Working with Time Series in Pandas¶

A Summary of lecture "Manipulating Time Series Data in Python", via datacamp

- toc: true

- badges: true

- comments: true

- author: Chanseok Kang

- categories: [Python, Datacamp, Time_Series_Analysis]

- image: images/google_lagged.png

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

plt.rcParams['figure.figsize'] = (10, 5)

How to use dates & times with pandas¶

- Date & time series functionality

- At the root: data types for date & time information

- Objects for points in time and periods

- Attributes & methods reflect time-related details

- Sequences of dates & periods

- Series or DataFrame columns

- Index: convert object into Time Series

- Many Series/DataFrame methods rely on time information in the index to provide time-series functinoality

- At the root: data types for date & time information

Your first time series¶

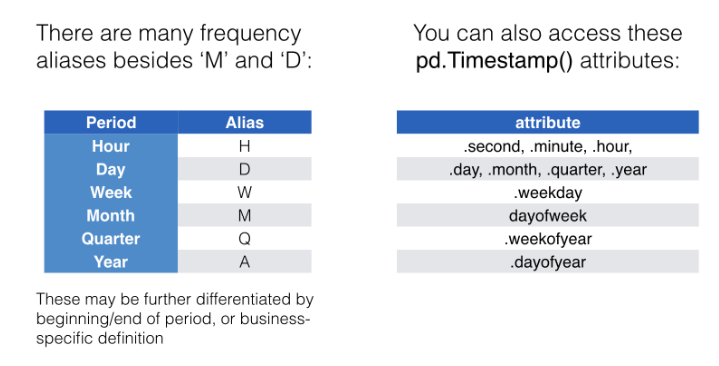

You have learned in the video how to create a sequence of dates using pd.date_range(). You have also seen that each date in the resulting pd.DatetimeIndex is a pd.Timestamp with various attributes that you can access to obtain information about the date.

Now, you'll create a week of data, iterate over the result, and obtain the dayofweek and weekday_name for each date.

# Create the range of dates here

seven_days = pd.date_range(start='2017-1-1',periods=7)

# Iterate over the dates and print the number and name of the weekday

for day in seven_days:

print(day.dayofweek, day.day_name())

6 Sunday 0 Monday 1 Tuesday 2 Wednesday 3 Thursday 4 Friday 5 Saturday

Note:

weekday_nameattribute is deprecated since 0.23.0. Instead, use.day_name()method.

Indexing & resampling time series¶

- Time series transformation

- Basic time series transformations include:

- Parsing string dates and convert to

datetime64 - Selecting & slicing for specific subperiods

- Setting & changing

DateTimeIndexfrequency- Upsampling : Higher frequency implies new dates -> missing data

- Parsing string dates and convert to

- Basic time series transformations include:

Create a time series of air quality data¶

You have seen in the video how to deal with dates that are not in the correct format, but instead are provided as string types, represented as dtype object in pandas.

We have prepared a data set with air quality data (ozone, pm25, and carbon monoxide for NYC, 2000-2017) for you to practice the use of pd.to_datetime().

data = pd.read_csv('./dataset/nyc.csv')

# Inspect data

print(data.info())

# Convert the date column to datetime64

data['date'] = pd.to_datetime(data['date'])

# Set date column as index

data.set_index('date', inplace=True)

# Inspect data

print(data.info())

# Plot data

data.plot(subplots=True);

<class 'pandas.core.frame.DataFrame'> RangeIndex: 6317 entries, 0 to 6316 Data columns (total 4 columns): # Column Non-Null Count Dtype --- ------ -------------- ----- 0 date 6317 non-null object 1 ozone 6317 non-null float64 2 pm25 6317 non-null float64 3 co 6317 non-null float64 dtypes: float64(3), object(1) memory usage: 197.5+ KB None <class 'pandas.core.frame.DataFrame'> DatetimeIndex: 6317 entries, 1999-07-01 to 2017-03-31 Data columns (total 3 columns): # Column Non-Null Count Dtype --- ------ -------------- ----- 0 ozone 6317 non-null float64 1 pm25 6317 non-null float64 2 co 6317 non-null float64 dtypes: float64(3) memory usage: 197.4 KB None

Compare annual stock price trends¶

In the video, you have seen how to select sub-periods from a time series.

You'll use this to compare the performance for three years of Yahoo stock prices.

yahoo = pd.read_csv('./dataset/yahoo.csv')

yahoo['date'] = pd.to_datetime(yahoo['date'])

yahoo.set_index('date', inplace=True)

yahoo.head()

| price | |

|---|---|

| date | |

| 2013-01-02 | 20.08 |

| 2013-01-03 | 19.78 |

| 2013-01-04 | 19.86 |

| 2013-01-07 | 19.40 |

| 2013-01-08 | 19.66 |

# Create dataframe prices here

prices = pd.DataFrame()

# Select data for each year and concatenate with prices here

for year in ['2013', '2014', '2015']:

price_per_year = yahoo.loc[year, ['price']].reset_index(drop=True)

price_per_year.rename(columns={'price':year}, inplace=True)

prices = pd.concat([prices, price_per_year], axis=1)

# Plot prices

prices.plot();

Set and change time series frequency¶

In the video, you have seen how to assign a frequency to a DateTimeIndex, and then change this frequency.

Now, you'll use data on the daily carbon monoxide concentration in NYC, LA and Chicago from 2005-17.

You'll set the frequency to calendar daily and then resample to monthly frequency, and visualize both series to see how the different frequencies affect the data.

co = pd.read_csv('./dataset/co_cities.csv')

co['date'] = pd.to_datetime(co['date'])

co.set_index('date', inplace=True)

co.head()

| Chicago | Los Angeles | New York | |

|---|---|---|---|

| date | |||

| 2005-01-01 | 0.317763 | 0.777657 | 0.639830 |

| 2005-01-03 | 0.520833 | 0.349547 | 0.969572 |

| 2005-01-04 | 0.477083 | 0.626630 | 0.905208 |

| 2005-01-05 | 0.348822 | 0.613814 | 0.769176 |

| 2005-01-06 | 0.572917 | 0.792596 | 0.815761 |

# Inspect data

print(co.info())

# Set the frequency to calendar daily

co = co.asfreq('D')

# Plot the data

co.plot(subplots=True);

# Set Frequency to monthly

co = co.asfreq('M')

# Plot the data

co.plot(subplots=True);

<class 'pandas.core.frame.DataFrame'> DatetimeIndex: 1898 entries, 2005-01-01 to 2010-12-31 Data columns (total 3 columns): # Column Non-Null Count Dtype --- ------ -------------- ----- 0 Chicago 1898 non-null float64 1 Los Angeles 1898 non-null float64 2 New York 1898 non-null float64 dtypes: float64(3) memory usage: 59.3 KB None

Lags, changes, and returns for stock price series¶

- Basic time series calculations

- Typical Time Series manipulations include:

- Shift or lag values back or forward back in time

- Get the difference in value for a given time period

- Compute the percent change over any number of periods

pandasbuilt-in methods rely onpd.DataTimeIndex - Typical Time Series manipulations include:

Shifting stock prices across time¶

The first method to manipulate time series that you saw in the video was .shift(), which allows you shift all values in a Series or DataFrame by a number of periods to a different time along the DateTimeIndex.

Let's use this to visually compare a stock price series for Google shifted 90 business days into both past and future.

# Import data here

google = pd.read_csv('./dataset/google.csv', parse_dates=['Date'], index_col='Date')

# Set data frequency to business daily

google = google.asfreq('B')

# Create 'lagged' and 'shifted'

google['lagged'] = google['Close'].shift(periods=-90)

google['shifted'] = google['Close'].shift(periods=90)

# Plot the google price series

google.plot();

plt.savefig('../images/google_lagged.png')

Calculating stock price changes¶

You have learned in the video how to calculate returns using current and shifted prices as input. Now you'll practice a similar calculation to calculate absolute changes from current and shifted prices, and compare the result to the function .diff().

yahoo = yahoo.asfreq('B')

# Created shifted_30 here

yahoo['shifted_30'] = yahoo['price'].shift(periods=30)

# Subtract shifted_30 from price

yahoo['change_30'] = yahoo['price'] - yahoo['shifted_30']

# Get the 30-day price difference

yahoo['diff_30'] = yahoo['price'].diff(periods=30)

# Inspect the last five rows of price

print(yahoo['price'].tail(5))

# Show the value_counts of the difference between change_30 and diff_30

print(yahoo['diff_30'].sub(yahoo['change_30']).value_counts())

date 2015-12-25 NaN 2015-12-28 33.60 2015-12-29 34.04 2015-12-30 33.37 2015-12-31 33.26 Freq: B, Name: price, dtype: float64 0.0 703 dtype: int64

Plotting multi-period returns¶

The last time series method you have learned about in the video was .pct_change(). Let's use this function to calculate returns for various calendar day periods, and plot the result to compare the different patterns.

We'll be using Google stock prices from 2014-2016.

google = pd.read_csv('./dataset/google.csv', parse_dates=['Date'], index_col='Date')

# Set data frequency to business daily

google = google.asfreq('D')

# Create daily_return

google['daily_return'] = google['Close'].pct_change(periods=1) * 100

# Create monthly_return

google['monthly_return'] = google['Close'].pct_change(periods=30) * 100

# Create annual_return

google['annual_return'] = google['Close'].pct_change(periods=360) * 100

# Plot the result

google.plot(subplots=True);