#ch:ml:sec:regularization)

#

# **Interpreting

# Residuals.** Our model assumes an additive Gaussian noise term.

# We can check

# the voracity of this assumption by examining the residuals after

# fitting. The

# residuals are the difference between the fitted values and the

# original data

#

# $$

# \hat{\epsilon}_i = \hat{a} x_i + \hat{b} - y_i

# $$

#

# While the p-value and the F-ratio provide some indication of whether

# or not

# computing the slope of the regression makes sense, we can get directly

# at the

# key assumption of additive Gaussian noise.

#

# For sufficiently small dimensions,

# the `scipy.stats.probplot` we discussed in

# the last chapter provides quick

# visual evidence one way or another by plotting

# the standardized residuals,

#

# $$

# r_i = \frac{e_i}{\hat{\sigma}\sqrt{1-v_i}}

# $$

#

# The other part of the iid assumption implies homoscedasticity (all

# $r_i$ have

# equal variances). Under the additive Gaussian noise assumption, the

# $e_i$ should

# also be distributed according to $\mathcal{N}(0,\sigma^2(1-v_i))$.

# The

# normalized residuals $r_i$ should then be distributed according to

# $\mathcal{N}(0,1)$. Thus, the presence of any $r_i \notin [-1.96,1.96]$ should

# not be common at the 5% significance level and is thereby breeds suspicion

# regarding the homoscedasticity assumption.

#

# The Levene test in

# `scipy.stats.leven` tests the null hypothesis that all the

# variances are equal.

# This basically checks whether or not the standardized

# residuals vary across

# $x_i$ more than expected. Under the homoscedasticity

# assumption, the variance

# should be independent of $x_i$. If not, then this is a

# clue that there is a

# missing variable in the analysis or that the variables

# themselves should be

# transformed (e.g., using the $\log$ function) into another

# format that can

# reduce this effect. Also, we can use weighted least-squares

# instead of ordinary

# least-squares.

#

# **Variable Scaling.** It is tempting to conclude in a multiple

# regression that small coefficients in any of the $\boldsymbol{\beta}$ terms

# implies that those terms are not important. However, simple unit conversions

# can cause this effect. For example, if one of the regressors is in

# units of

# kilometers and the others are in meters, then just the scale

# factor can give the

# impression of outsized or under-sized effects. The

# common way to account for

# this is to scale the regressors so that

#

# $$

# x^\prime = \frac{x-\bar{x}}{\sigma_x}

# $$

#

# This has the side effect of converting the slope parameters

# into correlation

# coefficients, which is bounded by $\pm 1$.

#

# **Influential Data.** We have

# already discussed the idea

# of leverage. The concept of *influence* combines

# leverage with

# outliers. To understand influence, consider

# [Figure](#fig:Regression_005).

#

#

#

#

#

# The point on the right has # outsized influence in this data because it is the only one used to determine the # slope of the fitted line.

# #

#

#

#

# The point on the right in

# [Figure](#fig:Regression_005) is the only one that

# contributes to the

# calculation of the slope for the fitted line. Thus, it

# is very influential in

# this sense. Cook's distance is a good way to get at this

# concept numerically.

# To compute this, we have to compute the $j^{th}$

# component of the estimated

# target variable with the $i^{th}$ point deleted. We

# call this $\hat{y}_{j(i)}$.

# Then, we compute the following,

#

# $$

# D_i =\frac{\sum_j (\hat{y}_j- \hat{y}_{j(i)})^2}{p/n \sum_j (\hat{y}_j-

# y_j)^2}

# $$

#

# where, as before, $p$ is the number of estimated terms

# (e.g., $p=2$ in the

# bivariate case). This calculation emphasizes the

# effect of the outlier by

# predicting the target variable with and

# without each point. In the case of

# [Figure](#fig:Regression_005),

# losing any of the points on the left cannot

# change the estimated

# target variable much, but losing the single point on the

# right surely

# does. The point on the right does not seem to be an outlier (it

# *is*

# on the fitted line), but this is because it is influential enough to

# rotate

# the line to align with it. Cook's distance helps capture this

# effect by leaving

# each sample out and re-fitting the remainder as

# shown in the last equation.

# [Figure](#fig:Regression_006) shows the

# calculated Cook's distance for the data

# in [Figure](#fig:Regression_005), showing that the data point on the right

# (sample index `5`) has outsized influence on the fitted line. As a

# rule of

# thumb, Cook's distance values that are larger than one are

# suspect.

#

#

#

#

#

#

#

#

#

#

# The point on the right in

# [Figure](#fig:Regression_005) is the only one that

# contributes to the

# calculation of the slope for the fitted line. Thus, it

# is very influential in

# this sense. Cook's distance is a good way to get at this

# concept numerically.

# To compute this, we have to compute the $j^{th}$

# component of the estimated

# target variable with the $i^{th}$ point deleted. We

# call this $\hat{y}_{j(i)}$.

# Then, we compute the following,

#

# $$

# D_i =\frac{\sum_j (\hat{y}_j- \hat{y}_{j(i)})^2}{p/n \sum_j (\hat{y}_j-

# y_j)^2}

# $$

#

# where, as before, $p$ is the number of estimated terms

# (e.g., $p=2$ in the

# bivariate case). This calculation emphasizes the

# effect of the outlier by

# predicting the target variable with and

# without each point. In the case of

# [Figure](#fig:Regression_005),

# losing any of the points on the left cannot

# change the estimated

# target variable much, but losing the single point on the

# right surely

# does. The point on the right does not seem to be an outlier (it

# *is*

# on the fitted line), but this is because it is influential enough to

# rotate

# the line to align with it. Cook's distance helps capture this

# effect by leaving

# each sample out and re-fitting the remainder as

# shown in the last equation.

# [Figure](#fig:Regression_006) shows the

# calculated Cook's distance for the data

# in [Figure](#fig:Regression_005), showing that the data point on the right

# (sample index `5`) has outsized influence on the fitted line. As a

# rule of

# thumb, Cook's distance values that are larger than one are

# suspect.

#

#

#

#

#

# The calculated Cook's distance for the data # in [Figure](#fig:Regression_005).

# #

#

#

#

# As another

# illustration of influence, consider [Figure](#fig:Regression_007) which shows

# some data that nicely line up, but

# with one outlier (filled black circle) in the

# upper panel. The lower

# panel shows so-computed Cook's distance for this data

# and emphasizes

# the presence of the outlier. Because the calculation involves

# leaving

# a single sample out and re-calculating the rest, it can be a

# time-

# consuming operation suitable to relatively small data sets. There

# is always the

# temptation to downplay the importance of outliers

# because they conflict with a

# favored model, but outliers must be

# carefully examined to understand why the

# model is unable to capture

# them. It could be something as simple as faulty data

# collection, or it

# could be an indication of deeper issues that have been

# overlooked. The

# following code shows how Cook's distance was compute for

# [Figure](#fig:Regression_006) and [Figure](#fig:Regression_007).

# In[9]:

fit = lambda i,x,y: np.polyval(np.polyfit(x,y,1),i)

omit = lambda i,x: ([k for j,k in enumerate(x) if j !=i])

def cook_d(k):

num = sum((fit(j,omit(k,x),omit(k,y))-fit(j,x,y))**2 for j in x)

den = sum((y-np.polyval(np.polyfit(x,y,1),x))**2/len(x)*2)

return num/den

# **Programming Tip.**

#

# The function `omit` sweeps through the data and excludes

# the $i^{th}$ data element. The embedded `enumerate` function

# associates every

# element in the iterable with its corresponding

# index.

#

#

#

#

#

#

#

#

#

#

#

#

# As another

# illustration of influence, consider [Figure](#fig:Regression_007) which shows

# some data that nicely line up, but

# with one outlier (filled black circle) in the

# upper panel. The lower

# panel shows so-computed Cook's distance for this data

# and emphasizes

# the presence of the outlier. Because the calculation involves

# leaving

# a single sample out and re-calculating the rest, it can be a

# time-

# consuming operation suitable to relatively small data sets. There

# is always the

# temptation to downplay the importance of outliers

# because they conflict with a

# favored model, but outliers must be

# carefully examined to understand why the

# model is unable to capture

# them. It could be something as simple as faulty data

# collection, or it

# could be an indication of deeper issues that have been

# overlooked. The

# following code shows how Cook's distance was compute for

# [Figure](#fig:Regression_006) and [Figure](#fig:Regression_007).

# In[9]:

fit = lambda i,x,y: np.polyval(np.polyfit(x,y,1),i)

omit = lambda i,x: ([k for j,k in enumerate(x) if j !=i])

def cook_d(k):

num = sum((fit(j,omit(k,x),omit(k,y))-fit(j,x,y))**2 for j in x)

den = sum((y-np.polyval(np.polyfit(x,y,1),x))**2/len(x)*2)

return num/den

# **Programming Tip.**

#

# The function `omit` sweeps through the data and excludes

# the $i^{th}$ data element. The embedded `enumerate` function

# associates every

# element in the iterable with its corresponding

# index.

#

#

#

#

#

#

#

# The upper panel shows data that fit on a line # and an outlier point (filled black circle). The lower panel shows the calculated # Cook's distance for the data in upper panel and shows that the tenth point # (i.e., the outlier) has disproportionate influence.

# #

#

#

#