Table of Contents

- 1 Customer Churn Analysis

- 2 The story Behind The Data

- 3 Data Description

- 4 SQL tasks

- 5 Python Deep Dive Analysis

- 5.1 Database Integration

- 5.2 Summary Statistics Short Analysis

- 5.3 Data Cleaning

- 5.4 Distribution Analysis for each of the columns in the dataset

- 5.5 Cross-Correlation Analysis

- 5.6 Raising Data Questions

- 5.6.1 Question 1: What type of credit card holders have churned the most? How about Customer Retention?

- 5.6.2 Question 2: Is there a relationship between credit card category, income category and the usage of credit cards by customers?

- 5.6.3 Question 3: How does income category & number of dependents per customer affect their credit card needs or usage?

- 5.6.4 Question 4: What age groups utilize their credit cards the most and the least? And What age groups have the most churned customers?

- 6 Data Enrichment

- 7 Tableau Tasks

- 8 Recommendations

Customer Churn Analysis¶

The story Behind The Data¶

Dollar Bank was concerned that more and more customers were leaving its credit card services. They asked me to use my Data Analytics skillsets to analyze the problem for them, in order to understand the main reasons for customers leaving the services. They also needed me to come up with recommendations for how the bank can mitigate further customer churns. Eventually, the bank wanted to proactively implement these recommendations in order to keep their customers happy.

A full ERD of Dollar Bank's datasets can be found here

Data Description¶

In this task, few datasets are provided:

BankChurners.csv- this file contains basic information about each client (10 columns). The columns are:CLIENTNUM- Client number. Unique identifier for the customer holding the account;Attrition Flag- Internal event (customer activity) variable - if the client had churned (attrited) or not (existing).Dependent Count- Demographic variable - Number of dependentsCard_Category- Product Variable - Type of Card (Blue, Silver, Gold, Platinum)Months_on_book- Period of relationship with bankMonths_Inactive_12_mon- No. of months inactive in the last 12 monthsContacts_Count_12_mon- No. of Contacts in the last 12 monthsCredit_Limit- Credit Limit on the Credit CardAvg_Open_To_Buy- Open to Buy Credit Line (Average of last 12 months)Avg_Utilization_Ratio- Average Card Utilization Ratio

basic_client_info.csv- this file contains some basic client info per each client (6 columns) -CLIENTNUM- Client number. Unique identifier for the customer holding the accountCustomer Age- Demographic variable - Customer's Age in YearsGender- Demographic variable - M=Male, F=FemaleEducation_Level- Demographic variable - Educational Qualification of the account holder (example: high school, college graduate, etc.`Marital_Status- Demographic variable - Married, Single, Divorced, UnknownIncome_Category- Demographic variable - Annual Income Category of the account holder (< $40K, $40K - 60K, $60K - $80K, $80K-$120K, > $120K, Unknown)

enriched_churn_data.csv- this file contains some enriched data about each client (7 columns) -CLIENTNUM- Client number. Unique identifier for the customer holding the accountTotal_Relationship_Count- Total no. of products held by the customerTotal_Revolving_Bal- Total Revolving Balance on the Credit CardTotal_Amt_Chng_Q4_Q1- Change in Transaction Amount (Q4 over Q1)Total_Trans_Amt- Total Transaction Amount (Last 12 months)Total_Trans_Ct- Total Transaction Count (Last 12 months)Total_Ct_Chng_Q4_Q1- Change in Transaction Count (Q4 over Q1)

SQL tasks¶

After a thorough discussion with relevant business units and project stakeholders, business questions were translated into simple & advanced SQL queries to provide answers to frequently asked questions by the different business units and relevant project stakeholders.

How many clients does the bank have and are above the age of 50?

What’s the distribution (in %) between male and female clients?

Let’s define a new variable called

age_group:- 10 < x ≤ 30

- 30 < x ≤ 40

- 40 < x ≤ 50

- 50 < x ≤ 60

- 60 <x ≤ 120

Per each

age_group,marital_statusandincome_category, find out the following values:a. Churn_rate (in %)

b. Average

Total_Relationship_Countc. Minimum value of

Total_Amt_Chng_Q4_Q1d. Count of customers

Make sure to order the data by the number of customers in descending order***

Out of the male clients, who are “blue” card holders, how many (in %) fall under the income category 40K - 60K?

Without the usage of group by at all, find the 3rd and 4th highest client IDs (

CLIENTNUM’s) ofTotal_Amt_Chng_Q4_Q1?We’re interested in knowing which client (CLIENTNUM) has the 2nd highest

Total_Trans_Amt, Per eachMarital_Status.

The bank wanted to create a dedicated campaign to target these specific clients moving forward. So my task in this section was to help the bank find those clients.

See Customer Churn ERD below

Question 1:

How many clients does the bank have and are above the age of 50?

-- How many clients does the bank have and are above the age of 50?

SELECT COUNT(*) AS clients_above_50

FROM basic_client_info

WHERE customer_age > 50

;

| clients_above_50 | |

|---|---|

| 0 | 3078 |

Question 2:

What’s the distribution (in %) between male and female clients?

-- What’s the distribution (in %) between male and female clients?

WITH total_count AS (

SELECT

COUNT(*) AS total

FROM basic_client_info

)

SELECT

gender,

ROUND(COUNT(*) * 100 / total :: numeric, 1) as percent_distribution

FROM basic_client_info, total_count

GROUP BY gender, total

;

| gender | percent_distribution | |

|---|---|---|

| 0 | M | 47.1 |

| 1 | F | 52.9 |

Question 3:

Per each age_group, marital_status and income_category, find out the following values:

- a. Churn_rate (in %)

- b. Average Total_Relationship_Count

- c. Minimum value of Total_Amt_Chng_Q4_Q1

- d. Count of customers

(Make sure to order the data by the number of customers in descending order)

-- Let’s define a new variable called age_group:

--10 < x ≤ 30

--30 < x ≤ 40

--40 < x ≤ 50

--50 < x ≤ 60

--60 <x ≤ 120

-- Rather than permanently updating the table, I am including this new variable in a view. This way I can easily refer to it without creating it every time its needed.

DROP VIEW IF EXISTS demographics;

CREATE VIEW demographics AS (

SELECT

clientnum,

CASE WHEN customer_age > 10 and customer_age <= 30 THEN '11 - 30'

WHEN customer_age > 30 and customer_age <= 40 THEN '31 - 40'

WHEN customer_age > 40 and customer_age <= 50 THEN '41 - 50'

WHEN customer_age > 50 and customer_age <= 60 THEN '51 - 60'

WHEN customer_age > 60 and customer_age <= 120 THEN '61 - 120'

END AS age_group,

marital_status,

income_category

FROM basic_client_info

)

;

-- Solution approach: Created a Pivot Table that groups the dataset by demographic variables: age group, marital status and income category, while also aggregating individual values into a summary of the churn rate, avg total relationship count, minimum total amount change [Q1-Q4] and number of customers, per each demographic group.

WITH churned AS (

SELECT

dem.clientnum AS clientnum,

age_group,

marital_status,

income_category,

total_relationship_count,

total_amt_chng_q4_q1,

CASE WHEN attrition_flag = 'Attrited Customer' THEN 1

ELSE 0 END AS is_churned

FROM demographics AS dem

JOIN bankchurners AS bc

ON dem.clientnum = bc.clientnum

JOIN enriched_churn_data AS ecd

ON dem.clientnum = ecd.clientnum

)

SELECT

age_group,

marital_status,

income_category,

ROUND(100 * SUM(is_churned) / (SELECT COUNT(*) FROM bankchurners)::numeric, 1) AS churn_rate_percent,

ROUND(AVG(total_relationship_count)) as avg_total_product_count,

MIN(total_amt_chng_q4_q1) as min_amt_chng_q4_q1,

COUNT(clientnum) as client_count

FROM churned

GROUP BY 1, 2, 3

ORDER BY 1, 7 DESC

;

| age_group | marital_status | income_category | churn_rate_percent | avg_total_product_count | min_amt_chng_q4_q1 | client_count | |

|---|---|---|---|---|---|---|---|

| 0 | 11 - 30 | Single | Less than $40K | 0.0 | 4 | 0.299 | 69 |

| 1 | 11 - 30 | Married | Less than $40K | 0.0 | 4 | 0.549 | 36 |

| 2 | 11 - 30 | Single | $40K - $60K | 0.0 | 4 | 0.331 | 29 |

| 3 | 11 - 30 | Single | Unknown | 0.0 | 4 | 0.391 | 27 |

| 4 | 11 - 30 | Divorced | Less than $40K | 0.0 | 5 | 0.632 | 16 |

| ... | ... | ... | ... | ... | ... | ... | ... |

| 111 | 61 - 120 | Single | $120K + | 0.0 | 5 | 0.564 | 2 |

| 112 | 61 - 120 | Married | $120K + | 0.0 | 4 | 0.424 | 2 |

| 113 | 61 - 120 | Divorced | Unknown | 0.0 | 4 | 0.808 | 2 |

| 114 | 61 - 120 | Unknown | $80K - $120K | 0.0 | 6 | 0.722 | 2 |

| 115 | 61 - 120 | Unknown | Unknown | 0.0 | 4 | 0.628 | 2 |

116 rows × 7 columns

Question 4:

Out of the male clients, who holds the “blue” card, how many (in %) hold the income category 40K - 60K?

WITH total_count AS (

SELECT

COUNT(*) AS total

FROM basic_client_info AS bci

JOIN bankchurners AS bc

ON bci.clientnum = bc.clientnum

WHERE gender = 'M'

AND card_category = 'Blue'

),

male_blue_card_holders AS (

SELECT

income_category

FROM basic_client_info AS bci

JOIN bankchurners AS bc

ON bci.clientnum = bc.clientnum

WHERE gender = 'M'

AND card_category = 'Blue'

)

SELECT

income_category,

ROUND(100 * COUNT(income_category) / total :: numeric, 2) AS percent_of_male_blue_card_holders

FROM male_blue_card_holders, total_count

GROUP BY income_category, total

LIMIT 1 OFFSET 3

;

| income_category | percent_of_male_blue_card_holders | |

|---|---|---|

| 0 | $40K - $60K | 16.49 |

Question 5:

Without the usage of group by at all, find the 3rd and 4th highest client IDs (CLIENTNUM’s) of Total_Amt_Chng_Q4_Q1?

SELECT

clientnum

FROM enriched_churn_data

ORDER BY total_amt_chng_q4_q1 DESC

LIMIT 2 OFFSET 2

;

| clientnum | |

|---|---|

| 0 | 713989233 |

| 1 | 713982108 |

Question 6:

We’re interested in knowing which client (CLIENTNUM) has the 2nd highest Total_Trans_Amt, Per each Marital_Status.

-- Which client (CLIENTNUM) has the 2nd highest Total_Trans_Amt, Per each Marital_Status.

WITH t1 AS (

SELECT

bci.clientnum,

marital_status,

total_trans_amt,

DENSE_RANK() OVER (PARTITION BY marital_status ORDER BY total_trans_amt Desc) AS rnk

FROM basic_client_info AS bci

JOIN enriched_churn_data AS ecd

ON bci.clientnum = ecd.clientnum

)

SELECT

marital_status,

clientnum AS client_with_2nd_highest_trans_amt

FROM t1

WHERE rnk=2

;

| marital_status | client_with_2nd_highest_trans_amt | |

|---|---|---|

| 0 | Divorced | 716894658 |

| 1 | Married | 717642633 |

| 2 | Single | 716004258 |

| 3 | Unknown | 719848008 |

Python Deep Dive Analysis¶

Database Integration¶

Import all the libraries required for this project, and connect to the postgres database hosted on AWS RDS

# Import numpy library for performing scientific computing as well as various mathematical operations.

import numpy as np

# Import pandas library for loading tables from the DB into dataframes to perform data manipulation and analysis.

import pandas as pd

# Import the matplotlib.pyplot and seaborn libraries for creating data visualizations and plots.

import matplotlib.pyplot as plt

import seaborn as sns

# Import psycopg2 library that will connect to the database

import psycopg2

# Import the config.py file and alias as creds. The config.py file contains all credentials for the postgres DB hosted by AWS.

import config as creds

# Import the create_engine function from sqlalchemy

from sqlalchemy import create_engine

# Use sqlalchemy create_engine function to create a dialect object tailored towards postgre & assign the the conn string to engine

# i.e engine = create_engine(dialect+driver://username:password@host:port/database)

try: # Using a try-except block to handle any exceptions that might occur during the connection process

engine = create_engine(f"postgresql+psycopg2://{creds.PGUSER}:{creds.PGPASSWORD}@{creds.PGHOST}:{creds.PGPORT}/{creds.PGDATABASE}")

# Test the connection by executing a simple query. If the connection is successful, the first print statement will be executed

with engine.connect() as connection:

connection.execute("SELECT 1")

print(f"Successfully connected to the {creds.PGDATABASE} database!")

except Exception as e: # If unsuccessful, an error message will be printed

print(f"Error: Failed to connect to the {creds.PGDATABASE} database!")

print(f"Exception details: {e}")

Successfully connected to the dollarbankdb database!

Load data into pandas dataframes

# Load all 3 tables from the dollarbank DB into 3 respective pandas dataframes, using engine (the connection string we created)

# as an argument in the pd.read_sql_table() pandas method that reads data from a SQL DB

table1 = 'bank_churners'

table2 = 'basic_client_info'

table3 = 'enriched_churn_data'

bank_churners_df = pd.read_sql_table(table1, engine)

basic_client_info_df = pd.read_sql_table(table2, engine)

enriched_churn_df = pd.read_sql_table(table3, engine)

bank_churners_df.head(3)

| clientnum | attrition_flag | dependent_count | card_category | months_on_book | months_inactive_12_mon | contacts_count_12_mon | credit_limit | avg_open_to_buy | avg_utilization_ratio | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 806160108 | Existing Customer | 1 | Blue | 56 | 2 | 3 | 3193.0 | 676.0 | 0.788 |

| 1 | 804424383 | Existing Customer | 1 | Blue | 56 | 3 | 2 | 10215.0 | 9205.0 | 0.099 |

| 2 | 708300483 | Attrited Customer | 0 | Blue | 56 | 4 | 3 | 7882.0 | 7277.0 | 0.077 |

basic_client_info_df.head(3)

| clientnum | customer_age | gender | education_level | marital_status | income_category | |

|---|---|---|---|---|---|---|

| 0 | 708082083 | 45 | F | High School | Married | Less than $40K |

| 1 | 708083283 | 58 | M | Unknown | Single | $40K - $60K |

| 2 | 708084558 | 46 | M | Doctorate | Divorced | $80K - $120K |

enriched_churn_df.head(3)

| clientnum | total_relationship_count | total_revolving_bal | total_amt_chng_q4_q1 | total_trans_amt | total_ct_chng_q4_q1 | total_trans_ct | |

|---|---|---|---|---|---|---|---|

| 0 | 828343083 | 3 | 1793.0 | 0.803 | 3646 | 0.659 | 68 |

| 1 | 828298908 | 4 | 2035.0 | 0.613 | 1770 | 0.741 | 47 |

| 2 | 828294933 | 3 | 2437.0 | 0.765 | 2519 | 0.565 | 36 |

Summary Statistics Short Analysis¶

Here I want to understand the characteristics of the dataset including basic statistics, central tendency, count of unique values in each column, whether or not there are missing values and any outliers in numerical columns.

I will then assess important information about the variability, skewness of the data, after dealing with outliers if any are present.

This analysis will be done on all 3 datasets in the following order:

- First, the bank_churners dataset

- Next, the basic_client_info dataset

- And finally, the enriched_churn_df dataset

Summary Statistics of the bank churners dataset¶

# Checking to see basic statistics of the numerical columns in the bank churners dataset

bank_churners_df.describe()

| clientnum | dependent_count | months_on_book | months_inactive_12_mon | contacts_count_12_mon | credit_limit | avg_open_to_buy | avg_utilization_ratio | |

|---|---|---|---|---|---|---|---|---|

| count | 1.012700e+04 | 10127.000000 | 10127.000000 | 10127.000000 | 10127.000000 | 10127.000000 | 10127.000000 | 10127.000000 |

| mean | 7.391776e+08 | 2.346203 | 35.928409 | 2.341167 | 2.455317 | 8631.953698 | 7469.139637 | 0.274894 |

| std | 3.690378e+07 | 1.298908 | 7.986416 | 1.010622 | 1.106225 | 9088.776650 | 9090.685324 | 0.275691 |

| min | 7.080821e+08 | 0.000000 | 13.000000 | 0.000000 | 0.000000 | 1438.300000 | 3.000000 | 0.000000 |

| 25% | 7.130368e+08 | 1.000000 | 31.000000 | 2.000000 | 2.000000 | 2555.000000 | 1324.500000 | 0.023000 |

| 50% | 7.179264e+08 | 2.000000 | 36.000000 | 2.000000 | 2.000000 | 4549.000000 | 3474.000000 | 0.176000 |

| 75% | 7.731435e+08 | 3.000000 | 40.000000 | 3.000000 | 3.000000 | 11067.500000 | 9859.000000 | 0.503000 |

| max | 8.283431e+08 | 5.000000 | 56.000000 | 6.000000 | 6.000000 | 34516.000000 | 34516.000000 | 0.999000 |

Checking for outliers

# Create two empty lists, one to store names of categorical variables, and the other for numerical variables

cat_vars = []

num_vars = []

# Iterate through the names of columns/variables in bank_churners_df, and add variables to the appropriate list

# depending on whether the are categorical or numerical

for column_name in bank_churners_df.columns:

if bank_churners_df[column_name].dtype == 'object':

cat_vars.append(column_name)

else:

num_vars.append(column_name)

# Set the figure size

fig, axs = plt.subplots(nrows=4, ncols=2, figsize=(15, 15))

# Reshape the axs array into a one-dimensional array by flattening its elements

axs = axs.flatten()

# Iterate through the list for numerical variables and create box plots of data in each numerical variable

for i, var in enumerate(num_vars):

# Using Seaborn's box plot for outlier detection

sns.boxplot(x=var, data=bank_churners_df, ax=axs[i])

# Adjust the figure's subplot positions and margins, and then display the figure

fig.tight_layout

plt.show();

# New line spacing

print('\n\n')

# Create new list to hold columns/variables that may have too many potential outliers

outlier_vars = []

# Iterate through the variables again and provide explanation as to whether or not outliers were detected and next steps

for column_name in bank_churners_df.columns:

if bank_churners_df[column_name].dtype == 'object':

print(f"\nThe '{column_name}' column is not a numerical column \n")

else:

# Using the general rule for identifying potential outliers which is that if any data point in a dataset is more than

# Q3 + 1.5xIQR or less than Q1 - 1.5xIQR, it's a high outlier. I would create a custom dictionary to capture potential outliers in each column.

data = bank_churners_df[column_name]

q1 = data.quantile(0.25)

q3 = data.quantile(0.75)

iqr = q3 - q1

iqr_lower = q1 - 1.5 * iqr

iqr_upper = q3 + 1.5 * iqr

outliers = dict(data[(data < iqr_lower) | (data > iqr_upper)])

list_of_outliers = list(outliers.values())

rows_with_outliers = list(outliers.keys())

# If no potential outliers detected, print message below

if len(list_of_outliers) == 0:

print(f"\nThere are no outliers in the '{column_name}' column \n")

else:

# If potential outliers detected were more than 10, add column name to the list of columns with possible outliers

if len(list_of_outliers) > 10:

outlier_vars.append(column_name)

# If not, print message below

else:

print(f"\nThe potential ouliers in the '{column_name}' column are:\n{list_of_outliers} \nAnd the respective rows with the potential outlier are:\n{rows_with_outliers}")

# Print message to explain next steps to validate outliers

print(f"\n Detected too many potential outliers in the following columns: {outlier_vars}. Based on the high number of potential outliers detected, use the column definition and check the summary statistics (min & max values) above to find out if there are truly outliers in these columns.\n")

# Print custom border at the end

print("\n" + "-"*30 + "end" + "-"*30)

There are no outliers in the 'clientnum' column The 'attrition_flag' column is not a numerical column There are no outliers in the 'dependent_count' column The 'card_category' column is not a numerical column There are no outliers in the 'avg_utilization_ratio' column Detected too many potential outliers in the following columns: ['months_on_book', 'months_inactive_12_mon', 'contacts_count_12_mon', 'credit_limit', 'avg_open_to_buy']. Based on the high number of potential outliers detected, use the column definition and check the summary statistics (min & max values) above to find out if there are truly outliers in these columns. ------------------------------end------------------------------

Observation: Based on the general rule for identifying potential outliers which is that if any data point in a dataset is more than Q3 + (1.5 x IQR) or less than Q1 - (1.5 x IQR), it's a high outlier, I want to get the lower and upper interquartile ranges for each column and use that to review the summary statistics to know if the min & max values of each column in the dataset can be considered as outliers based on the definition of the column/variable.

# Printing the Lower and upper interquartile ranges for all the columns in the dataset.

variables = pd.DataFrame(columns=['Variable','Lower Limit','Upper Limit'])

nan_columns = []

for i, var in enumerate(bank_churners_df.columns):

if var == 'clientnum':

iqr_lower = np.NaN

iqr_upper = np.NaN

nan_columns.append(var)

elif bank_churners_df[var].dtype == 'object':

iqr_lower = np.NaN

iqr_upper = np.NaN

nan_columns.append(var)

else:

df = bank_churners_df[var]

q1 = df.quantile(0.25)

q3 = df.quantile(0.75)

iqr = q3 - q1

iqr_lower = q1 - 1.5 * iqr

iqr_upper = q3 + 1.5 * iqr

variables.loc[i] = [var, iqr_lower, iqr_upper]

print(f"\nFor the following variables with null values: {nan_columns}, clientnum is not applicable as it is only a unique id number for each client in the dataset. The others are of string/object datatypes. Hence the null values \n")

variables

For the following variables with null values: ['clientnum', 'attrition_flag', 'card_category'], clientnum is not applicable as it is only a unique id number for each client in the dataset. The others are of string/object datatypes. Hence the null values

| Variable | Lower Limit | Upper Limit | |

|---|---|---|---|

| 0 | clientnum | NaN | NaN |

| 1 | attrition_flag | NaN | NaN |

| 2 | dependent_count | -2.000 | 6.000 |

| 3 | card_category | NaN | NaN |

| 4 | months_on_book | 17.500 | 53.500 |

| 5 | months_inactive_12_mon | 0.500 | 4.500 |

| 6 | contacts_count_12_mon | 0.500 | 4.500 |

| 7 | credit_limit | -10213.750 | 23836.250 |

| 8 | avg_open_to_buy | -11477.250 | 22660.750 |

| 9 | avg_utilization_ratio | -0.697 | 1.223 |

So are there outliers or not?

After reading the column/variable definition and comparing the lower and upper Limits for each column to the min & max values, it is safe to assume that the potential outliers that were detected, are actually not outliers

# Checking to know the datatypes of each column and if there are any missing values

bank_churners_df.info()

<class 'pandas.core.frame.DataFrame'> RangeIndex: 10127 entries, 0 to 10126 Data columns (total 10 columns): # Column Non-Null Count Dtype --- ------ -------------- ----- 0 clientnum 10127 non-null int64 1 attrition_flag 10127 non-null object 2 dependent_count 10127 non-null int64 3 card_category 10127 non-null object 4 months_on_book 10127 non-null int64 5 months_inactive_12_mon 10127 non-null int64 6 contacts_count_12_mon 10127 non-null int64 7 credit_limit 10127 non-null float64 8 avg_open_to_buy 10127 non-null float64 9 avg_utilization_ratio 10127 non-null float64 dtypes: float64(3), int64(5), object(2) memory usage: 791.3+ KB

There are 10 columns and 10127 rows in the dataset with no mising values in each of the columns. The datatypes for each of the columns are now known, as shown above

# Checking to see if there are any duplicates in the dataset. This is the count of unique entries (i.e rows) in the dataset.

bank_churners_df[bank_churners_df.duplicated()].count()

clientnum 0 attrition_flag 0 dependent_count 0 card_category 0 months_on_book 0 months_inactive_12_mon 0 contacts_count_12_mon 0 credit_limit 0 avg_open_to_buy 0 avg_utilization_ratio 0 dtype: int64

From above, no duplicated rows were found in the dataframe. So I assume that all rows are unique.

Next I want to check for unique values in each column of the dataframe

# Checking for unique variables

variables = pd.DataFrame(columns=['Variable','Number of unique values','Values'])

for i, var in enumerate(bank_churners_df.columns):

variables.loc[i] = [var, bank_churners_df[var].nunique(), bank_churners_df[var].unique().tolist()]

variables

| Variable | Number of unique values | Values | |

|---|---|---|---|

| 0 | clientnum | 10127 | [806160108, 804424383, 708300483, 808284783, 7... |

| 1 | attrition_flag | 2 | [Existing Customer, Attrited Customer] |

| 2 | dependent_count | 6 | [1, 0, 2, 3, 4, 5] |

| 3 | card_category | 4 | [Blue, Silver, Gold, Platinum] |

| 4 | months_on_book | 44 | [56, 55, 54, 53, 52, 51, 50, 49, 48, 47, 46, 4... |

| 5 | months_inactive_12_mon | 7 | [2, 3, 4, 0, 1, 6, 5] |

| 6 | contacts_count_12_mon | 7 | [3, 2, 0, 1, 4, 5, 6] |

| 7 | credit_limit | 6205 | [3193.0, 10215.0, 7882.0, 1438.3, 13860.0, 300... |

| 8 | avg_open_to_buy | 6813 | [676.0, 9205.0, 7277.0, 1438.3, 12208.0, 489.0... |

| 9 | avg_utilization_ratio | 964 | [0.788, 0.099, 0.077, 0.0, 0.119, 0.837, 0.679... |

Observation: Looks like the bank_churners table has some interesting data with lots of unique values to explore. Only the 'clientnum' column has a unique value for all 10127 rows in the dataset, and this is because this variable contains all client id/number which are expected to be unique to each client.

Interesting variables to explore based on their number of unique values include:

attrition_flag, dependent_count, card_category, months_inactive_12_mon, contacts_count_12_mon

For the months_on_book variable, it may be worth grouping them per number of years. E.g clients with months on book from 0 to 12 months could be grouped as "New Clients", then 13 to 24 months as "Established Clients" ...etc

Summary Statistics of the basic client info dataset¶

# Checking to see basic statistics of the numerical columns in the basic client info dataset

basic_client_info_df.describe()

| clientnum | customer_age | |

|---|---|---|

| count | 1.012700e+04 | 10127.000000 |

| mean | 7.391776e+08 | 46.325960 |

| std | 3.690378e+07 | 8.016814 |

| min | 7.080821e+08 | 26.000000 |

| 25% | 7.130368e+08 | 41.000000 |

| 50% | 7.179264e+08 | 46.000000 |

| 75% | 7.731435e+08 | 52.000000 |

| max | 8.283431e+08 | 73.000000 |

# Checking for outliers

for column_name in basic_client_info_df.columns:

if basic_client_info_df[column_name].dtype == 'object':

print(f"\nThe '{column_name}' column is not a numerical column")

else:

data = basic_client_info_df[column_name]

q1 = data.quantile(0.25)

q3 = data.quantile(0.75)

iqr = q3 - q1

iqr_lower = q1 - 1.5 * iqr

iqr_upper = q3 + 1.5 * iqr

outliers = dict(data[(data < iqr_lower) | (data > iqr_upper)])

list_of_outliers = list(outliers.values())

rows_with_outliers = list(outliers.keys())

if len(list_of_outliers) == 0:

print(f"\nThere are no outliers in the '{column_name}' column")

else:

if len(list_of_outliers) > 10:

# Using Seaborn's box plot for outlier detection

sns.boxplot(x=column_name, data=basic_client_info_df)

plt.title(f"\nChecking for Outliers in {column_name}")

plt.xlabel(f"\n{column_name}")

plt.show()

print(f"\nDetected too many potential outliers in the '{column_name}' column to show. Based on the high number of potential outliers detected, use the column definition and check the summary statistics (min & max values) above to find out if there are truly outliers in these columns.")

else:

print(f"\nThe potential ouliers in the '{column_name}' column are: {list_of_outliers} and the respective rows with the potential outliers are: {rows_with_outliers}")

print("\n" + "-"*30 + "end" + "-"*30)

There are no outliers in the 'clientnum' column The potential ouliers in the 'customer_age' column are: [73, 70] and the respective rows with the potential outliers are: [4115, 8317] The 'gender' column is not a numerical column The 'education_level' column is not a numerical column The 'marital_status' column is not a numerical column The 'income_category' column is not a numerical column ------------------------------end------------------------------

# Create two empty lists, one to store names of categorical variables, and the other for numerical variables

cat_vars = []

num_vars = []

# Iterate through the names of columns/variables in bank_churners_df, and add variables to the appropriate list

# depending on whether the are categorical or numerical

for column_name in basic_client_info_df.columns:

if basic_client_info_df[column_name].dtype == 'object':

cat_vars.append(column_name)

else:

num_vars.append(column_name)

# Set the figure size

fig, axs = plt.subplots(nrows=1, ncols=2, figsize=(12, 2))

# Reshape the axs array into a one-dimensional array by flattening its elements

axs = axs.flatten()

# Iterate through the list for numerical variables and create box plots of data in each numerical variable

for i, var in enumerate(num_vars):

# Using Seaborn's box plot for outlier detection

sns.boxplot(x=var, data=basic_client_info_df, ax=axs[i])

# Adjust the figure's subplot positions and margins, and then display the figure

fig.tight_layout

plt.show();

# New line spacing

print('\n\n')

# Create new list to hold columns/variables that may have too many potential outliers

outlier_vars = []

# Iterate through the variables again and provide explanation as to whether or not outliers were detected and next steps

for column_name in basic_client_info_df.columns:

if basic_client_info_df[column_name].dtype == 'object':

print(f"\nThe '{column_name}' column is not a numerical column \n")

else:

# Using the general rule for identifying potential outliers which is that if any data point in a dataset is more than

# Q3 + 1.5xIQR or less than Q1 - 1.5xIQR, it's a high outlier. I would create a custom dictionary to capture potential outliers in each column.

data = basic_client_info_df[column_name]

q1 = data.quantile(0.25)

q3 = data.quantile(0.75)

iqr = q3 - q1

iqr_lower = q1 - 1.5 * iqr

iqr_upper = q3 + 1.5 * iqr

outliers = dict(data[(data < iqr_lower) | (data > iqr_upper)])

list_of_outliers = list(outliers.values())

rows_with_outliers = list(outliers.keys())

# If no potential outliers detected, print message below

if len(list_of_outliers) == 0:

print(f"\nThere are no outliers in the '{column_name}' column \n")

else:

# If potential outliers detected were more than 10, add column name to the list of columns with possible outliers

if len(list_of_outliers) > 10:

outlier_vars.append(column_name)

# If not, print message below

else:

print(f"\nThe potential ouliers in the '{column_name}' column are:\n{list_of_outliers} \nAnd the respective rows with the potential outlier are:\n{rows_with_outliers}")

# Print message to explain next steps to validate outliers

print(f"\n Detected too many potential outliers in the following columns: {outlier_vars}. Based on the high number of potential outliers detected, use the column definition and check the summary statistics (min & max values) above to find out if there are truly outliers in these columns.\n")

# Print custom border at the end

print("\n" + "-"*30 + "end" + "-"*30)

There are no outliers in the 'clientnum' column The potential ouliers in the 'customer_age' column are: [73, 70] And the respective rows with the potential outlier are: [4115, 8317] The 'gender' column is not a numerical column The 'education_level' column is not a numerical column The 'marital_status' column is not a numerical column The 'income_category' column is not a numerical column Detected too many potential outliers in the following columns: []. Based on the high number of potential outliers detected, use the column definition and check the summary statistics (min & max values) above to find out if there are truly outliers in these columns. ------------------------------end------------------------------

Observation:

Detected 73 and 70 in the 'customer_age' column as potential outliers. After consulting with the data definition for that variable and comparing these potential outliers to the Q1 & Q3 values from the basic statistics above, my suggestion would be to keep these rows but exclude them when asking questions such as the average or mean age of clients of the bank.

# Checking to know the datatypes of each column and if there are any missing values

basic_client_info_df.info()

<class 'pandas.core.frame.DataFrame'> RangeIndex: 10127 entries, 0 to 10126 Data columns (total 6 columns): # Column Non-Null Count Dtype --- ------ -------------- ----- 0 clientnum 10127 non-null int64 1 customer_age 10127 non-null int64 2 gender 10127 non-null object 3 education_level 10127 non-null object 4 marital_status 10127 non-null object 5 income_category 10127 non-null object dtypes: int64(2), object(4) memory usage: 474.8+ KB

There are 6 columns and 10127 rows in the dataset with no mising values in each of the columns. The datatypes for each of the columns are now known, as shown above

# Checking to see if there are any duplicates in the dataset. This is the count of unique entries (i.e rows) in the dataset.

basic_client_info_df[basic_client_info_df.duplicated()].count()

clientnum 0 customer_age 0 gender 0 education_level 0 marital_status 0 income_category 0 dtype: int64

No duplicated rows were found in the dataframe. So I assume that all rows are unique.

Next I want to check for unique values in each column of the dataframe

# Just like before, I'm using a for loop for this step so that I don't have to repeat the process for each column in the basic_client_info_df dataframe

variables = pd.DataFrame(columns=['Variable','No of unique values','Values'])

for i, var in enumerate(basic_client_info_df.columns):

variables.loc[i] = [var, basic_client_info_df[var].nunique(), basic_client_info_df[var].unique().tolist()]

variables

| Variable | No of unique values | Values | |

|---|---|---|---|

| 0 | clientnum | 10127 | [708082083, 708083283, 708084558, 708085458, 7... |

| 1 | customer_age | 45 | [45, 58, 46, 34, 49, 43, 32, 37, 55, 52, 47, 5... |

| 2 | gender | 2 | [F, M] |

| 3 | education_level | 7 | [High School, Unknown, Doctorate, Uneducated, ... |

| 4 | marital_status | 4 | [Married, Single, Divorced, Unknown] |

| 5 | income_category | 6 | [Less than $40K, $40K - $60K, $80K - $120K, Un... |

Observation:

Just like in the previous dataset, only the 'clientnum' column has a unique value for all 10127 rows in the dataset, and this is because this variable contains all client id/number which are expected to be unique to each client.

The basic_client_info_df dataset contains demographic information about the bank's clients and would be very critical in understanding client behaviour and trends amongst the different client segments.

Summary Statistics of the enriched churn dataset¶

# Checking to see basic statistics of the numerical columns in the enriched churn dataset

enriched_churn_df.describe()

| clientnum | total_relationship_count | total_revolving_bal | total_amt_chng_q4_q1 | total_trans_amt | total_ct_chng_q4_q1 | total_trans_ct | |

|---|---|---|---|---|---|---|---|

| count | 1.012700e+04 | 10127.000000 | 10127.000000 | 10127.000000 | 10127.000000 | 10127.000000 | 10127.000000 |

| mean | 7.391776e+08 | 3.812580 | 1162.814061 | 0.759941 | 4404.086304 | 0.712222 | 64.858695 |

| std | 3.690378e+07 | 1.554408 | 814.987335 | 0.219207 | 3397.129254 | 0.238086 | 23.472570 |

| min | 7.080821e+08 | 1.000000 | 0.000000 | 0.000000 | 510.000000 | 0.000000 | 10.000000 |

| 25% | 7.130368e+08 | 3.000000 | 359.000000 | 0.631000 | 2155.500000 | 0.582000 | 45.000000 |

| 50% | 7.179264e+08 | 4.000000 | 1276.000000 | 0.736000 | 3899.000000 | 0.702000 | 67.000000 |

| 75% | 7.731435e+08 | 5.000000 | 1784.000000 | 0.859000 | 4741.000000 | 0.818000 | 81.000000 |

| max | 8.283431e+08 | 6.000000 | 2517.000000 | 3.397000 | 18484.000000 | 3.714000 | 139.000000 |

Checking for Outliers

# Create two empty lists, one to store names of categorical variables, and the other for numerical variables

cat_vars = []

num_vars = []

# Iterate through the names of columns/variables in bank_churners_df, and add variables to the appropriate list

# depending on whether the are categorical or numerical

for column_name in enriched_churn_df.columns:

if enriched_churn_df[column_name].dtype == 'object':

cat_vars.append(column_name)

else:

num_vars.append(column_name)

# Set the figure size

fig, axs = plt.subplots(nrows=4, ncols=2, figsize=(15, 15))

# Reshape the axs array into a one-dimensional array by flattening its elements

axs = axs.flatten()

# Iterate through the list for numerical variables and create box plots of data in each numerical variable

for i, var in enumerate(num_vars):

# Using Seaborn's box plot for outlier detection

sns.boxplot(x=var, data=enriched_churn_df, ax=axs[i])

# Remove the subplot at index 7 from the axs array within the current figure

fig.delaxes(axs[7])

# Adjust the figure's subplot positions and margins, and then display the figure

fig.tight_layout

plt.show();

# New line spacing

print('\n\n')

# Create new list to hold columns/variables that may have too many potential outliers

outlier_vars = []

# Iterate through the variables again and provide explanation as to whether or not outliers were detected and next steps

for column_name in enriched_churn_df.columns:

if enriched_churn_df[column_name].dtype == 'object':

print(f"\nThe '{column_name}' column is not a numerical column \n")

else:

# Using the general rule for identifying potential outliers which is that if any data point in a dataset is more than

# Q3 + 1.5xIQR or less than Q1 - 1.5xIQR, it's a high outlier. I would create a custom dictionary to capture potential outliers in each column.

data = enriched_churn_df[column_name]

q1 = data.quantile(0.25)

q3 = data.quantile(0.75)

iqr = q3 - q1

iqr_lower = q1 - 1.5 * iqr

iqr_upper = q3 + 1.5 * iqr

outliers = dict(data[(data < iqr_lower) | (data > iqr_upper)])

list_of_outliers = list(outliers.values())

rows_with_outliers = list(outliers.keys())

# If no potential outliers detected, print message below

if len(list_of_outliers) == 0:

print(f"\nThere are no outliers in the '{column_name}' column \n")

else:

# If potential outliers detected were more than 10, add column name to the list of columns with possible outliers

if len(list_of_outliers) > 10:

outlier_vars.append(column_name)

# If not, print message below

else:

print(f"\nThe potential ouliers in the '{column_name}' column are:\n{list_of_outliers} \nAnd the respective rows with the potential outlier are:\n{rows_with_outliers}")

# Print message to explain next steps to validate outliers

print(f"\n Detected too many potential outliers in the following columns: {outlier_vars}. Based on the high number of potential outliers detected, use the column definition and check the summary statistics (min & max values) above to find out if there are truly outliers in these columns.\n")

# Print custom border at the end

print("\n" + "-"*30 + "end" + "-"*30)

There are no outliers in the 'clientnum' column There are no outliers in the 'total_relationship_count' column There are no outliers in the 'total_revolving_bal' column The potential ouliers in the 'total_trans_ct' column are: [138, 139] And the respective rows with the potential outlier are: [1858, 10089] Detected too many potential outliers in the following columns: ['total_amt_chng_q4_q1', 'total_trans_amt', 'total_ct_chng_q4_q1']. Based on the high number of potential outliers detected, use the column definition and check the summary statistics (min & max values) above to find out if there are truly outliers in these columns. ------------------------------end------------------------------

Observation:

Detected 138 and 139 in the 'total_trans_ct' column as potential outliers. After consulting with the data definition for that variable, 'total_trans_ct' represents the total transaction count a client made in the last 12 months. This data would be useful to identify active clients that may be interested in using other bank products and services, hence my suggestion would be to keep them.

# Checking to know the datatypes of each column and if there are any missing values

enriched_churn_df.info()

<class 'pandas.core.frame.DataFrame'> RangeIndex: 10127 entries, 0 to 10126 Data columns (total 7 columns): # Column Non-Null Count Dtype --- ------ -------------- ----- 0 clientnum 10127 non-null int64 1 total_relationship_count 10127 non-null int64 2 total_revolving_bal 10127 non-null int64 3 total_amt_chng_q4_q1 10127 non-null float64 4 total_trans_amt 10127 non-null int64 5 total_ct_chng_q4_q1 10127 non-null float64 6 total_trans_ct 10127 non-null int64 dtypes: float64(2), int64(5) memory usage: 553.9 KB

There are 7 columns and 10127 rows in the dataset with no mising values in each of the columns. The datatypes for each of the columns are now known, as shown above

# Checking to see if there are any duplicates in the dataset. This is the count of unique entries (i.e rows) in the dataset.

enriched_churn_df[enriched_churn_df.duplicated()].count()

clientnum 0 total_relationship_count 0 total_revolving_bal 0 total_amt_chng_q4_q1 0 total_trans_amt 0 total_ct_chng_q4_q1 0 total_trans_ct 0 dtype: int64

No duplicated rows were found in the dataframe.

Next I want to check for unique values in each column of the dataframe

# Again I'm using a for loop for this step so that I don't have to repeat the process for each column in the basic_client_info_df dataframe

variables = pd.DataFrame(columns=['Variable','No of unique values','Values'])

for i, var in enumerate(enriched_churn_df.columns):

variables.loc[i] = [var, enriched_churn_df[var].nunique(), enriched_churn_df[var].unique().tolist()]

variables

| Variable | No of unique values | Values | |

|---|---|---|---|

| 0 | clientnum | 10127 | [828343083, 828298908, 828294933, 828291858, 8... |

| 1 | total_relationship_count | 6 | [3, 4, 6, 5, 1, 2] |

| 2 | total_revolving_bal | 1974 | [1793, 2035, 2437, 1821, 659, 765, 848, 1387, ... |

| 3 | total_amt_chng_q4_q1 | 1158 | [0.803, 0.613, 0.765, 0.63, 0.938, 0.644, 0.76... |

| 4 | total_trans_amt | 5033 | [3646, 1770, 2519, 2381, 3756, 4053, 1408, 426... |

| 5 | total_ct_chng_q4_q1 | 830 | [0.659, 0.741, 0.565, 0.481, 0.842, 0.692, 1.0... |

| 6 | total_trans_ct | 126 | [68, 47, 36, 40, 70, 66, 23, 92, 84, 33, 39, 4... |

Observation:

Again, just like in the previous dataset, only the 'clientnum' column has a unique value for all 10127 rows in the dataset, and this is because this variable contains all client id/number which are expected to be unique to each client.

The enriched_churn dataset contains enriched data about each client's use of their credit cards including the total revolving balance on the credit card, total transaction amounts and number of transactions in the last 12 months. These data points can be used to understand client spending and repayment habits while using their credit cards. It will also be ued for in-depth analysis to help the bank understand the main reasons why clients are churning and leaving its credit card services.

Data Cleaning¶

In the summary statistics analysis, Pandas.DataFrame methods were used to assess dataset properties. 'df.info()' provided summary information, 'df.describe()' offered descriptive statistics, and 'df.value_counts()' counted unique values. I perfomed outlier detection and data was validated to check if identified values were actually outliers. Additionally, I needed to convert the 'Clientnum' variable from an integer datatype to a string/object datatype for numerical analysis tasks. I used the define-code-test framework to perform this cleaning task.

Note: Storing unique ids as integers in SQL databases is good practice due to performance and efficiency reasons (integers take up less space in memory than strings, leading to faster joins and more efficient processing). I needed to convert this variable to strings only for the sake of numerical analysis such as cross-correlation analysis, descriptive stats and answering data questions.

My approach to data cleaning was to make a copy of each dataset first, so that if there any issues I have my original dataset intact. I then used the define-code-test framework for data cleaning, which involves defining cleaning steps using verbs and action words that clearly describe the cleaning tasks, performing the cleaning tasks accordingly and testing programmatically to see if my desired results were achieved.

# Making copies of all 3 datasets

df1 = bank_churners_df.copy()

df2 = basic_client_info_df.copy()

df3 = enriched_churn_df.copy()

# And then joining the resulting dataframes into one master dataset for easier access and manipulation

df = df1.merge(df2, on='clientnum').merge(df3, on='clientnum')

# Checking to make sure all 3 dataframes and their respective columns were joined correctly

df.info()

<class 'pandas.core.frame.DataFrame'> Int64Index: 10127 entries, 0 to 10126 Data columns (total 21 columns): # Column Non-Null Count Dtype --- ------ -------------- ----- 0 clientnum 10127 non-null int64 1 attrition_flag 10127 non-null object 2 dependent_count 10127 non-null int64 3 card_category 10127 non-null object 4 months_on_book 10127 non-null int64 5 months_inactive_12_mon 10127 non-null int64 6 contacts_count_12_mon 10127 non-null int64 7 credit_limit 10127 non-null float64 8 avg_open_to_buy 10127 non-null float64 9 avg_utilization_ratio 10127 non-null float64 10 customer_age 10127 non-null int64 11 gender 10127 non-null object 12 education_level 10127 non-null object 13 marital_status 10127 non-null object 14 income_category 10127 non-null object 15 total_relationship_count 10127 non-null int64 16 total_revolving_bal 10127 non-null float64 17 total_amt_chng_q4_q1 10127 non-null float64 18 total_trans_amt 10127 non-null int64 19 total_ct_chng_q4_q1 10127 non-null float64 20 total_trans_ct 10127 non-null int64 dtypes: float64(6), int64(9), object(6) memory usage: 1.7+ MB

Quality Issue to be Cleaned¶

Define¶

Change datatypes of clientnum variable in all 3 datasets from integer to string/object datatype

Note: Even though storing unique ids as integers in SQL databases is good practice due to performance and efficiency reasons (integers take up less space in memory than strings, leading to faster joins and more efficient processing), I still needed to convert this variable to strings for the sake of numerical analysis that I want to perform such as cross-correlation analysis, descriptive stats and answering data questions.

Code¶

df = df.astype({'clientnum': 'object'})

Test¶

df.clientnum.info()

<class 'pandas.core.series.Series'> Int64Index: 10127 entries, 0 to 10126 Series name: clientnum Non-Null Count Dtype -------------- ----- 10127 non-null object dtypes: object(1) memory usage: 158.2+ KB

Distribution Analysis for each of the columns in the dataset¶

I took a close look at all the columns to know how values were distributed in each column using either a histogram plot to show the distribution in variables with non unique values, or a bar chart to show the distribution in variables where unique values were less than 10.

# Creating an empty list that will be used to store columns with non unique values,

# distribution in these columns will be explained using histogram plots and descriptive stats

column_list = []

# Create two empty lists, one to store names of variables with unique vals < 10, and the other for variables with non-unique vals

unique_val_vars = []

non_unique_vars = []

# Iterate through the names of columns/variables in bank_churners_df, and add variables to the appropriate list

# depending on whether the are categorical or numerical

for column_name in df.columns:

unique_vals = df[column_name].value_counts().sort_values(ascending=False).index

unique_count = len(unique_vals)

if unique_count < 10:

unique_val_vars.append(column_name)

else:

non_unique_vars.append(column_name)

# Set the figure size

fig, axs = plt.subplots(nrows=5, ncols=2, figsize=(16, 25))

# Reshape the axs array into a one-dimensional array by flattening its elements

axs = axs.flatten()

# Set the color of the bars to default blue color

plot_color = sns.color_palette()[0]

# Iterate through the list of variables with unique vals < 10 and count plots of data in each variable

for i, var in enumerate(unique_val_vars):

# Sort the bars in the count plot in descending order using the sorted unique values in the variable

sorted_order = df[var].value_counts().sort_values(ascending=False).index

# Create the plot using seaborn's countplot and pass the sorted values in the order parameter,use preset color palette

plot = sns.countplot(x=var, data=df, ax=axs[i], order=sorted_order, color=plot_color)

# Rotate the x-axis tick labels to make then readable

axs[i].set_xticklabels(axs[i].get_xticklabels(), rotation=10)

# Set the plot title

axs[i].set_title(f"\n\nDistribution of {var}\n", y=0.95)

# Add bar labels containing the count

for p in plot.patches:

plot.annotate(f'{p.get_height():.0f}', (p.get_x() + p.get_width() / 2., p.get_height()), ha='center', va='baseline', fontsize=10, color='black', xytext=(0, 5), textcoords='offset points')

# Set the top margin to to 110% of the highest bar's count (i.e 1.1 times the maximum count)

axs[i].set_ylim(0, max(df[var].value_counts()) * 1.2)

# Adjust the figure's subplot positions and margins, and then display the figure

plt.subplots_adjust(hspace=0.6)

plt.tight_layout

plt.show();

# Now let's do the same for the variables with non-unique values

# First, calculate the number of rows and columns needed for the subplots

num_rows = (len(non_unique_vars) - 1) // 2 + 1

num_cols = 2

# Set the figure size

fig, axs = plt.subplots(nrows=num_rows, ncols=num_cols, figsize=(13, 5 * num_rows))

# Reshape the axs array into a one-dimensional array by flattening its elements

axs = axs.flatten()

# Filter out the 'clientnum' variable from the non_unique_vars list

filtered_non_unique_vars = [var for var in non_unique_vars if var != 'clientnum']

# New loop for filtered_non_unique_vars

for i, var in enumerate(filtered_non_unique_vars):

# add to list that would be explained also using descriptive stats

column_list.append(var)

# Plot the distribution histograms using the corresponding axes

sns.histplot(x=var, data=df, color=plot_color, kde=True, ax=axs[i])

# Set the plot title

axs[i].set_title(f'\n\n \nDistribution of {var}\n')

# Adjust the figure's subplot positions and margins, delete empty plots in the figure, and then display the figure

plt.subplots_adjust(hspace=0.4, wspace=0.4)

plt.tight_layout()

fig.delaxes(axs[10])

fig.delaxes(axs[11])

plt.show();

# Leave space between last histogram plot and the descriptive stats table

print("\n")

# Finally, use descriptive statistics to show how values are distributed in numerical columns

df[column_list].describe()

| months_on_book | credit_limit | avg_open_to_buy | avg_utilization_ratio | customer_age | total_revolving_bal | total_amt_chng_q4_q1 | total_trans_amt | total_ct_chng_q4_q1 | total_trans_ct | |

|---|---|---|---|---|---|---|---|---|---|---|

| count | 10127.000000 | 10127.000000 | 10127.000000 | 10127.000000 | 10127.000000 | 10127.000000 | 10127.000000 | 10127.000000 | 10127.000000 | 10127.000000 |

| mean | 35.928409 | 8631.953698 | 7469.139637 | 0.274894 | 46.325960 | 1162.814061 | 0.759941 | 4404.086304 | 0.712222 | 64.858695 |

| std | 7.986416 | 9088.776650 | 9090.685324 | 0.275691 | 8.016814 | 814.987335 | 0.219207 | 3397.129254 | 0.238086 | 23.472570 |

| min | 13.000000 | 1438.300000 | 3.000000 | 0.000000 | 26.000000 | 0.000000 | 0.000000 | 510.000000 | 0.000000 | 10.000000 |

| 25% | 31.000000 | 2555.000000 | 1324.500000 | 0.023000 | 41.000000 | 359.000000 | 0.631000 | 2155.500000 | 0.582000 | 45.000000 |

| 50% | 36.000000 | 4549.000000 | 3474.000000 | 0.176000 | 46.000000 | 1276.000000 | 0.736000 | 3899.000000 | 0.702000 | 67.000000 |

| 75% | 40.000000 | 11067.500000 | 9859.000000 | 0.503000 | 52.000000 | 1784.000000 | 0.859000 | 4741.000000 | 0.818000 | 81.000000 |

| max | 56.000000 | 34516.000000 | 34516.000000 | 0.999000 | 73.000000 | 2517.000000 | 3.397000 | 18484.000000 | 3.714000 | 139.000000 |

Observation

The attrition_flag column has categorical data and 2 unique values, hence a bar chart is satisfactory to show the distribution of customers who have churned (attrited) to those who are still existing customers.

Most of the bank's credit card customers have 3 or 2 dependants, while only few have 5 dependants in their care.

The blue credit card category is the most popular with approx. 93% of customers belonging to this card category. In second place is the Silver credit card, and then the Gold credit card. Customers who own a Platinum credit card are very few, accounting for a meager 0.2% of all customers.

In the last 12 months, the majority of customers are inactive for 3 months or less; while only a select few customers have been inactive for longer periods.

The same trend is also noticed in the number of contacts made by customers, as majority of customers have made contact 3 or 2 times in the last 12 months.

There are more female customers than male customers, with a difference of 589 more female customers than male.

Majority of the credit card customers are graduates accounting for alsmot 31% of all customers, while minority of the customers have doctorate or post-graduate degrees.

More customers earn less than 40k while less customers earn 120k or higher.

Most customers use 3 of the bank's products. Almost the same number of customers use 4, 5 or 6 of the bank's products. Fewer customers only have 1 product from the bank.

For numerical columns, the table shows the distribution of the variables. The shortest recorded month on book for a customer is 13 months while some customers have been around for up to 56 months. 36 months is the median number of months on book for the bank's customers. There are records of extremely high and extremely low card utilization ratios; however, the median average utilization ratio is 0.18. The youngest credit card customer is aged 26, while the oldest is aged 73. There are more customers aged 46 as this is the mdeian age.

Cross-Correlation Analysis¶

By cross-examining columns against each other, more insights and broader questions can be asked and answered. So let's see how variables are correlated to each other.

# Checking correlations between all numeric variable in the dataset

df.corr()

| dependent_count | months_on_book | months_inactive_12_mon | contacts_count_12_mon | credit_limit | avg_open_to_buy | avg_utilization_ratio | customer_age | total_relationship_count | total_revolving_bal | total_amt_chng_q4_q1 | total_trans_amt | total_ct_chng_q4_q1 | total_trans_ct | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| dependent_count | 1.000000 | -0.103062 | -0.010768 | -0.040505 | 0.068065 | 0.068291 | -0.037135 | -0.122254 | -0.039076 | -0.002688 | -0.035439 | 0.025046 | 0.011087 | 0.049912 |

| months_on_book | -0.103062 | 1.000000 | 0.074164 | -0.010774 | 0.007507 | 0.006732 | -0.007541 | 0.788912 | -0.009203 | 0.008623 | -0.048959 | -0.038591 | -0.014072 | -0.049819 |

| months_inactive_12_mon | -0.010768 | 0.074164 | 1.000000 | 0.029493 | -0.020394 | -0.016605 | -0.007503 | 0.054361 | -0.003675 | -0.042210 | -0.032247 | -0.036982 | -0.038989 | -0.042787 |

| contacts_count_12_mon | -0.040505 | -0.010774 | 0.029493 | 1.000000 | 0.020817 | 0.025646 | -0.055471 | -0.018452 | 0.055203 | -0.053913 | -0.024445 | -0.112774 | -0.094997 | -0.152213 |

| credit_limit | 0.068065 | 0.007507 | -0.020394 | 0.020817 | 1.000000 | 0.995981 | -0.482965 | 0.002476 | -0.071386 | 0.042493 | 0.012813 | 0.171730 | -0.002020 | 0.075927 |

| avg_open_to_buy | 0.068291 | 0.006732 | -0.016605 | 0.025646 | 0.995981 | 1.000000 | -0.538808 | 0.001151 | -0.072601 | -0.047167 | 0.007595 | 0.165923 | -0.010076 | 0.070885 |

| avg_utilization_ratio | -0.037135 | -0.007541 | -0.007503 | -0.055471 | -0.482965 | -0.538808 | 1.000000 | 0.007114 | 0.067663 | 0.624022 | 0.035235 | -0.083034 | 0.074143 | 0.002838 |

| customer_age | -0.122254 | 0.788912 | 0.054361 | -0.018452 | 0.002476 | 0.001151 | 0.007114 | 1.000000 | -0.010931 | 0.014780 | -0.062042 | -0.046446 | -0.012143 | -0.067097 |

| total_relationship_count | -0.039076 | -0.009203 | -0.003675 | 0.055203 | -0.071386 | -0.072601 | 0.067663 | -0.010931 | 1.000000 | 0.013726 | 0.050119 | -0.347229 | 0.040831 | -0.241891 |

| total_revolving_bal | -0.002688 | 0.008623 | -0.042210 | -0.053913 | 0.042493 | -0.047167 | 0.624022 | 0.014780 | 0.013726 | 1.000000 | 0.058174 | 0.064370 | 0.089861 | 0.056060 |

| total_amt_chng_q4_q1 | -0.035439 | -0.048959 | -0.032247 | -0.024445 | 0.012813 | 0.007595 | 0.035235 | -0.062042 | 0.050119 | 0.058174 | 1.000000 | 0.039678 | 0.384189 | 0.005469 |

| total_trans_amt | 0.025046 | -0.038591 | -0.036982 | -0.112774 | 0.171730 | 0.165923 | -0.083034 | -0.046446 | -0.347229 | 0.064370 | 0.039678 | 1.000000 | 0.085581 | 0.807192 |

| total_ct_chng_q4_q1 | 0.011087 | -0.014072 | -0.038989 | -0.094997 | -0.002020 | -0.010076 | 0.074143 | -0.012143 | 0.040831 | 0.089861 | 0.384189 | 0.085581 | 1.000000 | 0.112324 |

| total_trans_ct | 0.049912 | -0.049819 | -0.042787 | -0.152213 | 0.075927 | 0.070885 | 0.002838 | -0.067097 | -0.241891 | 0.056060 | 0.005469 | 0.807192 | 0.112324 | 1.000000 |

# Let's use correlation heatmaps to display the same information but in a visually appealing way.

import matplotlib.pyplot as plt

import seaborn as sns

fig, ax = plt.subplots(figsize=(14, 6))

sns.heatmap(df.corr(), vmin=-1, vmax=1, annot=True,cmap="rocket_r")

plt.xticks(rotation=75)

plt.show()

The correlation heatmap above helped me to start asking the right questions that can generate useful insights for the bank. Some of them include:

- How long have clients of different ages been customers of the bank's credit card service, and what is the relationship between age and months on book?

- What is the relationship between credit limit of clients or average open to buy credit, and the avg utilization ratio in the last 12 months?

- How does transaction amount increase or decrease based on the number of products that clients use?

To answer these questions, numerical columns can be plotted against each other using scatter plots to better understand the correlation trends between them. For example, making a scatter plot of total transaction count vs total transaction amount, or avg utilization ratio vs total revolving balance. Also numerical columns like months_on_book, months_inactive_12_mon, contacts_count_12_mon and Avg_Utilization_Ratio can be plotted against categorial columns with unique values like attrition_flag, gender, education_level and/or income_category, using preferably a bar chart or other charts like a pie chart or tree map, depending on the number of unique values in the categorical column.

Raising Data Questions¶

After the distribution and cross-correlation analyses performed above, I now have a better understanding of the bank's dataset, and can raise data questions to try and find clues and answer to help in my investigation. Grouping by the attrition flag or categorical demographic columns would help in plotting bar charts, pie charts, creating text tables and even tree maps using columns that hold numerical data about credit card usage patterns and repayment habits of all clients of the bank, in order to understand the reasons for leaving and recommend ways the bank can mitigate existing customers from churning.

Some possible data questions that can be raised include:

- How do the total relationship count (i.e number of products customers have) differ between age groups, or gender, or income category or any other demographic? A bar chart of total relationship count (numerical datatype) vs demographic categorical column can be used to answer this question.

- On average, how many of the bank's products do customers typically have? Who are the top or bottom customers by number of the bank's products they have? A histogram plot of the total_relationship_count and a text table showing top and bottom customers of the bank by their total product count, can be used to answer such questions.

- Which is the most popular credit card category? What type of credit card holders have churned the most? What is the credit limit according to the different credit card categories? How much credit is currently available for a customer to use based on the type of credit card they have? A histogram of the card_category, bar chart of card_category vs attrition_flag, text table of average credit_limit grouped by card_category, and a text table of avg_open_to_buy grouped by card_category can answer such questions.

- Does the number of dependents per customer affect their credit card needs or usage? Is there a relationship between dependent count and the type of credit card/credit limit a customer has? Plotting a graph of dependent count vs avg utilization ratio or total_trans_ct can answer the first question. A bar chart of dependent count vs credit limit or card category vs dependent count can answer the second question.

- Who are the top (10 or 20) and bottom (10 or 20) clients based on % change in transaction count or % change in transaction amount from Q1 to Q4? Are there any significant differences in % change for churned customers compared to existing customers? Are there any observed patterns when plotting these % change columns grouped by demographic columns? The total_amt_chng_q4_q1 and total_ct_chng_q4_q1 columns which are both numerical columns can be used to create a text table of top or bottom (10 or 20) clients based on their unique client numbers (clientnum column). Bar charts can also be used to answer these questions by grouping demographic columns like gender, marital status, education or income category.

But for now, I would select the most investigative questions out of the list of so many questions that can reveal the possible reasons why customers are churning and other insights that might have a direct or indirect connection to this problem.

Question 1: What type of credit card holders have churned the most? How about Customer Retention?¶

import numpy as np

result1 = df.groupby('card_category')['clientnum'].count().reset_index(name='total_customer_count')

result2 = df.groupby('card_category')['attrition_flag'].apply(lambda x: (x == 'Attrited Customer').sum()).reset_index(name='churned_count')

text_table = result1.merge(result2, on='card_category')

text_table['overall_churn_rate_pct'] = np.round(text_table['churned_count'] / len(df) * 100, 2)

text_table['category_churn_rate_pct'] = np.round(text_table['churned_count'] / text_table['total_customer_count'] * 100, 1)

text_table['category_retention_ratio'] = np.round(text_table['total_customer_count'] / text_table['churned_count'], 1)

text_table.sort_values(by='overall_churn_rate_pct', ascending=False)

| card_category | total_customer_count | churned_count | overall_churn_rate_pct | category_churn_rate_pct | category_retention_ratio | |

|---|---|---|---|---|---|---|

| 0 | Blue | 9436 | 1519 | 15.00 | 16.1 | 6.2 |

| 3 | Silver | 555 | 82 | 0.81 | 14.8 | 6.8 |

| 1 | Gold | 116 | 21 | 0.21 | 18.1 | 5.5 |

| 2 | Platinum | 20 | 5 | 0.05 | 25.0 | 4.0 |

Explanation:¶

The overall churn rate % shows that the bank's blue credit card holders have churned the most with a 15% churn rate. For Silver, Gold and Platinum credit card customers, the churn rate is less than 1% which is below the generally acceptable churn rate levels of around 5-8% for most banks and credit card companies. From this perspective, it can be seen that the customers with blue credit cards tend to churn the most compared to other credit card categories that the bank offers.

The category churn rate % and category retention ratio variables are being used here to highlight the likelihood of churn and provide a comparison of the initial customer base to the churned customers within each category. This is because the number of customers with blue credit cards are relatively larger than all the other three card categories combined. A higher category retention ratio indicates a lower proportion of churned customers to the initial customer base, which is generally a positive sign for customer retention within that category. Conversely, a lower ratio could indicate a potential issue with customer retention that might need to be addressed for that specific category.

Now all of a sudden we see that 1 in 4 platinum credit card holders churned, 1 in approx 5 Gold credit card customers churned, 1 in 6 Blue credit card customers churned, and finally 1 in approx 7 Silver credit card customers churned. From this perspective, it appears that there is a potential issue with customer retention of Platinum credit card customers. This is because out of a small number of only 20 total customers with a platinum credit card, 4 of them have churned.

Could this be related to the income category of customers in certain card categories? Or could there be something else happening? Let us investigate further.

Question 2: Is there a relationship between credit card category, income category and the usage of credit cards by customers?¶

# Grouping by card category & income category to see card utilization trends

view = df.groupby(['card_category', 'income_category'])['avg_utilization_ratio'].mean().sort_values(ascending=False)

# Using a suitable figure/chart size for the plot

plt.figure(figsize = [10, 5])

ax = view.plot(kind='bar', xlabel="\nCard Category , Income Category" , ylabel= "Avg Utilization Ratio", legend=False)

ax.bar_label(ax.containers[0], fmt='%.2f', label_type= 'edge')

plt.show();

Solution:¶

The plot above shows that on average, Blue credit card customers who earn less than $40k and those who earn between 40k-60k tend to use their credit cards the most; while Platinum credit card customers who earn between 40k-60k and those whose income category is unknown, tend to use their credit card the least.

On average, Blue credit card customers of all income categories tend to use their cards way more than Silver, Gold and Platinum credit card customers. And average usage trends amongst Silver, Gold and Platinum credit card customers who earn higher than 60k does not differ much, indicating that these customers are not heavily dependent on their credit cards and might also suggest that they are less likely to be interested in trying out other credit products/services the bank offers.

It is worth investigating further to see how factors such as dependent count affect the credit card needs of customers.

Question 3: How does income category & number of dependents per customer affect their credit card needs or usage?¶

# Grouping by dependent count & income category to see card utilization trends

view = df.groupby(['dependent_count', 'income_category'])['avg_utilization_ratio'].mean().sort_values(ascending=False)

# Using a suitable figure/chart size for the plot

plt.figure(figsize = [12, 5])

ax = view.plot(kind='bar', xlabel="\nDependent Count , Income Category" , ylabel= "Avg Utilization Ratio", legend=False)

#ax.bar_label(ax.containers[0], fmt='%.2f', label_type= 'edge')

plt.show();

Solution:¶

There is no clear correlation between credit card utilization and number of dependants, but when income category is grouped with dependent count, some ineteresting insights can be obtained.

We can see that on average, customers who earn less than 40k use their credit cards the most regardless of their number of dependants. Customers who earn between 40k-60k and those who earn between 60k-80k are not significantly different in their card usage rates regardless of their dependent count. But as earnings further increased, we observed a trend where credit card utilization decreased as number of dependants increased, especially for customers earning 120k or higher.

In general, Card Utilization decreased as income increased suggesting that customers who earn higher tend to use their credit cards less.

Question 4: What age groups utilize their credit cards the most and the least? And What age groups have the most churned customers?¶

# Creating a new column to group customers according to their age groups

import numpy as np

conditions = [

(df['customer_age'] > 10) & (df['customer_age'] <= 30),

(df['customer_age'] > 30) & (df['customer_age'] <= 40),

(df['customer_age'] > 40) & (df['customer_age'] <= 50),

(df['customer_age'] > 50) & (df['customer_age'] <= 60),

(df['customer_age'] > 60) & (df['customer_age'] <= 120)

]

values = ['11 - 30', '31 - 40', '41 - 50', '51 - 60', '61 - 120']

df['age_group'] = np.select(conditions, values)

first_view = df.groupby(['age_group'])[('avg_utilization_ratio')].apply(lambda x: np.round(x.mean(), 2)).sort_values(ascending=False)

second_view = df.groupby(['age_group'])['attrition_flag'].apply(lambda x: (x == 'Attrited Customer').sum()).sort_values(ascending=False)

# Resize the chart, and have two plots side-by-side

# Set a larger figure size for subplots

plt.figure(figsize = [12, 5])

# 1 row, 2 cols, subplot 1

plt.subplot(1, 2, 1)

# Plot a bar chart with the data

ax = first_view.plot(kind='bar', xlabel="\nAge Group" , ylabel= "Avg Utilization Ratio", legend=False)

# Include the bar labels

ax.bar_label(ax.containers[0], label_type= 'edge')

# Rotate the x ticks

plt.xticks(rotation=10)

# 1 row, 2 cols, subplot 2

plt.subplot(1, 2, 2)

# Plot a bar chart with the data

ax = second_view.plot(kind='bar', xlabel="\nAge Group" , ylabel= "Count of Churned Customers", legend=False)

# Include the bar labels

ax.bar_label(ax.containers[0], label_type= 'edge')

# Rotate the x ticks

plt.xticks(rotation=10)

# Now show the figure

plt.show();

Solution:¶

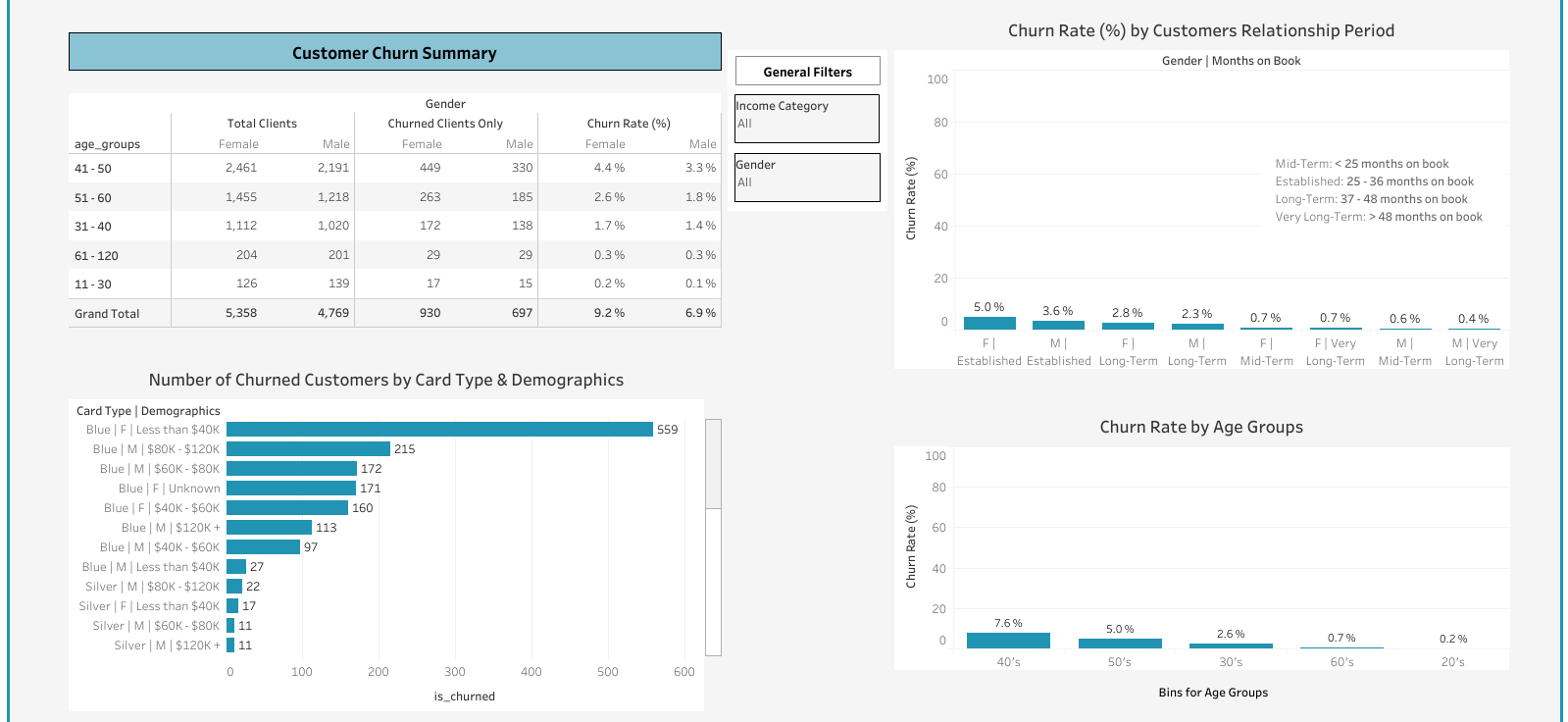

Here we see that on average, the difference in credit card utilization amongst age groups is not so much; with customers in the 11-30 age group using their credit cards the most while customers in thee 41-50 age groups have the lowest utilization ratio. However, the count of churned customers per age group adds context to this analysis. Now we see that the customers aged between 41 and 50 have churned the most, while customers between 11 and 30 churned the least. From this perspective, a big focus should be made on customers in the 41-50 age group, and more data should be collected to enrich the dataset and provide deeper insights about this group of customers in particular and all age groups in general.

Data Enrichment¶

When enriching a customer churn dataset for a bank's credit card service, the following additional variables may be useful to collect:

Internal data points such as customer complaints history, complaints resolution times, customer satisfaction ratings/comments/suggestions, can help perform better customer churn and retention analyses.

External data points like industry trends and economic indicators such as inflation rate, interest rates, unemployment rate, consumer sentiments and changes in GDP. This is because high inflation can reduce the purchasing power of consumers and make it more difficult for them to manage credit card debt. Changes in interest rates can affect the affordability of credit card debt and the attractiveness of credit card rewards programs; by benchmarking with the average industry interest rate, the bank can offer more competitive interest rates to retain existing clients and mitigate churn. High unemployment rates can affect consumer confidence and spending habits, which can impact credit card usage. And finally, consumer sentiments as well as changes in GDP greatly impact spending habits and credit card usage. Thus these economic indicators can provide valuable context for understanding customer behavior and predicting churn, while also identifying opportunities to improve customer retention and maximize profitability.

These external data points are readily available through public/private, free and paid data sources online, some of which are:

- World Bank Open Data: https://data.worldbank.org/

- US Government's Open Data Portal: https://www.data.gov/

- AWS Public Datasets: https://aws.amazon.com/public-datasets/

- Google's Dataset Search: https://datasetsearch.research.google.com/

- UCI Machine Learning Repository: http://archive.ics.uci.edu/ml/index.php

- Data World: https://data.world/

- Statista for unemployment rates, economic indicators and customer sentiments data: https://www.statista.com/

- Bloomberg Datasets for economic indicators: https://data.bloomberg.com/

- Alpha Vantage API for Economic Indicators : https://www.alphavantage.co/documentation/

- Bright Data for Customer Sentiments Data: https://brightdata.com/

- US Government Bureau of Labor Statistics for U.S unemployment rates: https://www.bls.gov/

- Statistics Canada for unemployment, economic indicators & customer sentiments: https://www.statcan.gc.ca/

- Kaggle Datasets: https://www.kaggle.com/datasets.

Tableau Tasks¶

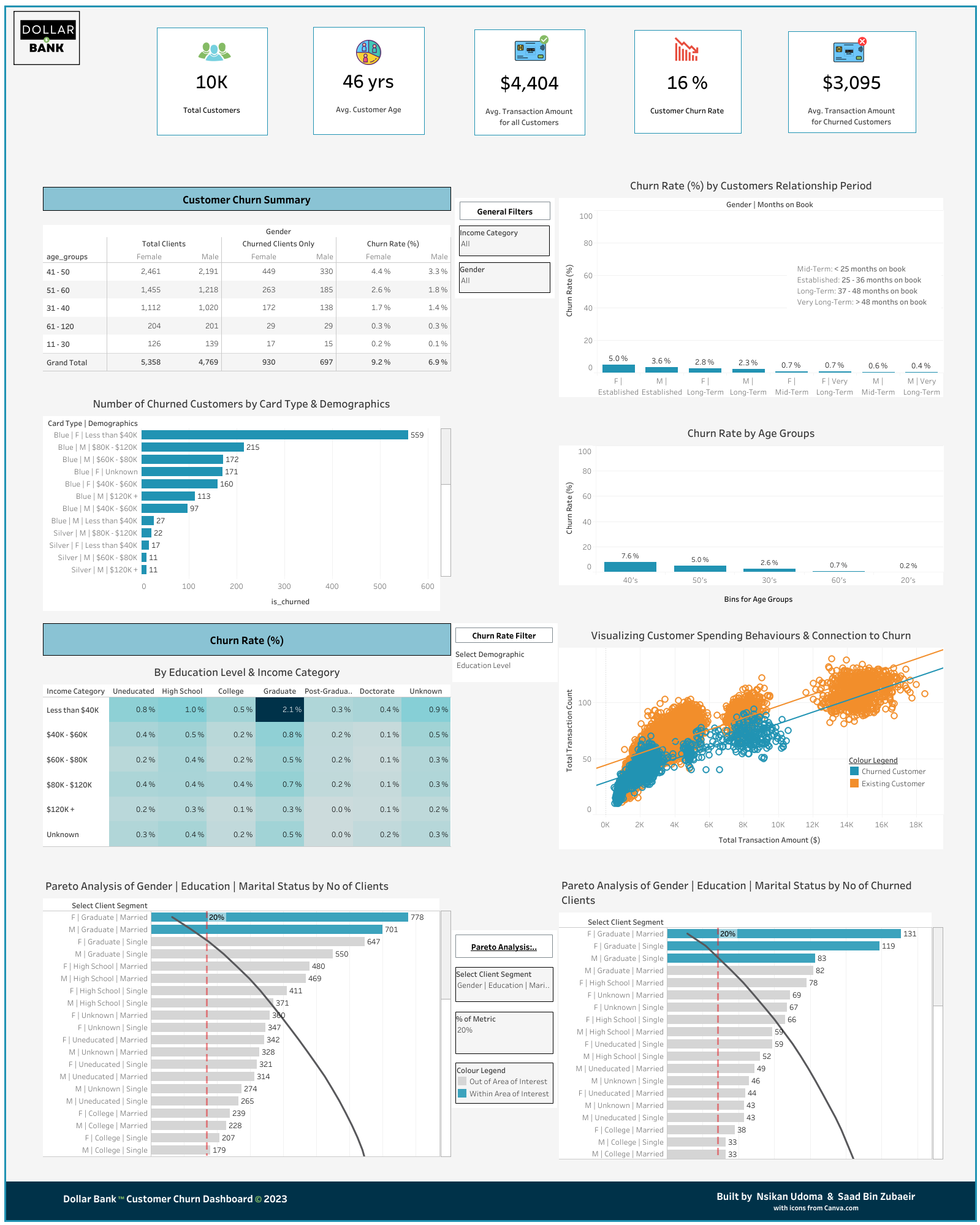

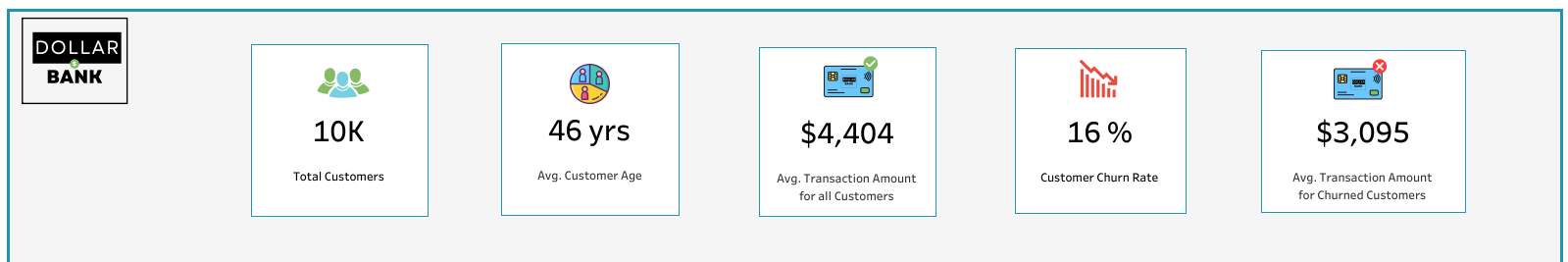

The task was to tell the story visually by building an interactive Tableau dashboard that contained:

KPIs in Bold at the Top. Metrics like:

- Total number of clients

- Churn rate %

- Average transaction amount per customer

- Average transaction amount before churn

Churn rate % among different age groups. This will be done by:

- Using the Bins function to split client age into age ranges

- Defining Churn rate % as a calculated field

- Choosing the most suitable way of visualizing the comparison

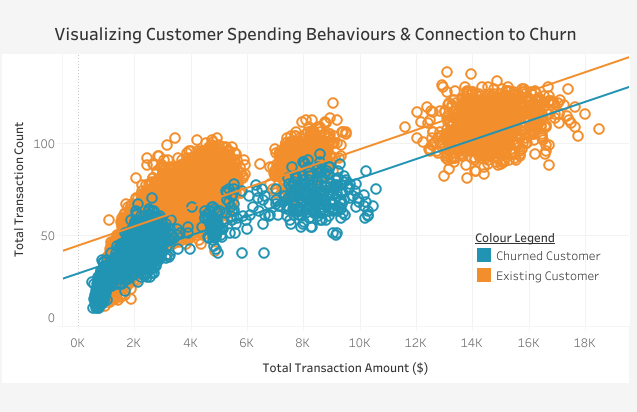

A Scatterplot visualizing certain customer spending behaviors and their connection to churn if such exists. For example, comparing total transaction amount and total transaction count of each client and using color to visually identify churned and existing customers.

A Highlight Table comparing Churn rate % among two demographic dimensions, where one is placed on Rows and another on Columns, forming a matrix.

A Bar Chart with multiple metrics by

Clientnum, where each row represents one Client and has multiple metrics as columns. Also using filters or parameters to let user drill down into the set of clients they are interested in.

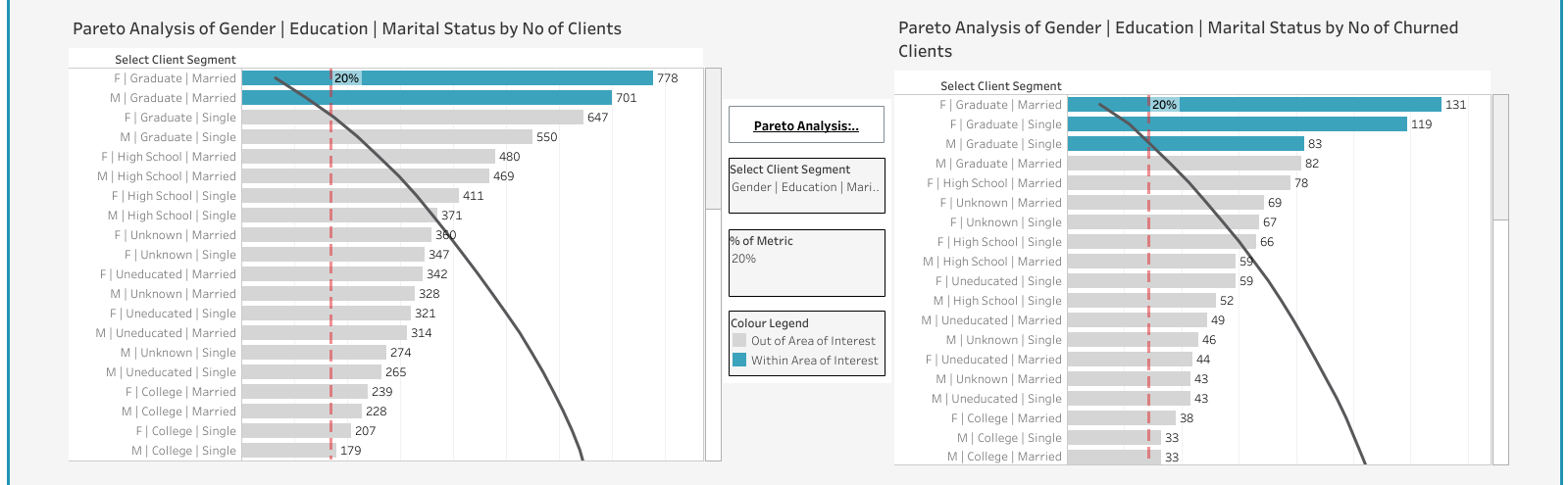

A Pareto Analysis based on custom defined customer segment.

Segment can include values from the demographic information of the client. Such as,

- Gender | Income

- Gender | Income | Marital status

Then allowing the dashboard user to choose a metric(s) to analyze. Such as,

- Total number of clients (People from which customer segments most often become clients of the bank?)

- Churn rate absolute (How many churned customers are in each segment?)

- Churn rate % (What is the relative churn rate in each customer segment?)

Parameters that allows dashboard users to interact with the dashboard. Such as,

- to change the metric used in the chart(s)

- to change the value of a benchmark

Insights¶

Overall Churn Rate: The overall churn rate is 16%, which indicates that around one in six customers were churning. This is a key metric for the bank to continuously monitor in its effort to mitigate churn and increase customer retention.